Contents

We will cover:

-

Understanding the full scope of measurement

-

Measuring Financed Emissions

-

Measuring Supply Chain Emissions

-

Target Setting

-

Reduction

-

Reporting your progress

-

How Sweep can help

We will cover:

We’d love to know a little more about you. Enter your details to unlock the page

In an era defined by the urgent need for climate action, the global banking sector stands at the forefront of the battle against climate change. With nearly 60% of the world’s leading banks committing to achieving net-zero carbon emissions, the financial industry plays a pivotal role in shaping a sustainable future.

However, a stark reality emerges from recent research from Accenture — only 12% of banks are currently on course to reduce their own Scope 1 and 2 emissions by the net-zero target date of 2050.

And crucially, the challenge extends beyond banks’ operational emissions, accounting for just a fraction of their total impact. The larger and more impactful task lies in addressing Scope 3 emissions, which contribute over 95% to the average bank’s overall carbon footprint.

In this complex landscape, banks face four critical challenges:

Effectively addressing their own operational emissions.

Measuring their full Scope 3 carbon footprint – including both financed and supply chain emissions.

Empowering corporate customers to decarbonize with effective tools.

Distributing and monitoring sustainable products to clients, including sustainable savings and loans.

In our guide, we offer insights into how banks can navigate these challenges to fulfill their commitment to a decarbonized future.

We address key aspects such as:

