Share estimations and benchmarks of emissions

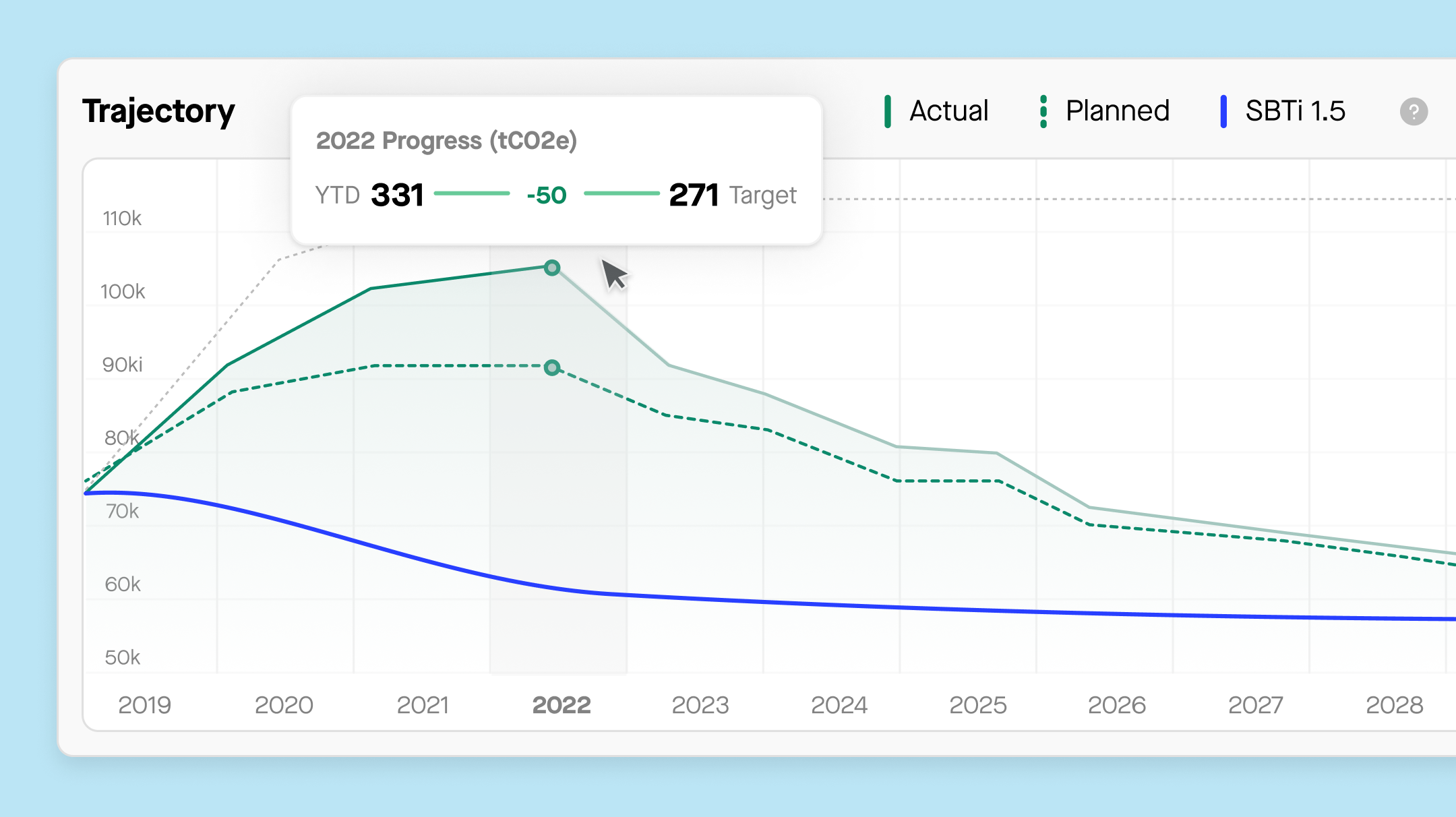

When running dealflow or yearly analysis of your investees, share the results of carbon footprint estimations with the details per category especially for those without existing climate data. Based on their sector and revenue, they can also get an idea of how they position compared to the initial estimation.

