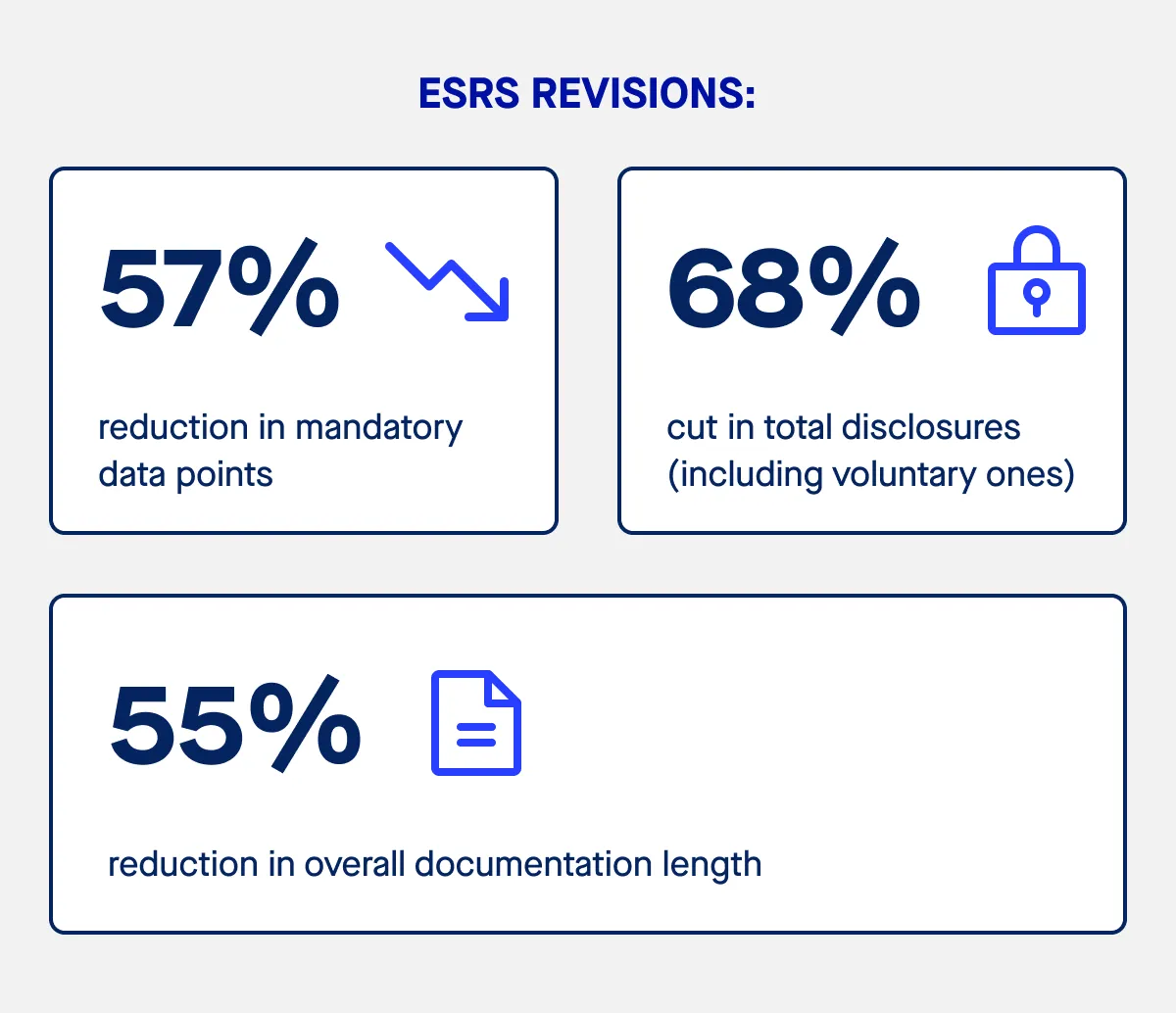

Key changes in the 2025 ESRS draft

The new draft focuses on four major themes: streamlining materiality, restructuring reports, introducing reliefs for difficult data, and aligning more closely with other frameworks.

A more targeted materiality assessment

The double materiality assessment remains at the heart of the ESRS, requiring companies to consider both financial materiality and impact materiality. However, the process is now more flexible.

Instead of analysing every section of every topical standard, companies can start with their business model to identify obviously relevant topics. Evidence requirements are scaled to the significance of the issue, reducing the risk of time-consuming investigations into matters that are unlikely to be material. Reporting can be limited to sub-topics, rather than full topical standards, where appropriate.

This change is intended to help companies focus on the sustainability issues that truly matter in their value chain and reduce time spent on less relevant areas.

Simplified report structures

Under the revised ESRS, sustainability statements can begin with a short, clear summary of key findings, followed by appendices for detailed data. This gives companies the freedom to create a logical narrative flow without repeating information in multiple sections.

The approach also improves readability for stakeholders, helping them find essential information without wading through pages of technical detail.

Clear separation of requirements and guidance

In the past, optional good-practice examples were often treated as if they were mandatory. The new structure moves all non-mandatory content into separate guidance documents. Application guidance now sits directly under the relevant disclosure requirement, making it much easier for preparers and auditors to identify what must be reported versus what is recommended.

Reliefs for challenging data collection

EFRAG has introduced a set of reliefs to ease the reporting burden, particularly for companies with global value chains. For example, if obtaining certain value chain data would involve undue cost or effort, companies can now disclose partial scope metrics. In some cases, qualitative disclosures can replace quantitative ones where precise figures are unavailable.

This flexibility should be particularly valuable in sectors such as road transportation, water and marine resources, or coal mining, where gathering complete subcontracting data can be difficult.

Better interoperability with global standards

The ESRS now uses terminology and definitions that more closely match the IFRS sustainability standards, supporting multinational companies that must report under multiple frameworks. This alignment should make it easier to prepare reports that meet both EU sustainability reporting standards and other global requirements, without duplicating work.

What has not changed

Despite the simplifications, some core aspects of the ESRS remain firmly in place:

- Double materiality is still central, combining financial materiality and impact materiality.

- Scope 3 greenhouse gas emissions must still be reported, though reliefs are available if data is limited.

- Links to key EU policies, including the Sustainable Finance Disclosure Regulation and the EU Taxonomy, remain in the framework.

- Certain sector specific standards and topical standards, such as those covering climate change mitigation, resource use, and circular economy topics, remain relevant for companies in affected industries.

How this affects your reporting strategy

The updated ESRS presents an opportunity for companies to revisit their sustainability reporting processes and identify efficiencies. For many, this will mean:

- Revisiting materiality assessments to take advantage of the top-down, business-model-first approach.

- Planning sustainability statements that make strategic use of appendices for detailed disclosures.

- Reviewing where new reliefs could help manage subcontracting accomplishments, limit paper submissions, or reduce the need for manual data gathering.

- Checking how esrs reporting will align with other disclosure requirements, such as those under the non-financial reporting directive or CSRD reporting obligations.

These updates may also have an indirect impact on non-EU companies, particularly those that operate in EU regulated markets or are part of EU-based value chains.

The role of sustainability reporting standards ESRS in the bigger picture

The ESRS is not an isolated set of rules. It is part of a broader ecosystem that includes other EU initiatives on sustainability, finance, and digital transformation. The standards themselves are designed to be an authoritative source of sustainability information, helping market participants make better decisions while supporting implementation of environmental and social policy.

They also aim to prepare the next generation of corporate reporting, integrating financial reporting with disclosures on climate change, water and marine resources, human rights, and other areas of very high concern.

Deadlines and consultation

The public consultation on the ESRS draft revisions runs until 29 September 2025. EFRAG will then submit its final technical advice to the European Commission by 30 November 2025, with final adoption expected in early 2026.

Once adopted, companies will need to apply the revised ESRS for reporting periods starting in the following year, with transitional reliefs for certain company sizes and industries.

Preparing for ESRS compliance

If your organisation is within scope for the CSRD, now is the time to prepare. Even if you are not directly in scope, voluntary alignment with ESRS standards can strengthen your credibility with investors, consumers, and agency partners.

Key steps include:

- Reviewing your existing sustainability reporting against the new general requirements and cross cutting standards.

- Updating your materiality assessment to focus on material impacts and sustainability risks most relevant to your sector.

- Training reporting teams on the new structure, disclosure requirement layouts, and topical standards.

- Exploring technology solutions to manage live interface submissions, streamline business processes, and integrate sustainability data with financial systems.

Looking ahead

The ESRS revisions are a clear signal that the European Commission and EFRAG are listening to company feedback. By removing unnecessary complexity while keeping the minimum disclosure requirements aligned with EU policy objectives, they aim to create a system that is both rigorous and workable.