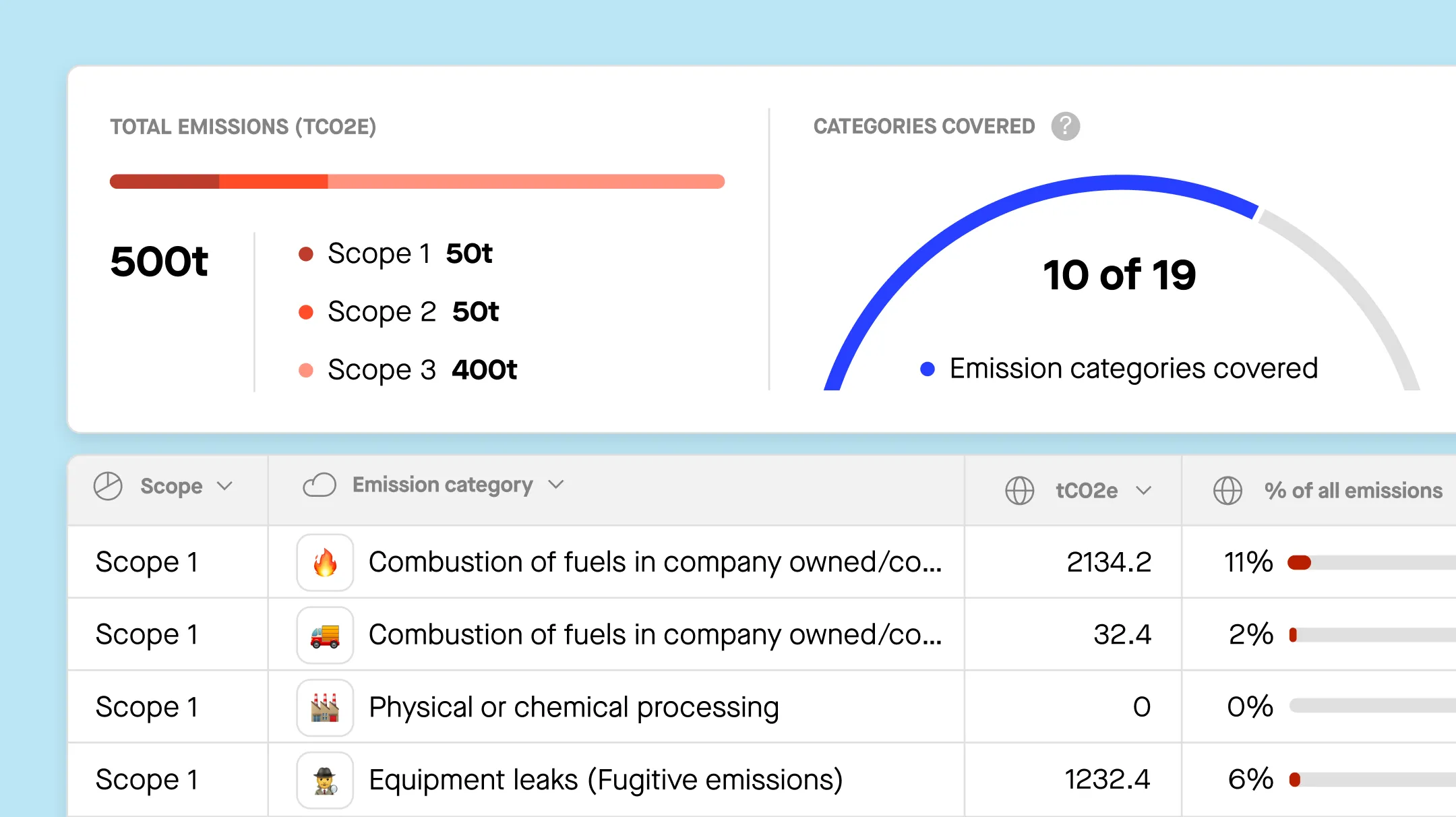

Key Challenge: Defining the operational boundaries for Scope 1 and 2 emissions can be complex. Banks need to clearly delineate the activities and assets within their control (Scope 1) and identify the sources of purchased energy (Scope 2). Determining the extent of organizational control and influence is crucial for a comprehensive assessment.

Overcoming this challenge requires a concerted effort by banks to implement robust data collection mechanisms, establish clear operational boundaries, enhance collaboration with data providers, and stay informed about evolving emission factors and reporting standards. This is where the right data collection tools can have a big impact.

While measuring Scopes 1 and 2 is challenging, getting to grips with Scope 3 is altogether more complex.

According to CDP Worldwide, a global climate disclosure system, emissions stemming from banks’ financing activities were roughly 700 times more significant than their direct operational emissions.

Recently, much attention in the sector has been directed toward managing “downstream” emissions from lending and investment portfolios – so called, “financed emissions.” Addressing these emissions is crucial, because financial institutions play a pivotal role in mitigating climate change by reallocating portfolios, investing in climate measures, and managing the emissions associated with loans and investments.

But the importance of mitigating “upstream” emissions from suppliers and contractors is also very significant. Accenture’s Rising to the Challenge of Net Zero Banking report emphasizes that supply chain emissions, often overlooked by banks, hold the key to significant emissions reductions. Collaborating with suppliers not only aligns with banks’ sustainability objectives but also opens avenues for cost savings and new business opportunities.

The NZBA, representing nearly half of the global banking industry, is dedicated to achieving net-zero emissions by 2050. Here’s what you need to know:

Commitment to Net Zero: The NZBA aligns banks’ lending and investment portfolios with net-zero emissions, covering both financed and operational emissions.Transparency and accountability: Members are required to set intermediate targets, regularly report progress, and establish robust governance structures, ensuring transparency in climate-related efforts.Collaborative engagement: Participating in the NZBA involves active engagement with clients and stakeholders, fostering collaboration for shared climate objectives and amplifying the impact of sustainability initiatives.Driving systemic change: Joining the NZBA signals your commitment to driving systemic change within the financial sector, adopting sustainable practices, and contributing to the broader transition to a low-carbon economy.

By becoming a part of the NZBA, you position your bank at the forefront of collective climate action. More details on the NZBA reporting targets can be found in the ‘Targets’ section below.

Banks recognize that carbon emissions data is essential to meeting their Net Zero carbon pledges. However, they often struggle to get reliable data from across their loan portfolio.

A recent report from Accenture has found that the majority of banks use emissions data with limited granularity for significant portions of their portfolios, enabling only intermediate or high-level measurements. Only a handful of banks possess a detailed understanding of the carbon footprint associated with funded clients and projects at a granular level. This includes factors such as activity, location, energy sources, or other characteristics that may be correlated with emissions.

The Partnership for Carbon Accounting Financials (PCAF) has set a universal standard for accounting and reporting, defining how emissions financed through different asset classes, such as listed equity, corporate bonds, business loans, unlisted equity, project finance, commercial real estate, mortgages, and motor vehicle loans, should be measured and disclosed globally. Many major banks now incorporate PCAF guidance into their disclosures, showcasing broad support for this approach within the banking industry.

To effectively address emissions within your portfolio, it’s crucial to create a clear map, considering various aspects such as loan books, equities, bonds, and more. This comprehensive mapping allows for a structured approach, enabling the prioritization of high-impact areas that contribute significantly to emissions.

Collaborate closely with asset managers and investment professionals to gain detailed insights into the underlying assets and entities within different portfolios. By delving into specific portfolios like loan books, equities, and bonds, you can tailor your decarbonization strategies more precisely to each asset class, ensuring a more effective and nuanced approach across your entire portfolio.

Improve the accuracy of your emissions evaluation with a step-by-step strategy. Start by looking at your whole portfolio by industry to spot sectors with higher emissions. Then, go deeper into each sector, focusing on major emitters or loans.