Link reduction to value creation

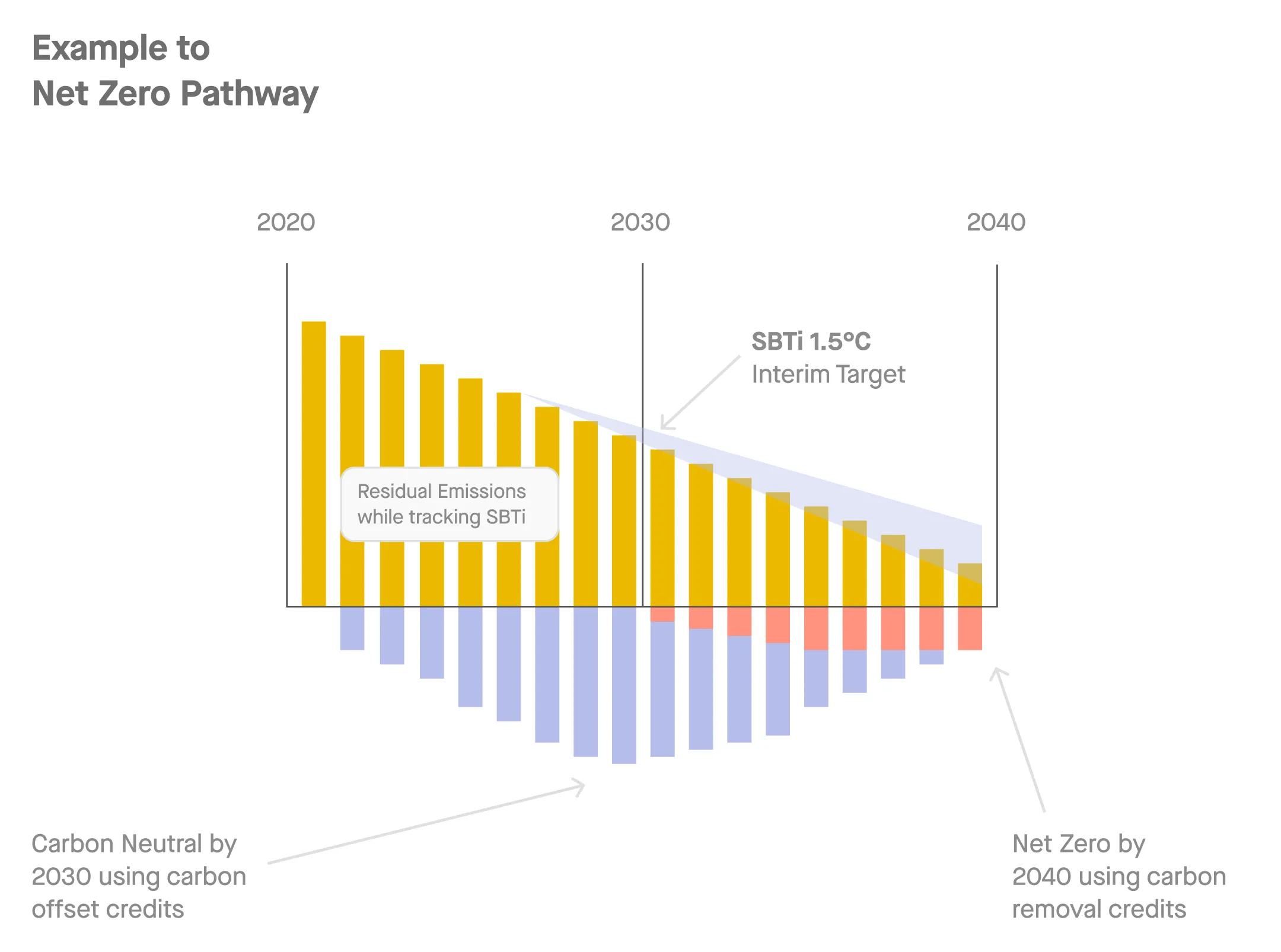

While you’re identifying the main sources of a company’s emissions, you should simultaneously think about the most effective methods of reducing them. This involves documenting the cost of investment and the potential benefits that can be gained from these actions, such as cost savings from energy efficiency, an increase in market share, and a reduction in regulatory and climate-related risks. It’s important to explicitly connect decarbonization measures to value creation in order to motivate both internal and external support for these initiatives.

