In this guide you’ll learn:

-

What CDP reporting involves

-

Changes to reporting in 2024

-

The most common reporting challeges

-

Streamlining your reporting and boosting your score

If you’re part of a company looking to report using the CDP, you’re likely aware of its significance in meeting investor and stakeholder expectations and understanding your supply chain impacts.

After experiencing a 30% increase in submissions last year, the CDP has announced some important changes for 2024. These changes include consolidating topics, paying closer attention to forest-related disclosures, and aligning more closely with the International Financial Reporting Standards (IFRS) S2.

While these changes may present challenges, the CDP expects them to ultimately make the ratings process smoother, especially given the expected high volume of submissions for 2024.

In this guide, we’ll walk you through what CDP reporting involves, highlight the changes for 2024, explore common reporting challenges, and provide strategies to streamline your reporting process and improve your score.

CDP, a not-for-profit organization, provides a global disclosure system for disclosing organizations’ environmental impact. Below is a handy recap of what the framework covers.

Central to the CDP reporting system is an annual questionnaire focusing on environmental practices and performance.

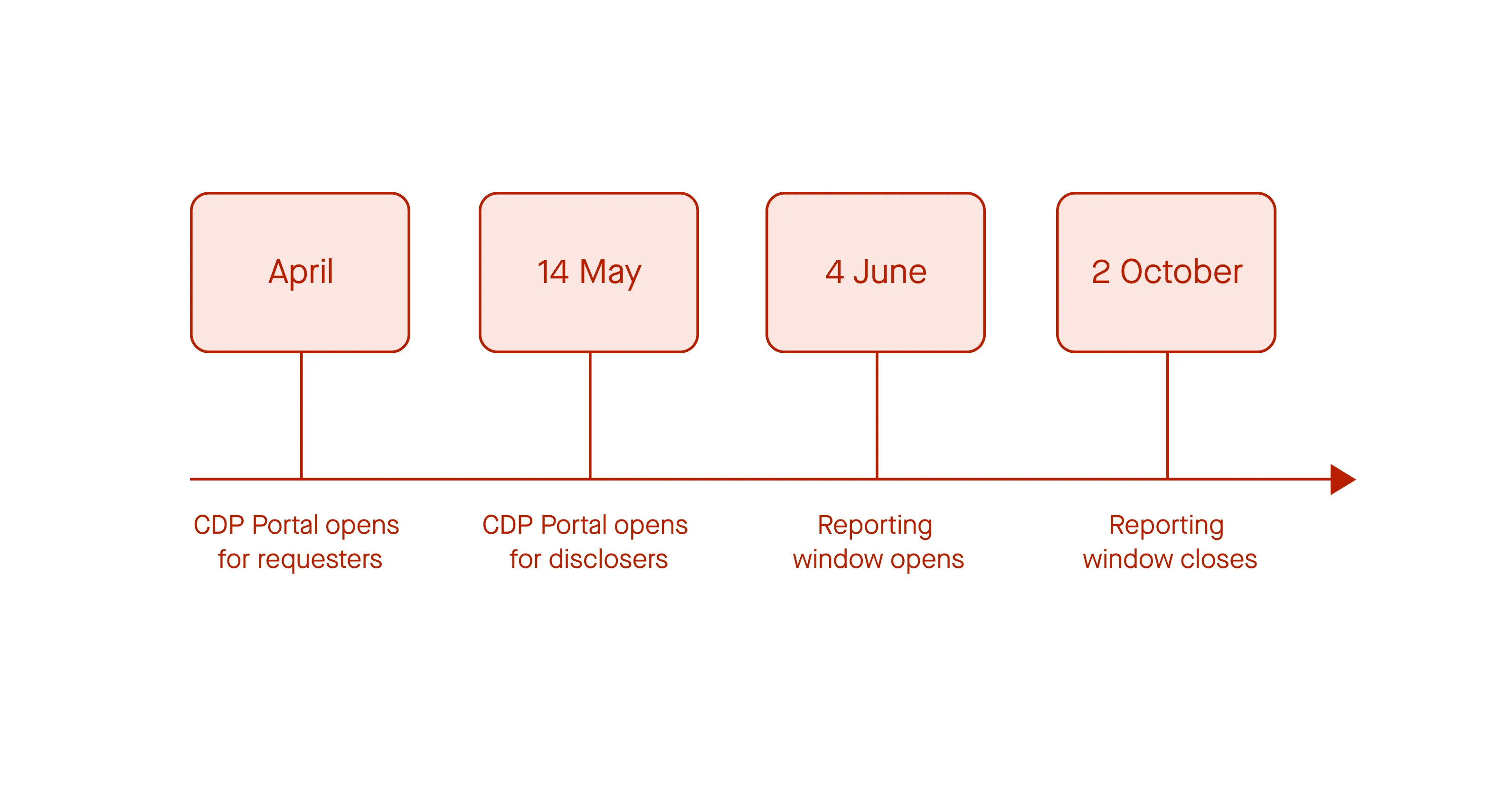

The timescale for reporting is as follows:

CDP questionnaires vary by industry, company size, and additional CDP commitments companies and governmental entities choose to respond to. CDP questionnaires align with the Task Force on Climate-related Financial Disclosures (TCDF), which requires reporting on sustainable and environmental finance, and climate risks associated with finances for companies and governments. Most reporting entities share climate information, but companies can also supply additional information on water, forests, and supply chain criteria.

Climate: Companies share information about how they address climate impacts, risk, emissions management, and decarbonization opportunities.

Water: Roughly 20% of all companies also report on water-related issues and risks.

Forests: Companies can elect to share what they do to verify and manage forest commodities and identify supply chain risks associated with deforestation.

Supply chains: These criteria give companies that are a part of the supply chain of other companies a chance to identify climate risks, decarbonization opportunities, and scope 1, 2, and 3 emissions.

Questionnaire responses are given grades on several criteria:

Verifiability of responses

Level of detail provided

Engagement on value and supply chains

Identification and addressing of climate risks

Ambition of emissions targets

Completeness of reporting for scope 1, scope 2, and scope 3 emissions

Responses also receive grades across industry-specific categories. The differences between a minus grade and a full letter grade depend on the level of engagement or awareness across different indicators:

Leadership (A and A-): These companies show environmental leadership and report on climate, forests, and water indicators. They develop climate and environmental transition plans, consider environmental risks associated with their supply chains, and align with the TCFD, Science Based Targets Initiative, the Sustainable Development Goals (SDGs), and other ESG reporting frameworks.

Management (B and B-): These companies address environmental impacts in their business but aren’t taking actions that would make them a leader in their industry.

Awareness (C and C-): This measure shows how comprehensive a company’s self-evaluation is regarding activities and operations that impact people and ecosystems.

Disclosure (D and D-): These companies answered every question but have not yet achieved core environmental indicators.

Failure (F): Shows a failure to provide sufficient information for evaluation. Typically, these companies failed to answer every question or received requests to provide questionnaire responses but didn’t.

CDP, a leading global environmental disclosure system, is continuously evolving its questionnaires to drive corporate ambition further and support the transition to a 1.5°C, nature-positive world. In 2024, significant changes are being introduced to streamline reporting and enhance the holistic assessment of environmental impacts.

One of the major changes for 2024 is the introduction of the new integrated CDP Corporate Questionnaire. This consolidated questionnaire combines the existing formats for climate, forests, and water security into a single comprehensive questionnaire. By consolidating these questionnaires, CDP aims to encourage a more holistic and balanced disclosure across different environmental issues. The new questionnaire follows the latest scientific developments, aligns with high-quality disclosure frameworks and standards, and includes incremental changes to data points from previous questionnaires.

The new questionnaire challenges companies to take more effective action across the entire spectrum of environmental issues. It emphasizes the assessment and management of dependencies, impacts, risks, and opportunities throughout ecosystems, including land use, biodiversity, and plastics. This expanded focus reflects the growing importance of environmental considerations in corporate strategy.

CDP is also aligning further with emerging reporting frameworks and standards to ensure compatibility with evolving disclosure requirements expected by investors and regulators:

International Financial Reporting Standards (IFRS) S2 Climate-related Disclosures

Task Force on Nature-Related Financial Disclosures (TNFD) recommendations

European Sustainability Reporting Standards (ESRS)

U.S. Securities and Exchange Commission (SEC) climate disclosure rule

Task Force on Climate-related Financial Disclosures (TCFD)

These alignments enhance the relevance and reliability of CDP reporting in the rapidly evolving landscape of environmental disclosure.