Follow the Pareto principle—begin with 4 or 5 key sectors, set specific goals, and then zoom in on individual emitters. This approach is widely used by banks which are part of the Net Zero Banking Alliance (NZBA). It guarantees a thorough analysis, reduces the risk of misjudging baseline data and ensures precise target setting.

Acquiring accurate data on the underlying assets of your loan book is a crucial step in comprehending your portfolio’s environmental impact. Leveraging tools like PCAF, which details how to calculate the attribution factor based on financial data and the carbon footprint of underlying assets, aids in estimating the carbon emissions of your portfolio companies. However, it’s essential to note that banks often begin with sector-based revenue estimates, leading to potential inaccuracies in setting precise decarbonization targets due to limited data granularity.

These data-driven insights empower you to make informed decisions and drive positive change within your portfolio.

Sweep for Finance is a unified platform to capture all the carbon data from across your portfolio in a single location – helping you to efficiently achieve your climate targets.

We can help you:

Map your entire portfolio and identify your emission hotspots. The aim is to focus on your top emitters – 20% of them are likely responsible for 80% of your total Scope 3 footprint.

Connect with your business banking clients or loanees in order to collect more granular data. We can propose several solutions to engage with your network:

Help your corporate clients to start their climate journey for free, by answering a carbon survey. This will create a free account on the Sweep platform and provide a carbon footprint in a GHG Protocol format.

Support your corporate clients to go further in their climate strategy by proposing a Sweep family offer. This would involve upgrading their free plan to a corporate plan with access to emissions measurement and reduction.

Enable your corporate clients to define their climate targets and share these targets with you in order to achieve common climate goals and trajectories.

We know that when it comes to decarbonization, it’s not easy to drive engagement, which is why Sweep supports you to raise climate awareness among your clients and your staff through a comprehensive eLearning platform, on- and offline events, dedicated newsletters and more.

Navigating the complexities of supply chain emissions, banks face challenges in identifying numerous firms within their networks and accurately measuring emissions from diverse suppliers.

As with financed emissions, mapping your supply chain contributors is crucial as it gives you a clear picture of the activities, processes, and systems involved in the entire chain. It also helps you identify your top emitters.