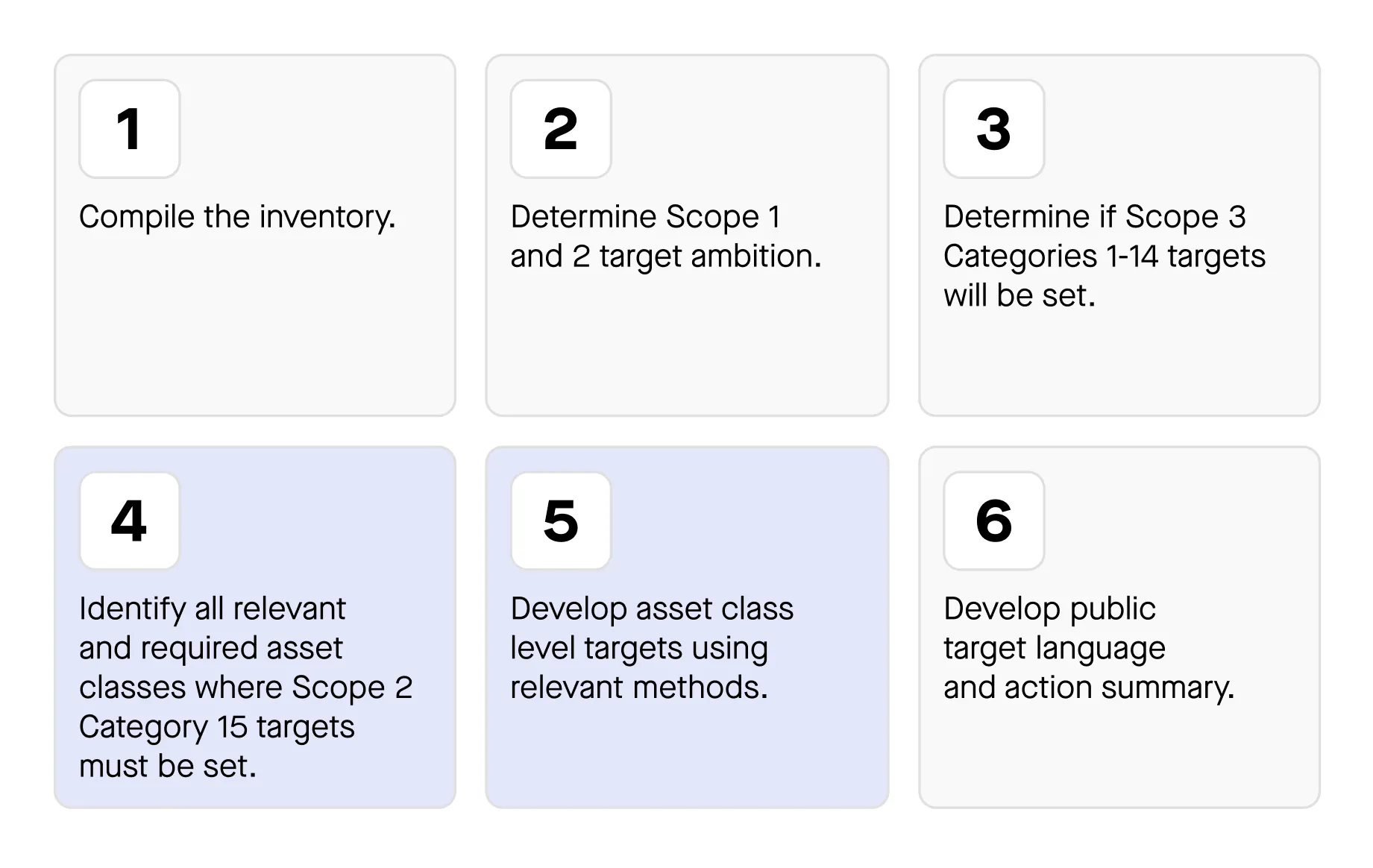

Offer methodology guidance

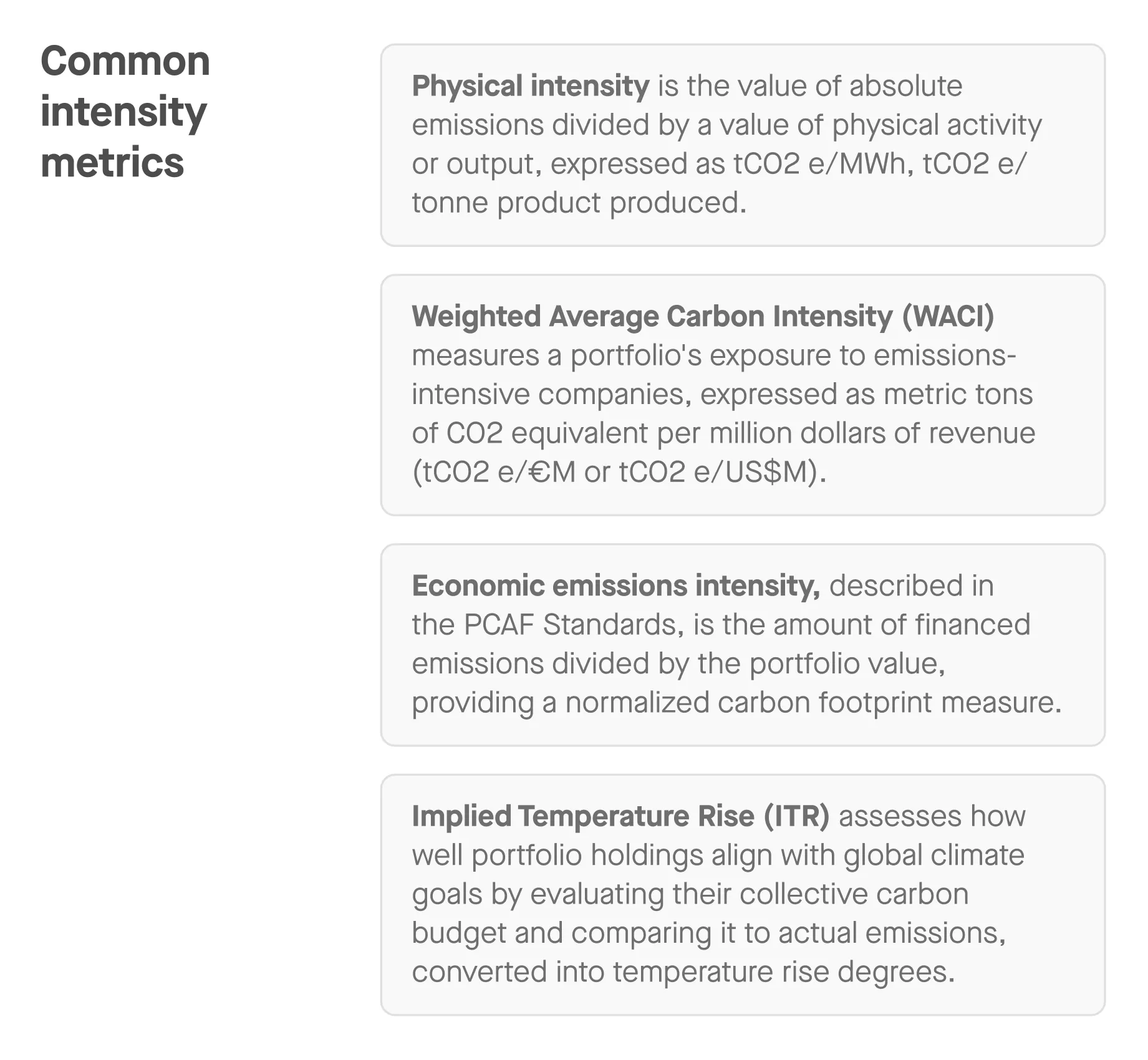

Investees often have queries regarding carbon accounting rules, data requirements (physical vs. monetary), and organizational boundaries. Providing training, education, and personalized support in addressing these questions can be invaluable. Whether through digital resources, consulting services, or direct interaction, offering time and materials to build knowledge bridges any gaps for those lacking time or expertise.

