The Omnibus bill: what has happened so far

The Omnibus edition of the bill and related standards were adopted following a vote in the European Parliament, and the new rules will enter into force according to the established implementation timeline. These developments form part of a wider policy shift that includes legislative updates and regulatory stories from across the EU.

For companies preparing their sustainability reports for the upcoming year, this development is particularly important. Understanding what’s changing and how it may affect your reporting requirements is critical for compliance and long-term sustainability strategy.

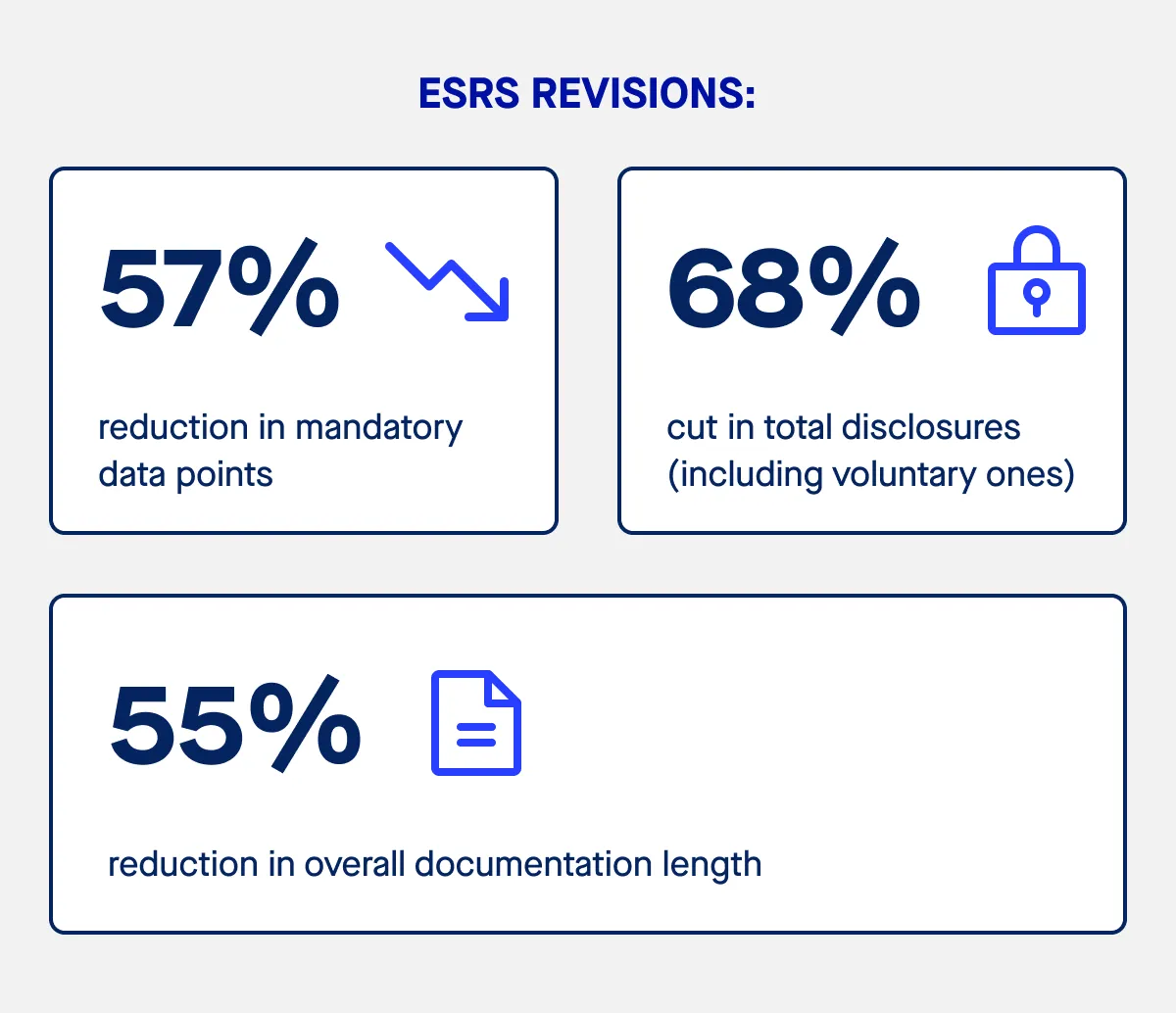

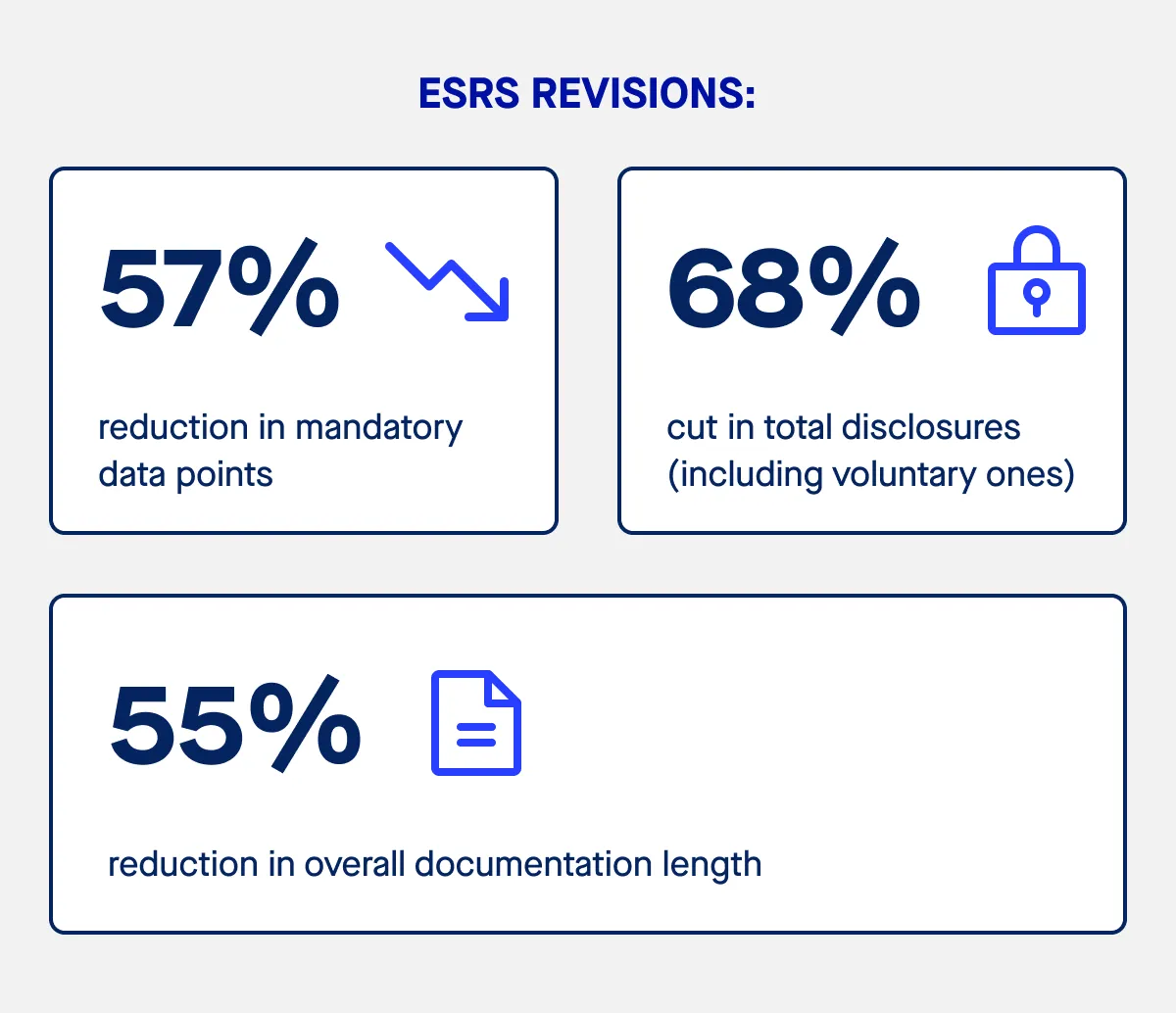

ESRS revisions: fewer disclosures, greater clarity

The newly published draft standards reflect a clear shift in the EU’s approach to sustainability reporting. EFRAG has proposed:

- A 57% reduction in mandatory data points

- A 68% cut in total disclosures (including voluntary ones)

- A 55% reduction in overall documentation length

One of the most notable changes is the complete removal of all voluntary (“may”) disclosures. This decision ensures greater clarity for companies by focusing on what is strictly required, rather than offering optional elements that often created confusion or led to excessive reporting. Companies must now disclose information in a standardized form, which makes it easier to measure sustainability performance and ensures comparability across organizations.

Disclosures can now also be placed in appendices rather than embedded within the main narrative sections of a report. This flexibility will help companies maintain clear and coherent reporting while addressing their reporting obligations more efficiently.