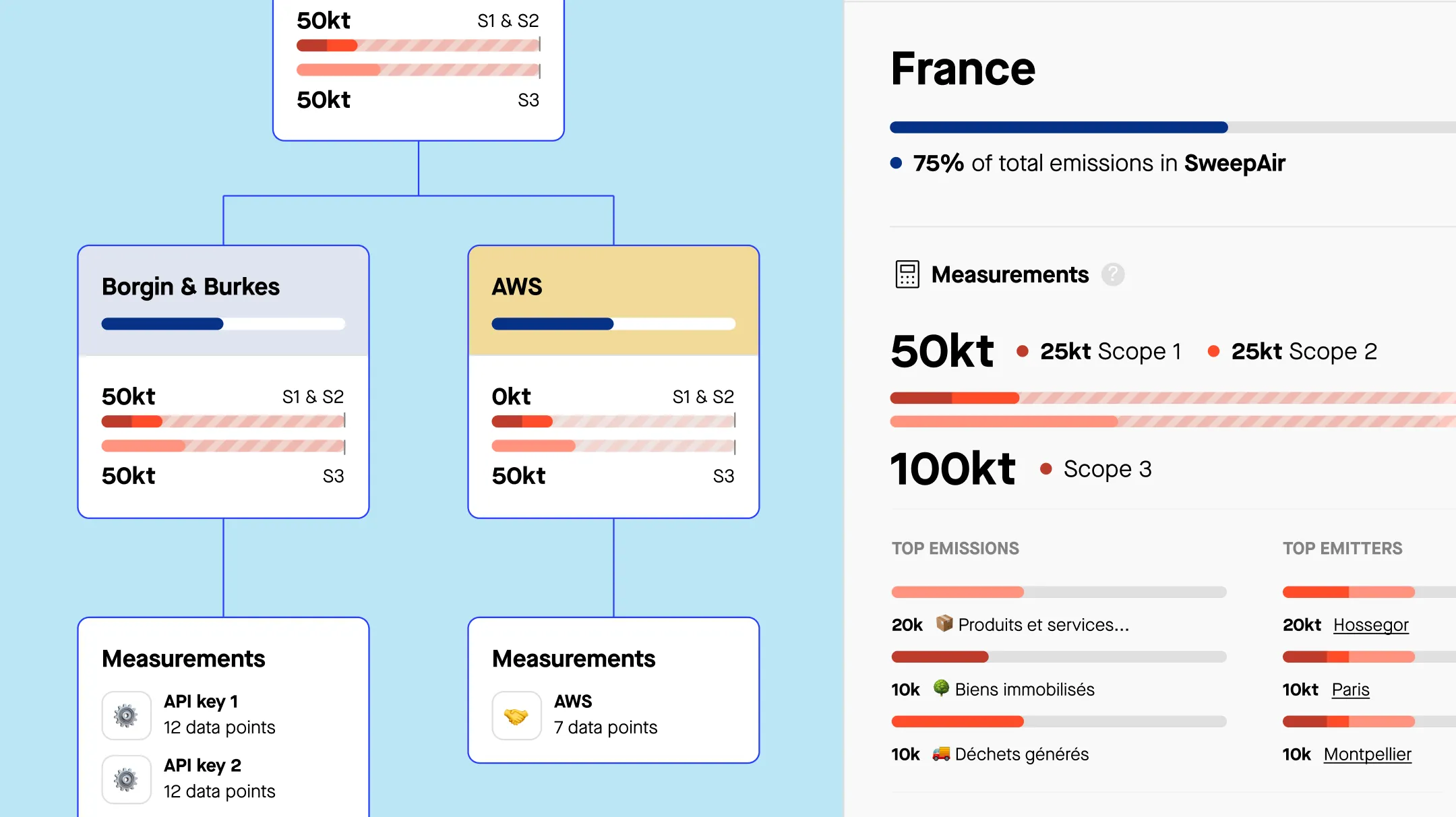

With a clear map (which we refer to as a ‘Tree’ in Sweep) you’ll be able to visualize exactly what data you’ll need and from whom. You can also use this to conduct a baseline measurement of your emissions using the data that you have at your disposal.

