1. The finance department’s role in sustainability transition

In recent years, the role of the CFO has expanded significantly beyond traditional financial management. While setting decarbonization targets and sustainability strategies is typically the domain of the Chief Sustainability Officer (CSO), the CFO plays a crucial role in making these initiatives actionable and credible. By allocating resources for ESG projects and integrating sustainability considerations into financial planning and decision-making, CFOs ensure that sustainability efforts are not just strategic but also tangible and impactful. Their ability to provide financial backing and credibility is key to turning sustainability strategies into real, measurable outcomes.

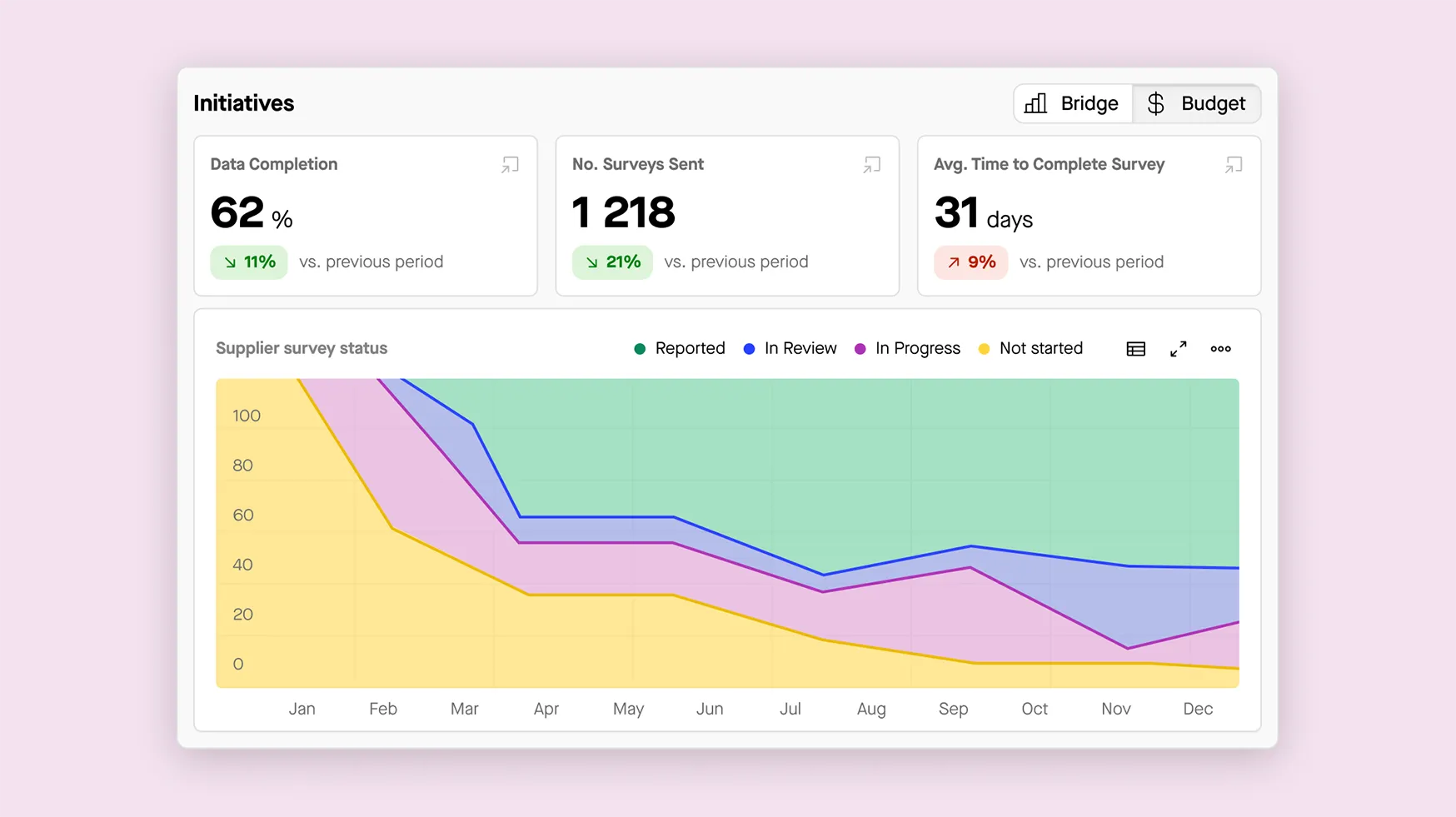

By becoming more involved in the transformation of companies towards more sustainable models, CFOs are influencing the way in which CSR is conducted. The same standards that apply to the management of financial data will also apply to non-financial data: reliability and audibility, forecasts and projections, and even budgeting. Like ERP finance, only a digital ESG data management platform can enable the CSO/CFO duo to steer an effective transformation of the company.

Understanding the scope of financing

When discussing financing for sustainability, it’s important to understand the two primary approaches: optimizing existing financial practices, and transforming the business model.

Optimizing financial practices

This approach involves reallocating resources within existing financial structures to support sustainability goals. This could include investing in energy-efficient technologies, improving supply chain sustainability, or achieving ESG certifications. The aim being to both enhance operational efficiency and integrate sustainability into the current financial framework without overhauling the entire business model.

Transforming the business model

Transforming the business model involves more profound changes, such as radically changing the revenue base by developing new products or services and discontinuing others. This requires a significant capital investment and strategic overhaul, reflecting a long-term commitment to sustainability. Such transformations often necessitate substantial shifts in financial planning and resource allocation.

2. Business benefits of financing the sustainability transition

a) Business development and innovation

Financing the sustainability transition offers significant opportunities for business development and innovation. By developing products and services that are compatible with global carbon neutrality in 2050, companies can create new revenue streams and explore new markets. Such investments often lead to breakthroughs in technology and operational efficiency. An example of this is one of Sweep’s clients, Oxford Photovoltaics, a UK company, spun out from Oxford University. It has recently begun large-scale production of perovskite solar cells which have been found to be considerably more efficient and cost-effective than other solar panel materials.