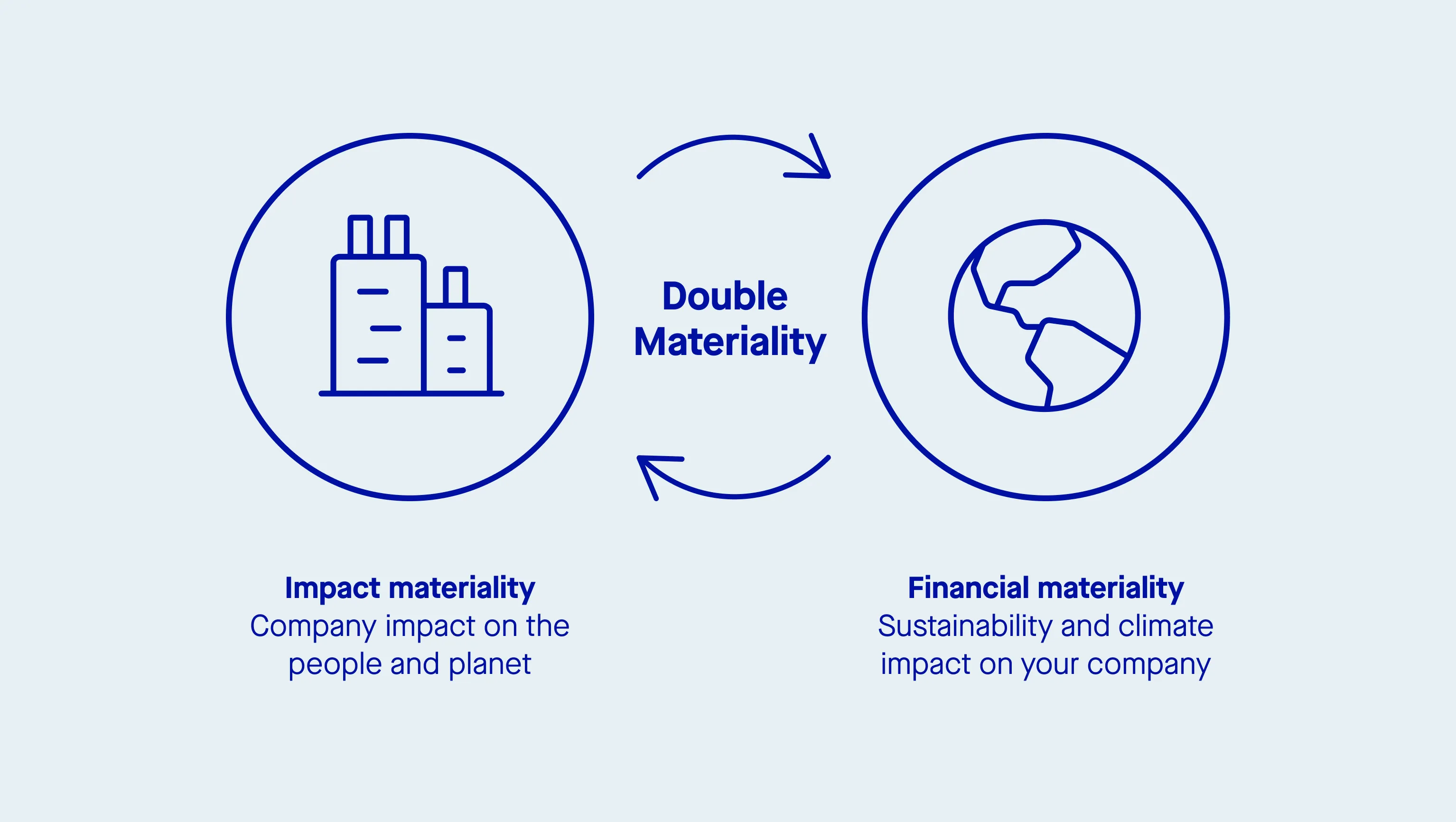

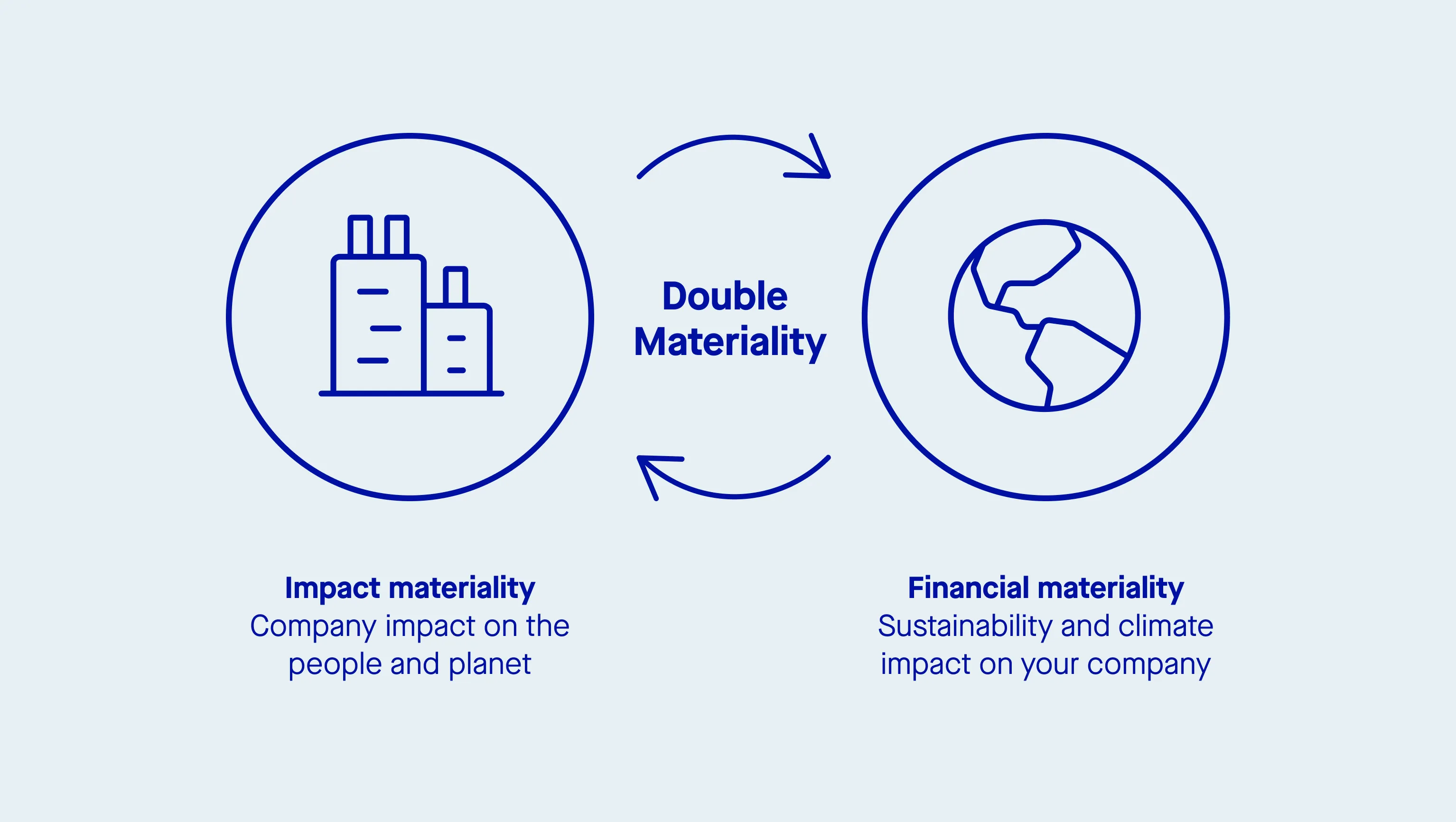

Double materiality: streamlined but still central

Despite the move toward simplification, the double materiality principle remains central to the ESRS framework. This principle requires companies to disclose both how social and environmental issues affect their business and how their operations impact people and the planet. Companies are required to consider their use of resources, impacts on the environment, and pollution across their entire value chain.

The revised ESRS encourages a more practical approach, allowing companies to:

- Focus on clearly relevant impacts, risks, and opportunities (IROs)

- Use reasonable evidence thresholds to justify material topics

- Avoid excessive analysis of obvious issues

For instance, energy companies can assume climate-related risks are material, while food manufacturers might prioritise water and biodiversity without the need for extensive justification.

Improved alignment with IFRS and global standards

Another central goal of the updated ESRS is to align more closely with international sustainability frameworks, particularly IFRS S1 and S2. This is critical for multinational companies that must comply with multiple reporting regimes. The integration of ESRS with global standards will help companies better track and report their sustainability performance, supporting company-wide compliance efforts.

The revised ESRS introduces:

- Terminology aligned with IFRS

- Reporting reliefs allowing use of estimates where data is unavailable

- Options for site-level or segment-specific disclosures

These improvements help enable companies to collect proportionate sustainability data while ensuring reports remain useful and relevant.