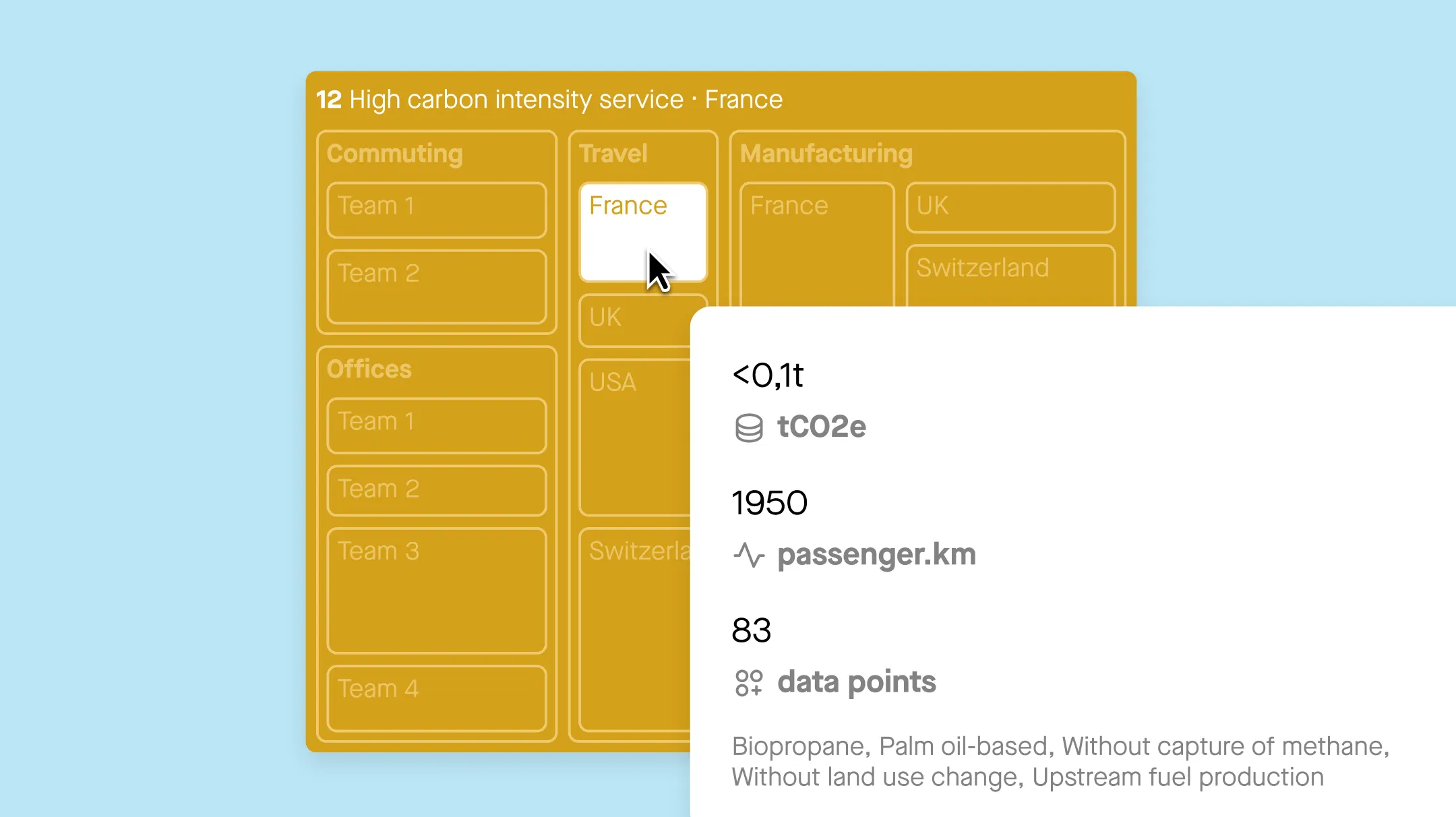

Focus on your strategic suppliers first (using the above-mentioned Pareto Principle), and get them on board by making more exact data collection as simple as you can. Provide your procurement and sustainability teams with tools to automate data collection for purchased goods and services. Empower them to send surveys to suppliers to collect missing data.

If you don’t have exact supplier-based data at your disposal, don’t worry. You can still obtain a baseline measurement for your supply chain emissions. Our platform is specifically designed to suit suppliers with varying levels of data maturity.

We can help you:

Model your supply chain using benchmark data and identify your emission hotspots. We use industry averages and spend-based data as a starting point.

Send each supplier a straightforward climate survey. This is the first step to embarking on their own climate journey and tracking the impact of their actions. Note that you can adapt our climate surveys to your needs.

An important next step is setting collaborative emission reduction targets. This will provide a clear goal for your portfolio companies and suppliers to work towards, and help to measure their progress.

You can use science-based targets (SBTs) as a guide to set ambitious and achievable targets that are aligned with the Paris Agreement.

It’s worth setting separate targets for your Scope 1, 2, and 3 emissions, either absolute or intensity-based.

The Financial Sector Science-Based Targets Guidance by SBTi empowers financial institutions, such as banks, investors, insurance companies, and pension funds, to establish science-based targets aligning with the Paris Climate Agreement in their lending and investment endeavors.

The guidance outlines steps for FIs to:

Establish a comprehensive headline target detailing the inclusion of asset classes and the proportion of their overall portfolio covered;

Set targets for individual asset classes, specifying the method employed and presenting specific target language;

Detail the actions to be undertaken to achieve both headline and asset class–specific targets.

Absolute emission targets

Absolute emission targets refer to a specific amount of emissions that your bank commits to reducing or avoiding over a given period of time. This target is set in terms of the total amount of emissions and isn’t dependent on the growth of your business, or the profits made in a given year.

Example: Bank A pledges to reduce its financed emissions by 40% compared to its baseline by 2030.

Intensity-based emission targets

Intensity-based emission targets refer to a reduction in emissions per unit of economic activity. They allow firms to set emission reduction targets while at the same time accounting for growth or business changes (such as mergers or acquisitions).

Example: Bank B pledges to remove 5 metric tons of CO₂ per $1 million invested.

If you sign up to the NZBA, you commit to aligning your lending and investment portfolios with net-zero by 2050 and set science-based emission reduction targets for 2030 or sooner for the most carbon intensive sectors in your portfolio. This must be done within 18 months of joining the alliance.

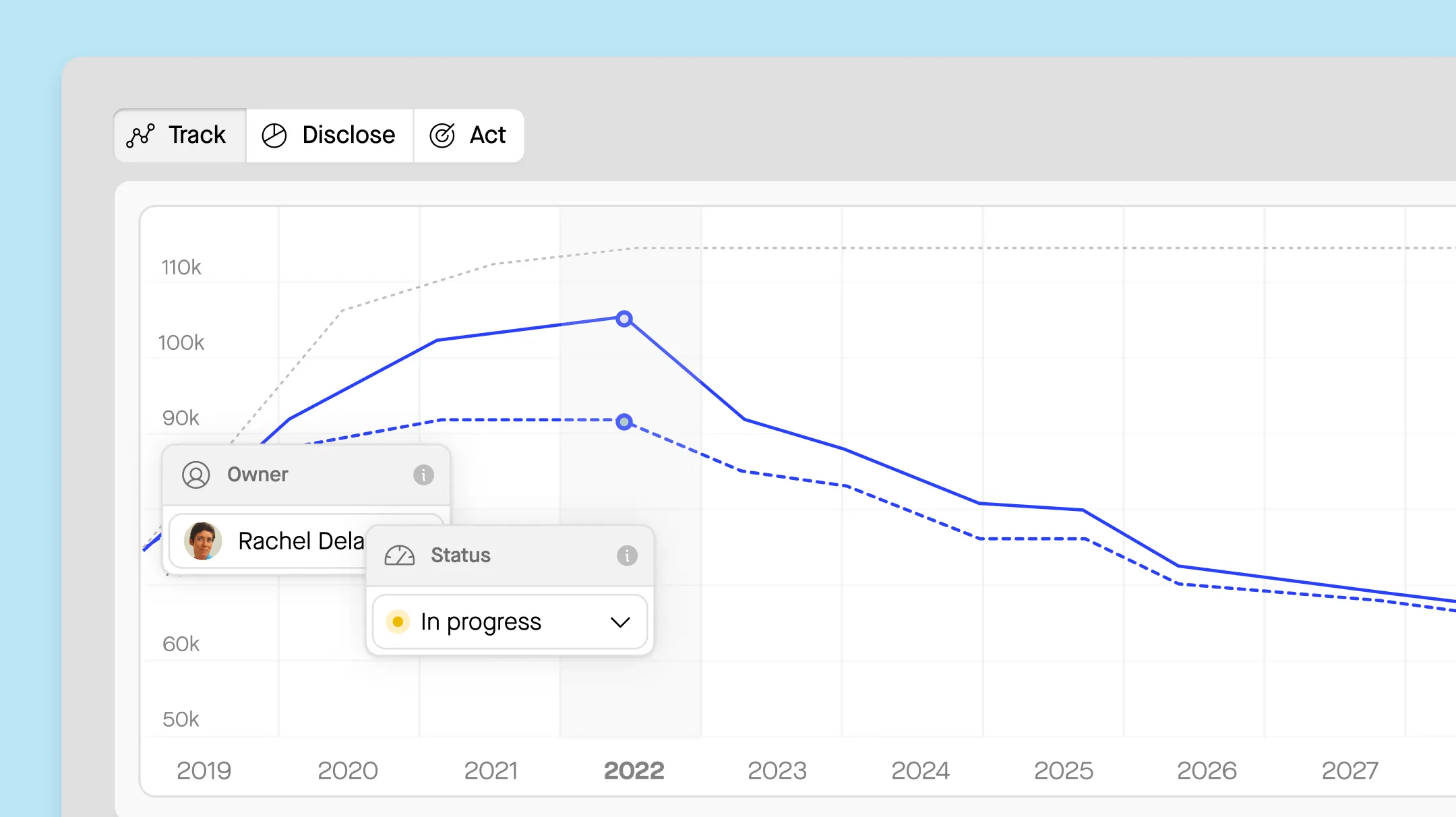

Sweep enables you to take the lead on your decarbonization strategy, and support the transition to a net zero economy.

Using our platform you can easily set targets at different levels: for portfolio companies, funds, or entities, and cascade the fund temperature alignment back to them.

The network approach is key to collaborative reduction.

Banks face the significant challenge of aligning their loan portfolios and supporting their suppliers and customers on their own decarbonization journeys. This task is virtually insurmountable without the right tools for the job.

In the pursuit of decarbonization, banks can lead the way by leveraging their capital resources and close corporate ties to encourage companies in their lending and investment portfolios to substantially reduce greenhouse gas emissions.

As banks transition into becoming trusted advisors and partners in their customers’ journey to net zero, they gain a competitive edge in building a stronger, more diverse, and resilient business.

To kick start collaborative reduction efforts, banks can:

Collaborate on Net Zero transition: Work closely with corporate customers, providing expertise, services, resources, and finance to facilitate their transition to net zero. This requires a fundamental shift in how banks interact with clients, emphasizing trust-building, sharing best practices, and assisting in ESG data gathering, analysis, and reporting. Collaborative efforts should extend beyond financial support, fostering a holistic approach to sustainability through joint initiatives and knowledge sharing.

Train employees: Equip relationship managers with climate science expertise, turning them into ‘climate advisors’ capable of guiding corporate customers through the decarbonization process. This involves comprehensive training, education, and upgrading information systems to support industry-specific climate science skills. By empowering employees with a deep understanding of climate-related challenges, banks can effectively drive sustainable practices within their organizations and among their clientele.

Integrate climate risk assessment: Implement robust climate risk assessment practices across lending and investment activities. This involves incorporating climate-related risk factors into decision-making processes, ensuring that banks thoroughly assess the environmental impact of their financial activities. By integrating climate risk assessments, banks can better align their strategies with the goals of the Paris Agreement and proactively manage risks associated with climate change, fostering a more sustainable financial sector.