For instance, the adoption of renewable energy sources and waste reduction processes not only reduces operational costs but also opens up new revenue streams through the development of innovative, eco-friendly products. A good example of this is Iberdrola, a leader in renewable energy, which has focused on decarbonization for over 20 years, reducing emissions significantly and closing coal plants. The company aims to triple its renewable capacity to 60GW by 2025 and 95GW by 2030, investing heavily in network infrastructure and expanding its global customer base to 70 million with advanced energy solutions.

Furthermore, companies that embrace sustainability are better positioned to access emerging markets and attract investment.

b) Competitiveness

Financing sustainability is shown to enhance a company’s competitiveness by differentiating it in the marketplace. A recent OECD report reveals that the European carbon market, which covers over 40% of emissions from European Union states, has led to increased revenues and asset values for the companies involved, contrary to fears of reduced competitiveness. The study found that while achieving a 10% reduction in greenhouse gas emissions over a seven year period, these companies also increased their revenue by 7% to 18% and asset growth by 6% to 10%, without negatively impacting either employee numbers or profits. These results challenge the notion that carbon regulations hinder economic performance and instead suggest potential benefits from investing in carbon reduction technologies.

Additionally, companies that proactively adopt green technologies report gaining a competitive edge by staying ahead of regulatory requirements and responding more effectively to shifts in consumer preferences. This proactive approach helps companies avoid the costs of late compliance and potential penalties, reinforcing their position in the market.

c) Resilience

Financially supporting the transition to sustainability builds organizational resilience. Companies that integrate sustainable practices are better equipped to handle environmental and regulatory risks. For example, businesses that invest in energy-efficient technologies or sustainable supply chains are less vulnerable to fluctuations in energy prices or raw material shortages. During the energy crisis caused by the ongoing war in Ukraine, the companies that switched to local energy sources have been the most resilient, maintaining operational stability while others faced supply disruptions and soaring costs.

Recent research from Accenture shows that companies with consistently high ESG performance achieved 2.6 times higher total shareholder returns and 4.7 times higher operating margins compared to those with medium ESG performance. These top-performing companies are also more resilient, effectively managing ESG risks and resources while seizing growth opportunities in a low-carbon economy.