It’s important to find tools that can support with the following:

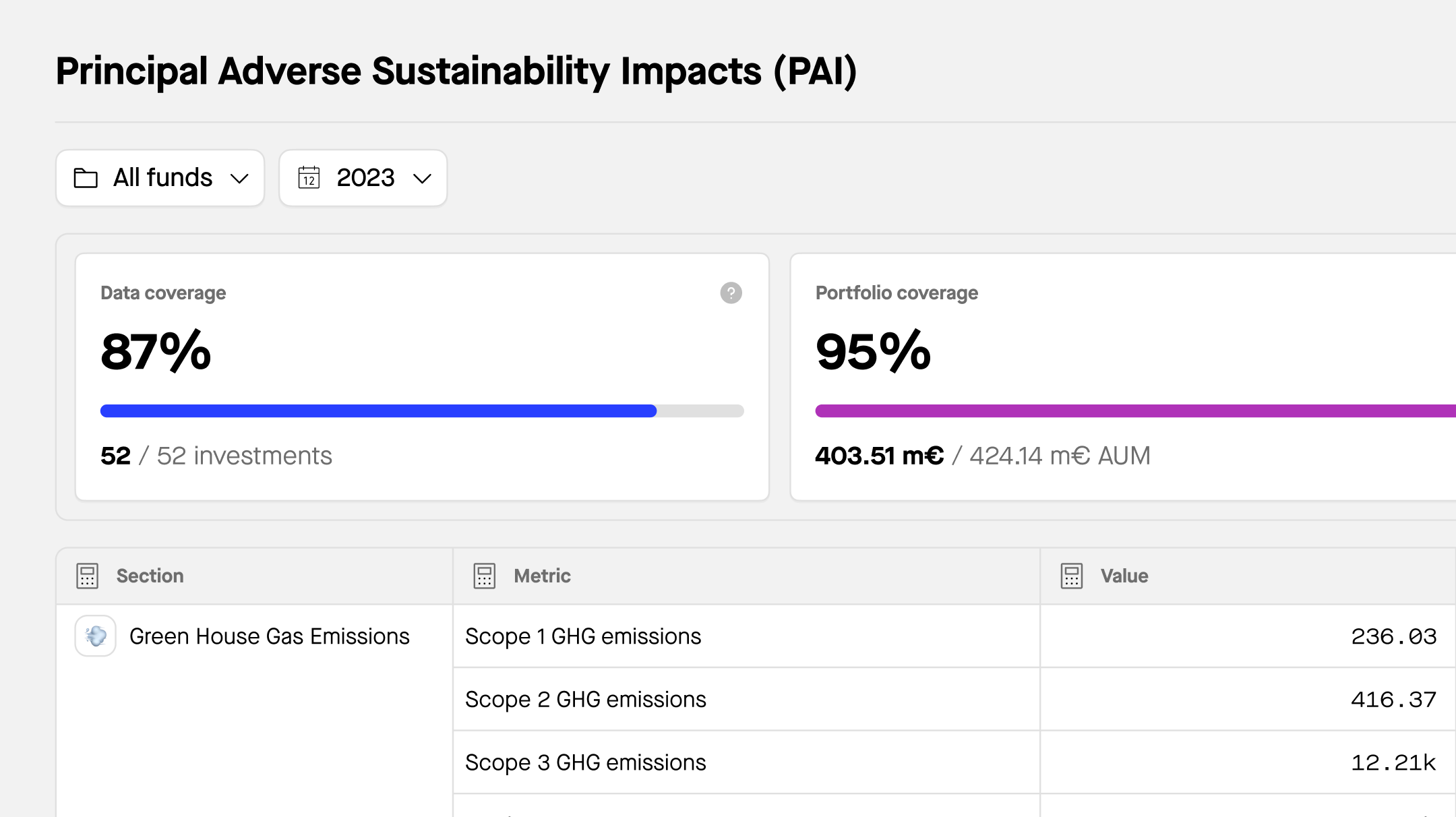

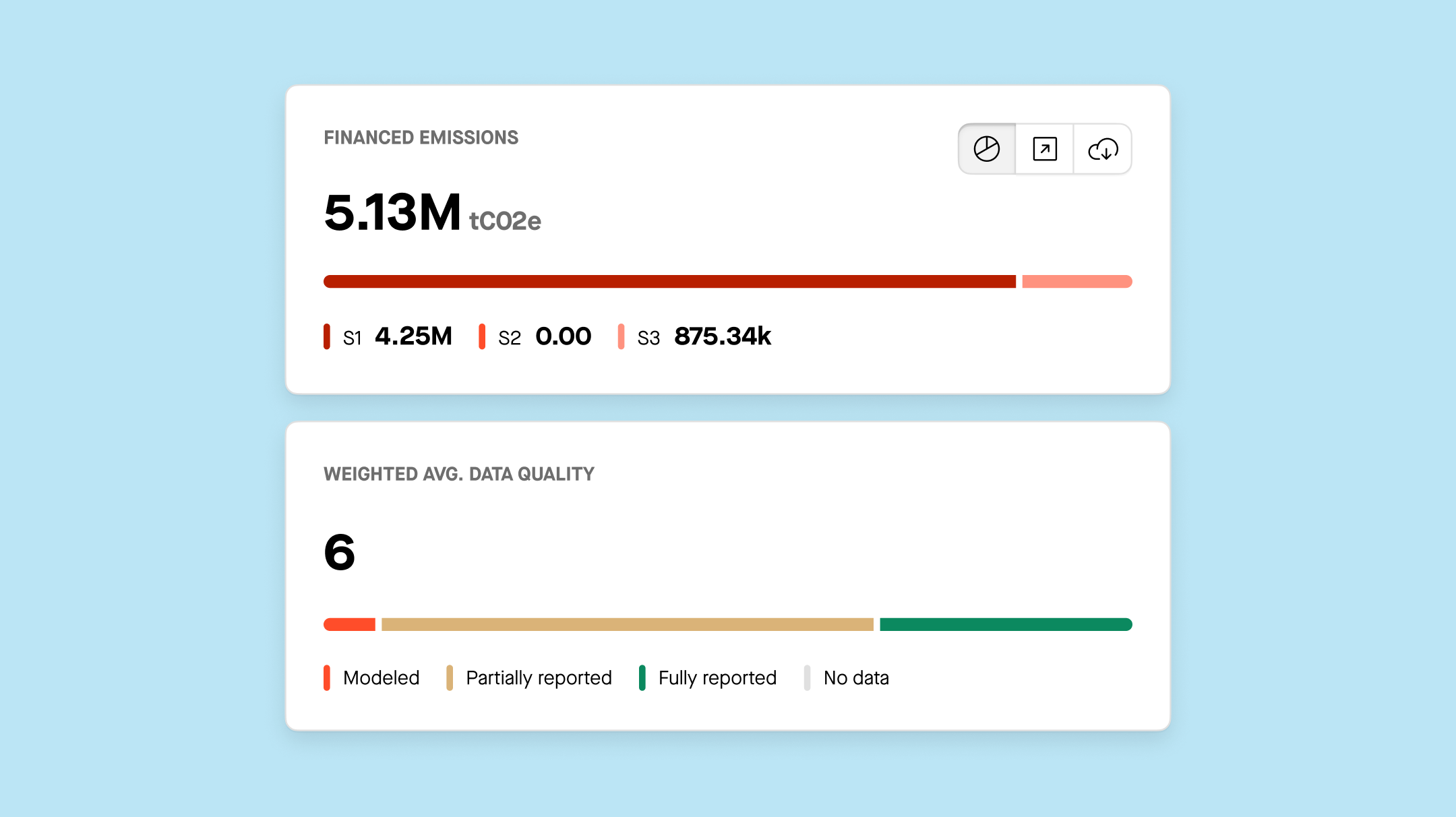

Centralized data management: Consolidating and managing various types of extra-financial data that are used as a foundation for all your investees (or most) for consistency and comparison