Offer green products and services: Develop a comprehensive range of sustainable offerings that incentivize and enable customers to enhance their sustainability, moving beyond competitive pricing to provide tailored ‘green glove’ solutions and partnerships. This involves creating innovative financial products that align with customers’ sustainability goals and actively contribute to the development of a green economy.

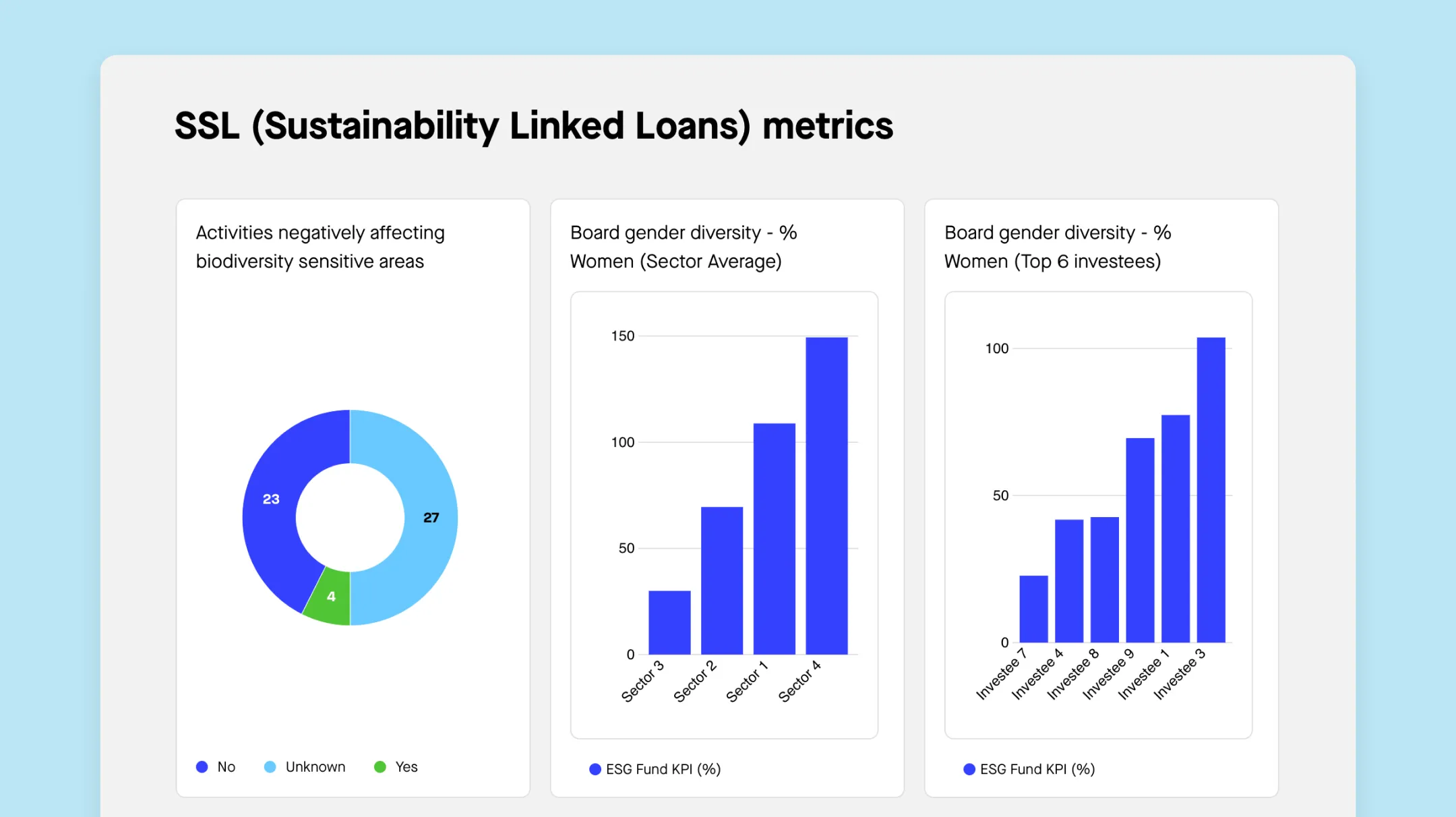

These loans tie the interest rates and terms to the borrower’s achievement of predefined environmental, social, or governance (ESG) performance targets. By incentivizing borrowers to meet stringent sustainability criteria, such as reducing carbon emissions or enhancing social responsibility, your bank can actively contribute to a low-carbon economy.

Sustainability-linked loans not only integrate environmental considerations into the financial decision-making process but also encourage clients to prioritize decarbonization initiatives.

Sweep can help you engage securely with your loanees in order to collect the ESG metrics linked to any SLL facility.