By anticipating and addressing potential disruptions, these companies can ensure continuity and stability in their operations.

Moreover, enhanced resilience through sustainability can improve a company’s reputation and reliability, making it a more attractive partner for investors and stakeholders who prioritize long-term stability and risk management.

d) Talent attractiveness

Investing in sustainability not only benefits the company but also makes it more appealing to top talent. A recent study by Deloitte, found that 69% of employees want their companies to invest in sustainability efforts, including reducing carbon, using renewable energy, and reducing waste.

Aligning with employee values can lead to higher job satisfaction, lower turnover rates, and a more engaged workforce. In a competitive job market, being recognized as a leader in sustainability can significantly enhance a company’s ability to attract and keep skilled professionals.

3. Strategies for financing the transition and boosting ROI

For Chief Financial Officers and Finance Directors, the return on investment (ROI) from financing the transition to a low-carbon economy can be substantial. Let’s take a closer look at how strategic investments in sustainability can deliver impressive financial returns and support long-term growth.

a) Optimizing operations for cost efficiency and risk reduction

Energy management

One of the most straightforward ways to save money and reduce your environmental footprint is through energy efficiency. Implementing practices like upgrading to energy-efficient lighting, optimizing heating and cooling systems, and investing in energy management technologies can lead to immediate cost reductions.

Furthermore, transitioning to renewable energy sources, such as solar or wind power, is increasingly cost-effective. As fossil fuel prices rise and renewable technologies become more affordable, investing in renewables not only supports your sustainability goals but also shields your company from price volatility.

Engaging in a Power Purchase Agreement (PPA) can provide long-term stability, allowing you to lock in favorable rates and avoid the unpredictability of energy markets.

Material use

Reducing material consumption and waste directly impacts your expenses. By focusing on more efficient use of resources, you can lower material costs and potentially reduce operational overhead.

This approach not only helps in cutting costs but also aligns with broader environmental goals by minimizing waste and lowering your carbon footprint. Implementing practices such as recycling, using less material-intensive products, and optimizing production processes can lead to substantial savings and environmental benefits.

Working conditions

Reassessing and optimizing your working conditions, including telecommuting policies and business travel, can lead to both financial and environmental gains.

Encouraging remote work can reduce the need for office space, lower utility costs, and cut down on business travel expenses.

Implementing a robust business travel policy that favors virtual meetings over physical travel can further reduce costs and CO2 emissions. These practices not only contribute to your sustainability goals but also enhance employee satisfaction and productivity.

Supply chain management

Your supply chain represents a significant portion of your carbon footprint and financial risk. It’s crucial to identify and manage these risks effectively to avoid issues such as stock-outs and lost revenue. Approximately two-thirds of your risks come from your supply chain, making it essential to assess and address potential vulnerabilities.

Regulations like the Corporate Sustainability Reporting Directive (CSRD) assist in identifying and managing these risks. By improving supply chain transparency and resilience, you can uncover opportunities for cost savings, efficiency improvements, and risk mitigation.

b) Navigating carbon pricing and taxes

Internal carbon pricing

Implementing an internal carbon pricing mechanism can help you put a financial value on emissions within your organization. It can also send out a clear message around the price linked to carbon footprint reduction. This practice involves setting a price per ton of carbon emitted, which can drive internal efforts to reduce emissions. Companies with lower emissions will incur lower costs, creating a financial incentive to invest in cleaner technologies and practices. Internal carbon pricing can also help in making more informed investment decisions and aligning with broader carbon reduction goals.

External carbon taxes and mechanisms

Understanding and preparing for external carbon pricing mechanisms, such as carbon taxes, Emission Trading System (ETS) and the European Union’s Carbon Border Adjustment Mechanism (CBAM), is critical. The CBAM, set to be implemented in 2026, introduces a levy on the importation of carbon-intensive products such as cement, steel, and aluminum. This mechanism aims to reduce the carbon intensity of imported goods and incentivize local industries to lower their emissions. Preparing for these changes can help manage costs and ensure compliance. By reducing your carbon footprint, you can also minimize the impact of such taxes and potentially benefit from incentives associated with lower emissions.