On 14 April 2023, the European Commission published a series of answers on the interpretation of the SFDR, reaffirming the transparency objective of the regulation. It has left it up to financial organizations to develop their own product classification methodologies, without endorsing a strict definition of sustainable investment.

What is the Sustainable Finance Disclosures Regulation (SFDR)?

The Sustainable Finance Disclosure Regulation (SFDR) is a European Union regulation that sets out a framework for financial institutions and advisers to disclose information about the sustainability of their investment products. It aims to make the financial sector more transparent and accountable in terms of how it integrates environmental, social and governance (ESG) factors into its investment decisions, and to help investors make informed decisions about the sustainability of investments. The SFDR applies to a wide range of financial market participants, including banks, insurers, investment firms, and other financial institutions that provide investment services in the EU. For further details, have a read here.

What are the key SFDR developments to date?

In March 2021, the SFDR regulation entered into its next phase of implementation, in which financial institutions and advisers were required to start reporting on their sustainable investment practices to investors using a standardized format, based around three levels of commitment.

-

Article 6, which applies to funds that don't have a specific focus on sustainability.

-

Article 8, which covers funds that have a focus on environmental or social factors.

-

Article 9, which applies to funds that have a strong focus on sustainable investment.

Regardless of which commitment level a fund falls into, financial organizations are required to disclose how they are considering sustainability risks in their investment decisions. However, funds that are marketed as sustainable investments must also meet certain classification requirements and be classified as either an Article 8 or Article 9 fund.

The definition of a sustainable investment

However, there have been several criticisms of the definition of sustainable investments and the fact that some Art 9 funds had some exposure to Oil and Gas companies. As a result, the European Securities and Markets Authority (ESMA) clarified its position in June 2021, saying that, for an investment fund to be listed under Article 9, 100% of its investments must be sustainable within the meaning of Article 2 of the SFDR Regulation, which implies

(i) investment in an economic activity that contributes to environmental and social objectives,

(ii) the establishment of good governance practices (sound management structures, staff relations, remuneration of competent staff and compliance with tax obligations), and

(iii) not causing significant harm to a social and/or environmental objective.

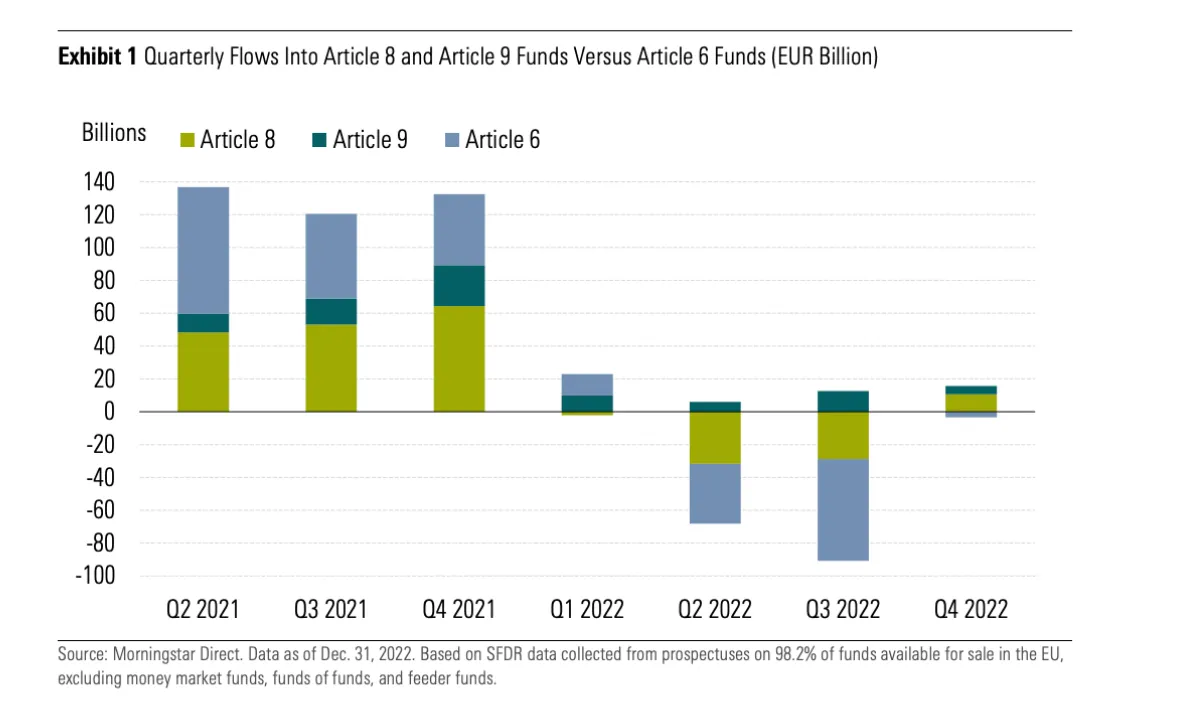

The last quarter of 2022 was then marked by a strong wave of downgrades from Article 9 to Article 8 funds. A study conducted by Morningstar in January 2023 identified 307 downgrades from September to December 2022, representing EUR 175 billion in assets.

This interpretation forced funds that had made a less ambitious trade-off in their asset allocation to downgrade or revise their prospectus to comply with this position. According to the Morningstar study, two thirds of Article 9 funds (63%) target more than 70% sustainable investment exposure, 6.3% target between 90% and 100%, and only 36 funds in the sample target 100% sustainable investment allocation.

Our key takeaways from the Commission's answers to key SFDR questions

Here are our top takeaways from the European Commission’s responses.

1. What is the definition of sustainable investments?

The facts: The Commission confirmed that the Article 2 (17) sustainable investment definition “does not prescribe any specific approach to determine the contribution of an investment to environmental or social objectives.”

Financial market participants must “carry out their own assessment for each investment, disclose their underlying assumptions” and “the methodology they have applied to carry out their assessment of sustainable investments.”

“The notion of sustainable investment can therefore also be measured at the level of a company and not only at the level of a specific activity”

Our analysis: The EU Commission prefers to allow firms flexibility around disclosure, rather than being prescriptive. It doesn’t set a minimum quantitative threshold for when a company contributes to an E/S objective or require firms to adopt a taxonomy alignment approach to value how much an investment is sustainable.

The Commission also states that the fact that an investee company has a transition plan aimed at mitigating environmental damage, does not automatically mean it is a sustainable investment. It insists that the classification is based on scientific evidence rather than promise. This means that the emission reduction track record matters rather than the promised transition plan.

The definition of sustainable investment could have brought consistency and convergence across the market but this would have also meant the end of the Art 9 funds.

2. What does it mean to "consider" principal adverse impacts (PAIs)?

The facts: The Commission confirmed that “Consideration of PAI involves both:

-

Obtaining and reporting data on adverse impacts

-

But also implementing processes around how to mitigate those impacts.

Our analysis: This is a great milestone for investors’ engagement and stewardship! The disclosure of principal adverse impact metrics is not sufficient, and firms must also disclose the policies and procedures they have put in place to mitigate the PAIs, where adverse harm is identified.

3. What is the timing of periodic reports for portfolio management services?

The facts: The Commission confirmed the existing market view that SFDR periodic reports should just be provided annually as referred to in recital 21.

Our analysis:

In a portfolio management context, MiFID portfolio management reporting should be provided quarterly, whilst Recital 21 of SFDR suggested SFDR periodic reports should only be provided annually, and suggested it should be in “every fourth report”.

So how have financial players reacted?

Financial companies are still trying to figure out exactly how to calculate and report on their sustainability practices. Because of this, many funds don't yet include information about how they are aligned with the new rules in their documents for investors.

In the survey conducted by Morningstar, 85% of Article 8 funds and 70% of Article 9 funds do not commit to any taxonomy alignment in the pre-contractual documentation. For the few funds that do, the thresholds remain low, around 10-15%.

But it’s worth noting that the reporting of Article 29 of the French Energy and Climate Law already requires reporting entities with more than €500 million in assets or balance sheet total to communicate the green share and brown share of assets.

What’s next for SFDR?

On 12 April 2023, the three European Supervisory Authorities (the European Banking Authority (EBA), the European Insurance and Occupational Pensions Authority (EIOPA) and the European Securities and Markets Authority (ESMA) published a joint Consultation Paper setting out proposed amendments to SFDR.

The ESAs are proposing changes to the SFDR Regulation, aimed at addressing issues that have emerged since the introduction of the SFDR. The proposed amendments include:

-

Extending the list of universal social indicators for the disclosure of the principal adverse impacts (PAI) of investment decisions on the environment and society, such as earnings from non-cooperative tax jurisdictions or interference in the formation of trade unions.

-

Refining the content of other indicators for adverse impacts and their respective definitions, applicable methodologies, formulae for calculation as well as the presentation of the share of information derived directly from investee companies, sovereigns, supranationals or real estate assets.

-

Adding product disclosures regarding decarbonisation targets, including intermediate targets, the level of ambition and how the target will be achieved.

-

Improving the disclosures on how sustainable investments ‘do not significantly harm’ the environment and society.

The deadline for comments on the Consultation Paper is 4 July 2023. After it considers the comments received, the ESAs plan to prepare a final report and submit it to the European Commission by the end of October 2023.

Let’s stay tuned.

block

How can Sweep help with the SFDR?

The SFDR ready-to-use questionnaires developed by our experts enable you to efficiently gather all the disclosure related data you need. We ensure transparency and help you save precious time thanks to automation and digitalization.

Make sure you’re up to speed when the regulations enter into force – skip the headache and let the platform manage all the calculations and aggregations for you.

The tool is easy to use, supports you with setting targets and effectively engaging with your portfolio companies.

Find out more about how we can help you stay compliant.