When it comes to reporting, one of your key KPIs will be your loan portfolio’s and suppliers’ progress on their Scope 3 emissions. This will require you to share your reporting tool with each of them and to regularly monitor progress against targets. Each individual company target will fit into your own overall climate target.

Some banks choose to classify their loans based on their progress towards decarbonization. For example, you might choose to use a scale like this:

Level 1: Loans that have achieved net zero for Scopes 1 and 2, and whose Scope 3 reduction trajectories are aligned with a 2°C max increase in temperature.

Level 2: Loans whose Scope 1 and 2 trajectories are aligned with a 2°C max increase in temperature, with Scope 3 calculations 80% based on physical data.

Level 3: Loans whose Scope 1 and 2 trajectories are aligned with a 2°C max increase in temperature, with Scope 3 calculations 60% based on physical data.

Level 4: Loans that have calculated their Scope 1 and 2 emissions based on physical data and their Scope 3 carbon footprint based on spend-based data.

Level 5: Loans that are using a spend-based approach across all scopes to calculate and act on their carbon footprint.

Such classifications enable you to more easily demonstrate progress against targets.

E.g. In January 2020, we had 10% of loans at level 3, 20% at level 4 and 70% at level 5. But in January 2023, we have 5% of loans at level 1, 15% at level 2, 30% at level 3 and the remainder at level 4.

Your bank’s financed emissions reports are likely to be requested by a number of stakeholders, including customers, and analysts. Reporting is also essential for complying with regulations. These depend on your region and scope of operations.

The number of countries with mandatory disclosures relating to financed emissions is on the rise.

Here are the key ones that you should be aware of:

The Sustainable Financial Disclosure Regulation (SFDR), led by the European Commission, sets out sustainability-related disclosure requirements for financial market participants, including asset managers, investment funds, insurance companies, and pension funds, that provide financial products or services within the EU. The regulation requires these entities to disclose information about the environmental, social, and governance (ESG) risks and impacts of their products, including how they integrate sustainability into their investment decisions and how they communicate about sustainability to their clients.

The SFDR aims to create a more sustainable financial system by providing investors with more information about the sustainability of their investments and promoting more sustainable investment practices by financial market participants.

The Corporate Sustainability Reporting Directive (CSRD) was adopted by the European Commission in late 2022. The directive will require companies operating in the European Union (EU) to disclose non-financial information related to sustainability topics. The application of the rules will be phased in gradually between 2024 and 2028, depending on the size and type of the company.

Large public-interest companies with over 500 employees, who are already subject to the existing non-financial reporting directive, will need to comply with the new requirements from 1 January 2024, with their reports due in 2025.

Large companies that are not currently subject to the non-financial reporting directive, but have more than 250 employees and/or €40 million in turnover and/or €20 million in total assets, will need to comply with the CSRD from 1 January 2025, with their reports due in 2026.

Listed small and medium-sized enterprises (SMEs) and other undertakings will need to comply from 1 January 2026, with their reports due in 2027. SMEs will have the option to opt-out until 2028.

Note that financial organizations that are subject to other EU regulations, such as the Sustainable Finance Disclosure Regulation (SFDR), may be exempt from certain CSRD requirements, provided that they comply with their existing disclosure obligations under these regulations.

The UK Sustainable Disclosure Regulation (SDR), led by the UK Financial Conduct Authority (FCA), aims to provide investors with more comprehensive, consistent and comparable sustainability information from issuers and investment managers. It requires these organizations to disclose information related to the environmental, social, and governance (ESG) risks and impacts of their investments and activities.

In the US, the Securities and Exchange Commission (SEC) requires publicly-traded companies, including financial organizations, to disclose material climate-related risks and impacts in their financial filings. This includes the potential physical risks associated with climate change, as well as the transition risks related to changing market conditions, new regulations, and technological innovations. Note that financed emissions should be included in the disclosure.

Sweep enables you to respond to key stakeholder requests with easy-to-use climate and ESG reporting tools.

Analyze your financed emissions with market-standard metrics and flexible reports that scale with you (including the SFDR, CSRD and more).

If we could leave you with one leading thought, it’s that effectively engaging your entire portfolio and supply chain in your decarbonization strategy is key to achieving your climate targets. It may seem like a daunting task, but with the right tools to automate data collection and ease of collaboration, you’ll soon be on the right path.

We’re here to support you at every step. And your customers can get started for free!

Our free plan lets companies measure their emissions in Sweep – so you can invite your customers. And once their measurements are in Sweep, we can help them get further along their own carbon track.

Get in touch today.

Sweep is a carbon and ESG management platform that empowers businesses to meet their sustainability goals.

Using our platform, you can: