What are the three scopes?

The greenhouse gas protocol outlines three scopes for carbon accounting, each covering different emission sources.

Scope 1 encompasses direct emissions from sources that a company owns or controls, such as fuel combustion in boilers or vehicle fleets.

Scope 2 includes indirect emissions from purchased electricity, steam, heating, and cooling consumed by the organization.

Scope 3 covers all other indirect emissions, including those from upstream and downstream activities, such as business travel, employee commuting, and supply chain activities.

Understanding and accounting for emissions across these three scopes provides a comprehensive view of an organization’s carbon footprint and informs targeted emission reduction strategies.

What are the most common carbon accounting challenges?

Despite its importance, carbon accounting poses several challenges.

Collecting accurate data across diverse emissions sources: One of the foremost challenges in carbon accounting is the sheer complexity and time involved in gathering precise emissions data. This difficulty is particularly pronounced for Scope 3 emissions, which require engaging a wide array of stakeholders, including suppliers and partners, each with their own types and formats of climate data. The diversity of these data sources often leads to inconsistencies and gaps, making it hard to achieve a comprehensive and accurate emissions inventory. There is often confusion about which emission factors are best to use.

Conducting efficient carbon emissions calculations: Another significant hurdle is the management and integration of large volumes of climate data from various sources. Companies often struggle to collate this data in a cohesive manner that aligns with their existing systems. This integration process is not only technically challenging but also resource-intensive, requiring advanced software solutions and dedicated personnel to ensure the accuracy of carbon emissions calculations.

Securing buy-in from internal and external stakeholders: Achieving widespread engagement and commitment from both internal teams and external partners is critical yet challenging. Internally, conflicting business priorities can hinder the adoption of various carbon accounting tools and practices. Externally, convincing suppliers and other partners to participate in detailed emissions measurement and reduction efforts can be difficult, particularly if they do not perceive immediate benefits or have their own constraints.

Maintaining transparency and reporting consistency: Ensuring that carbon accounting reports are transparent, consistent, and compliant with various regulatory standards is a continuous challenge. Companies must adhere to stringent reporting requirements that can vary by region and industry. This necessitates a robust quality control system and meticulous documentation practices to maintain credibility and meet the expectations of regulators, investors, and other stakeholders.

How carbon accounting software can help

Carbon, or greenhouse gas accounting platforms play a pivotal role in streamlining carbon accounting processes and supporting emission reduction initiatives. These software solutions automate data collection, analysis, and reporting, enabling organizations to accurately measure their carbon dioxide emissions and forecast future emissions trends.

By providing insights into energy consumption patterns, carbon accounting softwares help identify emission hotspots, providing actionable insights for efficiency improvements. Moreover, these platforms facilitate emissions management, enabling organizations to track progress towards sustainability goals, enhance environmental performance, and mitigate risks associated with climate change. Such software can also be very useful when it comes to regulatory compliance, and extensive reporting capabilities.

Selecting the best carbon accounting software for your company

Whether you’re looking to map your business’s carbon footprint for the first time, set emission reduction targets, or manage comprehensive ESG data across your value chain, there’s a provider out there for you. There are currently several dozen carbon accounting platforms on the market. We’ve analysed five of the top scoring carbon accounting software options, to help you select the best one for your organization.

1. Sweep

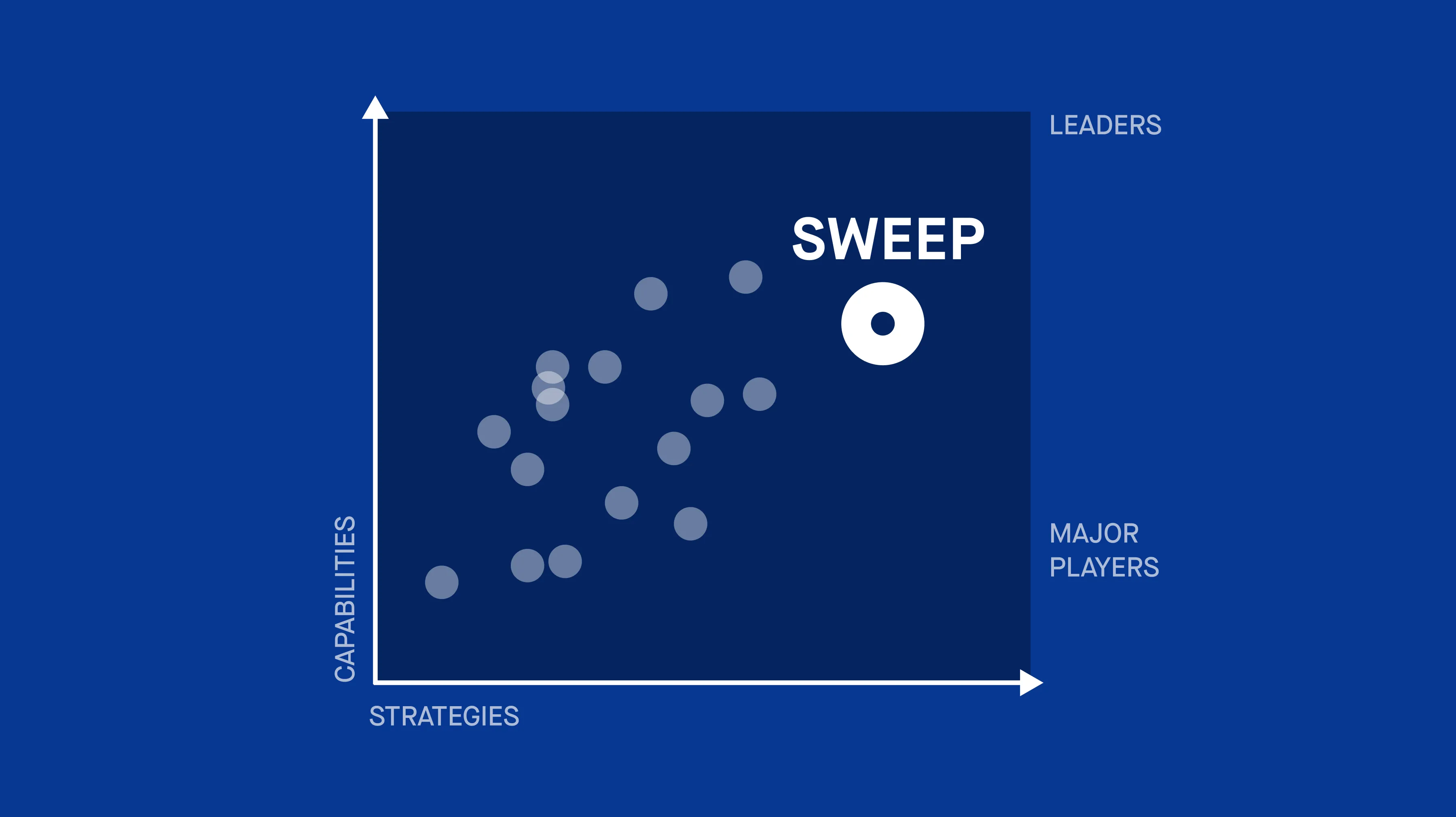

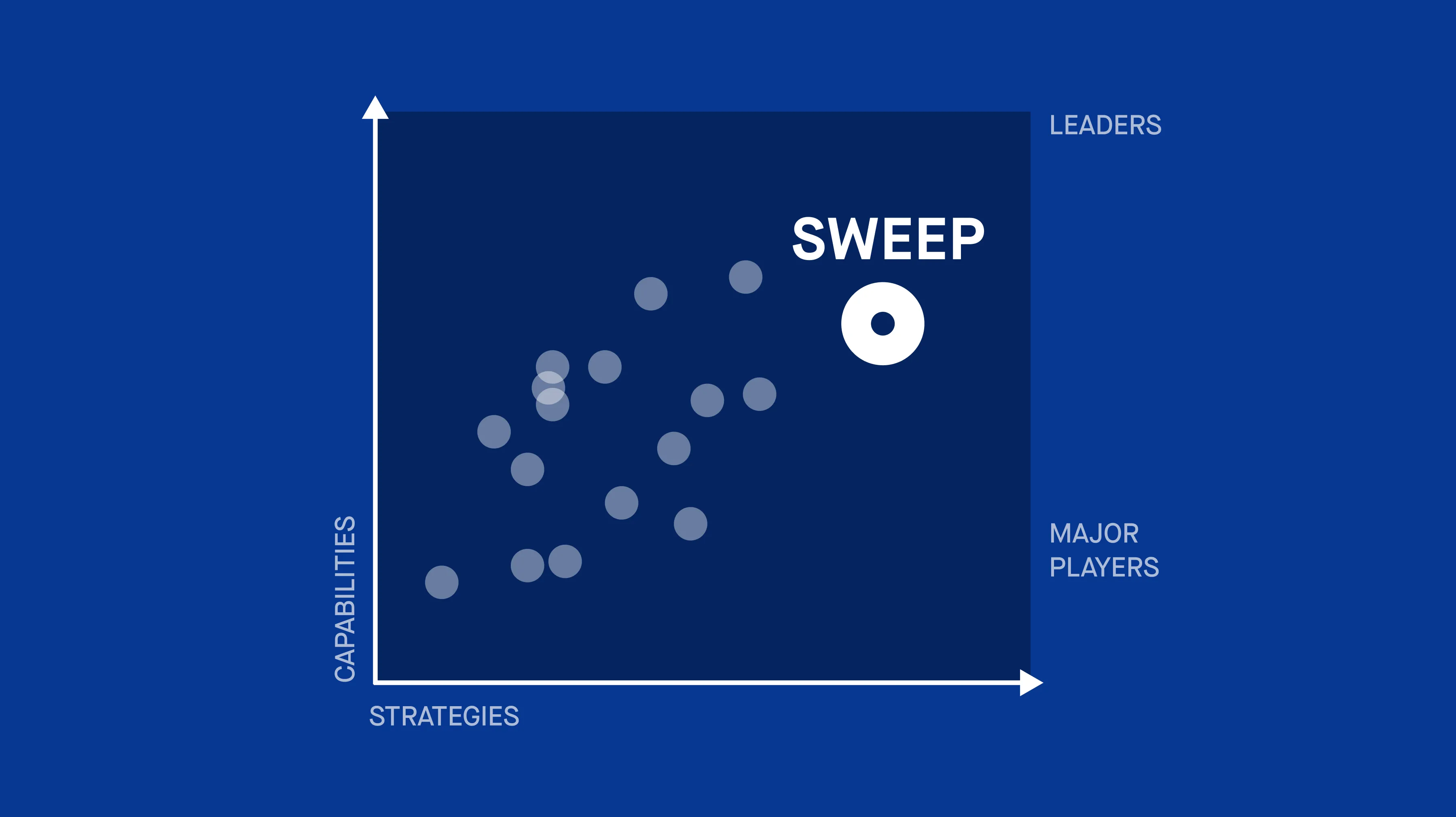

Sweep is a sustainability data management platform helping businesses to achieve their climate goals. It has offices in Paris, Montpellier and London. Sweep has been ranked as the leader among carbon accounting software in the latest IDC Vendor Marketscape Report, surpassing larger, more longstanding providers.

Strengths:

- Trust at every step: Built for robust ESG data management, Sweep handles large datasets, ensures data integrity, and provides dynamic analysis capabilities to help companies make an impact on their sustainability journeys.

- Flexibility: Sweep offers extensive customization options, adapting to organizational needs with ease. It has an extensive library of emission factors. Organizational supply chains are easily modelled using an intuitive format known as ‘Sweep trees.’

- Supplier engagement: Sweep empowers sustainability and procurement teams to work together to build climate programs that clearly track progress towards your reduction goals.

- Sustainability reporting capabilities: Sweep provides businesses with extensive reporting capabilities, aligned with industry standards, like the GHG Protocol and Bilan Carbone.

Most suited to:

Sweep is well suited to organizations of all sizes, with a graduated model to suit varying company sizes, and different levels of data maturity and complexity.

Sweep supports enterprises, with robust solutions for tracking Scope 3 emissions from across the entire value chain. It also works with financial organizations to track and manage the carbon footprint generated by their portfolios.

Note:

The platform has recently launched a Starter package for growing businesses looking to reduce their carbon footprint.

Clients include:

L’Oreal, Lacoste, EDF, HP and Burberry.

2. Watershed

Watershed is a carbon accounting platform with offices in San Francisco, Calif., New York, NY, and London, UK.

Strengths:

Comprehensive sustainability tools: Watershed offers a comprehensive suite of sustainability tools, including carbon, water, and waste accounting modules fully integrated with reporting and carbon reduction opportunities.

Expertise-embedded solutions: Watershed leverages expertise from leading climate scientists and policy experts, embedded into its platform to ensure accuracy and relevance in emissions measurement, reporting, risk management and carbon reduction strategies.

Recent acquisition of VitalMetrics: With the acquisition of VitalMetrics, Watershed enhances its capabilities by incorporating a greenhouse gas emissions database, enabling automatic ingestion of public data and customized surveys to suppliers.

Most suited to:

Watershed’s platform is best suited for medium and large businesses across finance, consumer goods, and supply chain sectors.

Clients include:

FedEx, BlackRock, Douglas, Spotify and Walmart.

3. Microsoft Sustainability Cloud

The Microsoft Sustainability Cloud is a growing set of ESG capabilities from Microsoft, enabling organizations to accelerate sustainability progress and business growth.

Strengths:

- Data intelligence: Microsoft Sustainability Cloud enables businesses to integrate carbon accounting data collection across their value chain with a focus on cost savings.

- Support with data governance: The tool effectively helps businesses to improve audit trails and workflow management. It also enables them to trace reporting data back to the source, including all calculations and actions.

- Sustainability reporting: The tool enables companies to export increasingly accurate, timely, and comprehensive sustainability reports to track the success of their sustainability efforts.

Clients include:

Group Bimbo, Ingredient and FLSmidth.

4. IBM Environmental Intelligence Suite

IBM® Environmental Intelligence Suite is an enterprise software platform to monitor, predict, and respond to climate impact. It can be classed as a combination of ESG performance ad risk management software.

Strengths:

- In-depth insights: The suite combines climate, and environmental data with advanced analytics to enable organizations to anticipate and effectively mitigate environmental risks. This includes the projection of future carbon emissions.

- Comprehensive carbon accounting software: IBM’s Carbon Performance Engine’s GHG Emissions API enables companies to calculate internal and supply chain emissions quickly and easily.

- Biomass estimation: The platform enables users to calculate above-ground biomass in various forested areas by using APIs to assess the impact of deforestation on carbon sequestration.

Clients include:

Sheltair Aviation, Agrilife, Plan 21 and Shell.

5. Persefoni

Persefoni is a leading carbon accounting platform. The company has offices in the US, Canada, UK, Germany, Japan and Singapore.

Strengths:

Carbon-related investing: The software specializes in improving carbon-related investing for the financial industry by facilitating integration with the Partnership for Carbon Accounting Financials framework.

Generative AI capabilities: Persefoni incorporates generative AI capabilities for interpreting data, detecting anomalies, and mapping procurement activity to various emissions factors, providing advanced analytical insights and automation to reduce emissions further.

Supply chain transparency tools: Persefoni’s software includes tools for pulling carbon emissions data from publicly listed companies, simplifying supply chain transparency with larger partners and enabling better environmental impact assessment.

Most suited to:

Persefoni is most suited to financial organizations of all sizes, although it is increasingly offering climate solutions for business.

Clients include:

Bain and company, Citi, Dropbox, Evergy and Burlington.

6. Normative

Normative is a comprehensive carbon accounting platform, designed to help companies meet net zero emissions. It has offices in Stockholm, Copenhagen and London.

Strengths:

Comprehensive carbon management platform: Normative’s Carbon Accounting and Carbon Network software offer a unified SaaS solution for capturing, modeling, and reporting carbon data, fostering collaboration to drive carbon reductions.

Scope 3 visibility: Normative’s software provides enhanced visibility into notoriously difficult-to-track Scope 3 emissions for more precise environmental impact management.

Support for small suppliers: Normative provides a free carbon calculator for smaller suppliers and underpins the SME Climate Hub Business Carbon Calculator, aiding in emission reduction planning and progress tracking.

Most suited to:

Normative’s platform is best suited for large enterprises with complex supply chains seeking comprehensive carbon accounting solutions and collaboration tools.

Note:

The platform is currently limited when it comes to tracking ESG data more holistically, with the focus being predominantly on carbon emissions.

Clients include:

Hertz, Nordea, Topps Tiles, Flying Tiger Copenhagen and Hitachi.

7. Greenly

Greenly, is a carbon accounting software based in France, specializing in helping companies of all sizes reduce their carbon emissions.

Tailored carbon accounting solutions: By leveraging data analytics and third-party expertise, Greenly creates personalized solutions for customers seeking to measure and address their company’s carbon footprint.

Data-driven approach: Greenly integrates data analysis with real-life climate expertise to develop customized carbon emission reduction plans for businesses, making it an ideal choice for companies looking for tailored solutions to mitigate their environmental impact.

Reduced effort: Greenly’s goal is to help companies reduce their carbon footprint through strategic activities. The platform considerably reduces the effort required to carry out a carbon assessment.

Most suited to:

Greenly is most suited to companies financial institutions of all sizes seeking personalized solutions to reduce their carbon emissions.

Note:

The platform is currently limited when it comes to tracking ESG data more holistically, with the focus being predominantly on carbon emissions.

Clients include:

HSBC, Hello Fresh, Tier, Axa and Givenchy.

The best carbon accounting software is in reach

We hope that our analysis has helped you in your search for the right carbon accounting software for your organization.

It’s worth remembering that using a robust carbon accounting solution can help you ensure regulatory compliance, manage your climate risks, and drive long term business growth.

Want to find out more about how Sweep can help?

Reach out to us today.