Implications for CSRD scope and timeline

The ESRS revisions are closely linked to broader changes being introduced through the Omnibus CSRD, which also includes amendments to the Corporate Sustainability Reporting Directive (CSRD) and the Corporate Sustainability Due Diligence Directive (CSDDD).

Key CSRD changes include:

- All businesses of a certain size (covers both unlisted and listed companies) – more than 1,000 employees and either a €50M+ turnover or €25M+ balance sheet total – will be required to report

- A two-year delay for Wave 2 and Wave 3 reporters, pushing reporting to fiscal years starting in 2028–2029

- A voluntary reporting standard for very small and medium-sized enterprises (VSMEs)

These updates, once passed, will significantly reduce the number of companies subject to reporting while still promoting transparency and accountability. Clients are expected to adapt their reporting processes to meet these new reporting obligations, as the changes are designed to help companies lead in sustainability reporting and respond to evolving market demands.

Notably, out-of-scope companies may still face indirect pressures from stakeholders and capital markets, making voluntary alignment with ESRS guidance a strategic choice.

CSDDD and supply chain transparency

The Omnibus bill also proposes important updates to the CSDDD, particularly in how companies manage supply chain due diligence obligations:

- Companies will only need to monitor their direct business partners

- Supply chain assessments will be required every five years (for firms with 500+ employees), with ad hoc updates as needed

These updates are intended to help companies better identify and manage risk within their supply chains, supporting more effective risk management and resilience. They also represent a shift toward more simplified due diligence obligations that reduce the overall administrative burden.

EU Taxonomy reporting becomes optional for many

The EU Taxonomy Regulation is also affected by the Omnibus reforms. Companies with fewer than 1,000 employees and turnover below €450 million can now opt into Taxonomy reporting voluntarily.

Other key changes include:

- Simplified templates and exemptions for activities contributing less than 10% of turnover, capital expenditure, or assets

- Adjusted Green Asset Ratio (GAR) calculations allowing banks to exclude exposures to companies no longer under the scope of CSRD

These reforms are designed to reduce complexity while supporting a more sustainable economy and maintaining a connection with capital market-oriented companies.

Sector-specific standards removed, assurance unchanged

In a move toward simplicity, the European Commission has removed the requirement to adopt sector-specific standards. This decision avoids fragmented reporting and allows companies to focus on a consistent set of general requirements.

Assurance requirements remain unchanged:

- The move to a reasonable assurance requirement has been postponed

- Reasonable assurance may still be introduced in the future

- Limited assurance will continue, reducing the immediate audit burden

However, companies will still need a skilled team to manage sustainability reporting and assurance processes, ensuring accurate and reliable disclosures across departments. A future shift could increase legal and civil liability exposure.

What companies should do next

The publication of the revised ESRS drafts and their alignment with the Omnibus CSRD mean that in-scope companies should take proactive steps to adjust their sustainability strategies and reporting requirements. Engaging relevant organisations and stakeholders – such as investors, civil society, and consumers – is essential to ensure that updated strategies and disclosures meet regulatory expectations and foster effective collaboration.

1. Reassess your reporting scope

- Determine whether your organisation remains within the updated CSRD scope

2. Review your materiality assessment

- Use appendices for detailed data

- Streamline your report’s narrative structure

4. Monitor developments and submit feedback

- Participate in the consultation process (open until 29 September 2025)

5. Align with global standards

- Ensure compatibility with IFRS S1/S2

- Understand how the draft Taxonomy Delegated Act and other delegated acts may impact disclosure obligations

A turning point in corporate sustainability

The introduction of the revised ESRS, as part of the Omnibus CSRD, marks a turning point in the evolution of corporate sustainability reporting. By simplifying disclosures, reducing unnecessary complexity, and improving global alignment, these reforms aim to make ESG reporting more effective, actionable, and accessible. Companies that adapt quickly will be ahead in meeting new legislation and shaping the next page of sustainability reporting across the EU.

As the first companies prepare for implementation in the next fiscal year, and others assess whether their size keeps them in or out of scope, the focus should remain on producing high-quality, meaningful sustainability information. Environmental issues are no longer a peripheral concern – they are central to business strategy, stakeholder expectations, and long-term value creation.

With the Corporate Sustainability Reporting Directive now firmly in motion and consultation underway, businesses have a vital opportunity to influence how sustainability reporting will evolve in Europe. The final implementation of ESRS will also depend on how each Member State transposes the directive into National law, making it essential for companies, especially any EU subsidiary or EU parent companies of international groups, to stay informed and engaged at both the EU and country levels. This includes not just large companies, but also smaller companies that may be indirectly affected through their business relationships or market participation.