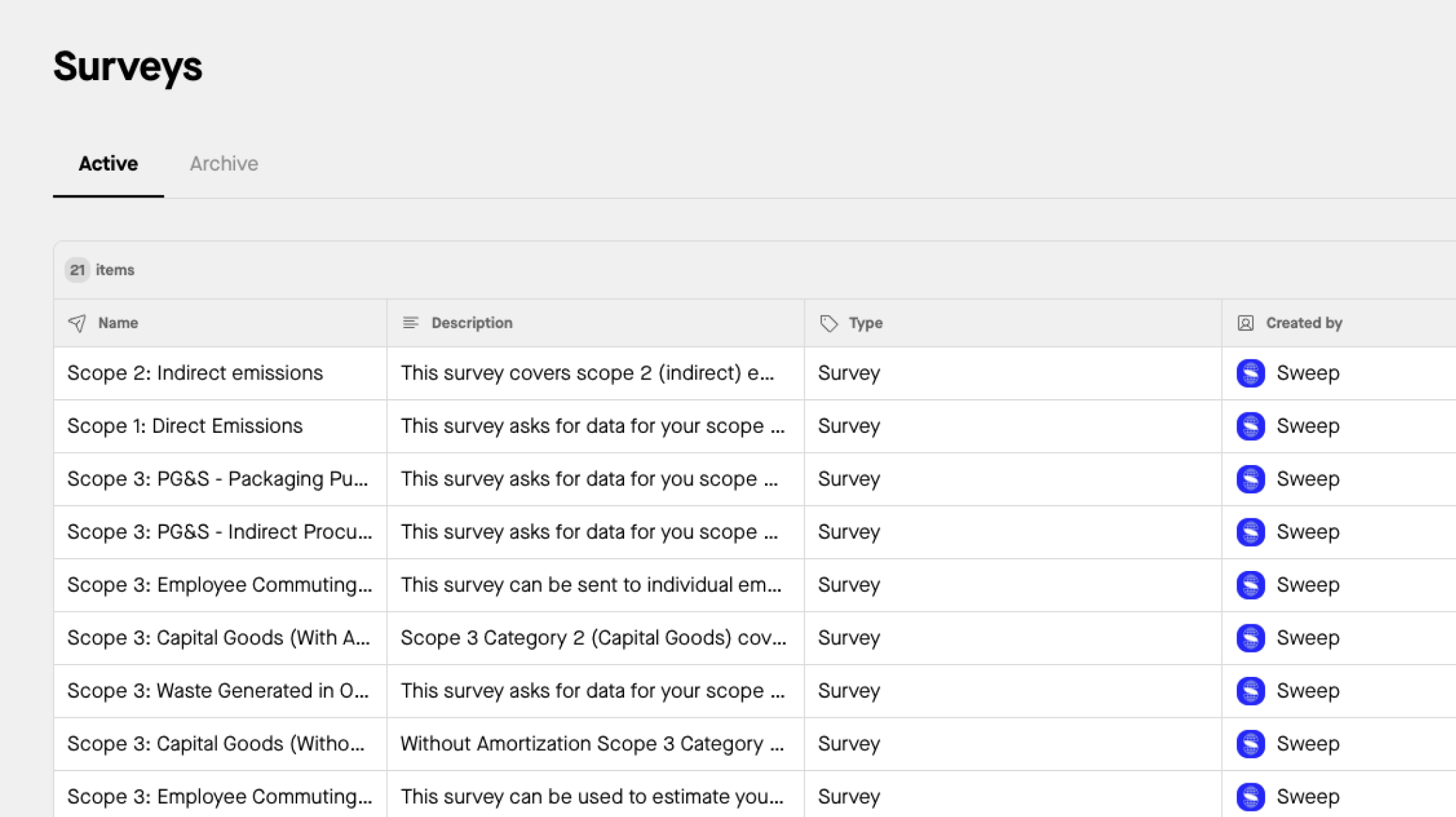

Customizing data collection: Supporting companies to select the right data based on their organization structure and data maturity.

Identifying emission hotspots: Highlighting where to prioritize reduction efforts.

Facilitating collaboration: Inclusion of collaboration features to enable seamless communication among users.

Ensuring data integrity: Quality controls and regular updates to help maintain data accuracy.

Bring money into the process

Whether it is during a due diligence period, before an exit or preparing for new funding rounds, private markets often have privileged contact with their portfolio, sometimes as a majority shareholder, as a Board member or a trusted advisor – investors can and have the responsibility to drive their investee in the right direction and require both commitments and proofs of realization as part of the deal conditions.

We have seen credit actors creating sustainability-linked coupons, mirroring banks, or offering mezzanines each year based on climate performance and completion of promises; or infrastructure players providing additional funding under the condition of using renewable energy projects, such as solar or wind farms.

Some private equity firms offer services that portfolio companies have to pay back in case of non completion – others just pay entirely for the carbon footprint measurement services (whether they are consulting or digital).