In response to increased demand for environmental disclosure, changes are being made to the CDP disclosure portal. The new portal will feature enhanced collaboration capabilities and self-service functionality, making it easier for companies to disclose, track progress, and access data. These improvements aim to streamline the reporting process and facilitate better environmental impact measurement and management.

In summary, the changes introduced by CDP in 2024 represent a significant step towards more comprehensive and streamlined environmental reporting. These changes will empower companies to better understand and address their environmental impacts while meeting the evolving expectations of investors and regulators.

One of the primary challenges faced by companies reporting through CDP is the incomplete disclosure of emissions data. Despite the importance of comprehensive emission reporting, only 37% of companies disclosed emissions across all three scopes. This incomplete disclosure hampers efforts to accurately assess and mitigate carbon footprints, hindering progress towards emission reduction targets and climate action.

Many companies struggle with integrating biodiversity considerations into their sustainability strategies. Despite the introduction of the biodiversity module in 2022, few companies have broadened their sustainability strategies to address biodiversity issues effectively. Integrating governance, commitments, monitoring, and reporting on all ESG issues is essential for CDP reporting.

Climate transition plans are crucial for demonstrating a company’s commitment to achieving a 1.5-degree pathway and aligning with a net-zero carbon economy. However, many companies face challenges in developing clear and credible transition plans. The lack of clarity and ambiguity in these plans hinders effective communication of sustainability goals and may impede progress towards emission reduction targets.

Effective engagement with suppliers is essential for achieving decarbonized and resilient supply chains. However, many companies struggle with inadequate supply chain engagement despite guidance from CDP and other sustainability frameworks. This poses a significant challenge in achieving comprehensive sustainability goals and attaining A-list status with CDP.

Financial institutions (FIs) are increasingly measuring their portfolio impact on climate, but they still experience significant challenges with emissions management. 40% of them still only reported operational emissions targets, and 25% reported no targets at all. Closing this gap is essential for ensuring that financial portfolios align with global emission reduction goals and contribute to sustainable finance practices.

Implement robust data collection processes to ensure the accuracy and completeness of the information you submit to CDP – encompassing emissions, water usage, forest management, and other material metrics. Consider conducting third-party verification to enhance the credibility of your reported data.

The open sustainability data platform Our platform seamlessly integrates with diverse IT systems, simplifying the data collection for carbon and ESG reporting. Sweep AI assistant Sweepy automatically converts imported files into required formats, reducing manual efforts and the risk of error.

Anomaly detection for data integrity Our data quality assessment controls automatically detect anomalies to ensure data integrity and accuracy, allowing your team to base their decisions on reliable data.

Streamlined workflows for efficiency By automating tasks like data cleansing and survey response generation, Sweep AI enhances the efficiency and impact of your sustainability reporting.

Develop a comprehensive sustainability strategy that aligns with CDP’s disclosure requirements and addresses key environmental challenges, such as climate change and biodiversity loss. Set ambitious, science-based targets for emissions reduction, water conservation, and forest stewardship to demonstrate your organization’s commitment to environmental stewardship and long-term sustainability.

Setting ambitious, science-based targets

Sweep’s Act module allows you to set reduction targets and roadmaps (for emissions reduction, water conservation, and forest stewardship) aligned with the science-based targets initiative.

Setting a sustainability strategy aligned with CDP requirements

Sweep provides tools to develop a comprehensive sustainability strategy that seamlessly aligns with CDP’s disclosure requirements.

Assess the environmental impact of your supply chain and investment portfolio to identify opportunities for emissions reduction and sustainable practices. Collaborate with suppliers to enhance transparency and sustainability throughout the supply chain, and integrate environmental criteria into investment decision-making processes to align with CDP’s disclosure requirements and demonstrate a holistic approach to environmental management.

Efficient supplier engagement

Your sustainability and procurement teams can work together to build a climate program that tracks your progress towards your reduction goals. Together, you can take data-driven decisions to optimize and future-proof your supply-chain.

Shared targets and effective monitoring

Drive collective and collaborative climate action along your value chain by setting shared climate targets and monitoring progress.

Contact us today.

Sweep is a carbon and ESG management platform that empowers businesses to meet their sustainability goals.

Using our platform, you can: