Defining climate risk for businesses

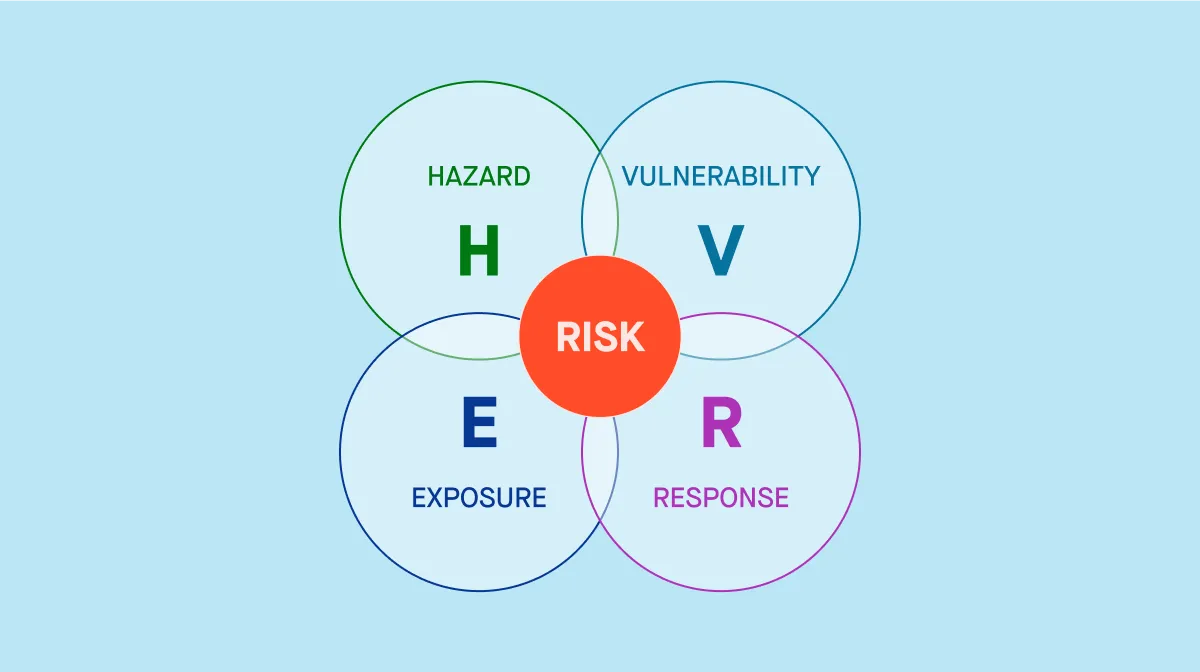

For businesses, climate risk refers to the potential negative financial, operational, and strategic impacts resulting from climate change. Rising global temperatures, shifting climate patterns, and the acceleration of greenhouse gas emissions are reshaping risk landscapes across industries. These changes influence everything from resource availability to market stability and regulatory frameworks. Climate risk is now a central consideration for corporate strategy, investment decisions, and supply chain resilience. The consequences are not abstract — they translate into higher operational costs, supply disruptions, changing consumer preferences, regulatory pressures, and reputational risks. Companies must understand and integrate climate-related risks into their enterprise risk management frameworks to remain competitive and resilient in a rapidly changing world.

Categories of climate risks for businesses

Businesses encounter climate risk through three primary categories: physical risks, transition risks, and liability risks. A clear understanding of these categories is essential for developing robust risk management and business continuity strategies.

Physical climate risks – Physical climate hazards refer to the direct, tangible threats climate change poses to business operations, assets, and supply chains. These risks can be acute, such as hurricane risk, flood risk, wildfires, and heatwaves, which can damage infrastructure, interrupt logistics, disrupt production, and lead to significant economic losses.

They can also be chronic, including long-term changes such as ocean warming, heat stress, persistent droughts, and shifting precipitation patterns, which can erode asset values, increase operational costs, and threaten water and energy security. These intensifying climate hazards can impair facility operations, reduce workforce safety, disrupt access to critical raw materials and distribution channels, and threaten physical capital, directly affecting business continuity and profitability.

Transition climate risks – Transition risks emerge from the economic, regulatory, and market changes associated with the global shift toward a low-carbon economy. Businesses face financial and operational exposure as governments enact stricter climate policies, investors demand greater climate disclosure, and consumers shift preferences toward sustainable products and services.

Key transition risks for businesses include policy and regulatory changes such as new carbon pricing mechanisms, emissions regulations, and environmental reporting requirements, which can increase operational costs and reshape competitive dynamics.

Market shifts may also threaten business models as changing customer expectations and technological advancements render existing products or services obsolete. Additionally, companies with significant investments in high-carbon assets risk financial losses as these assets lose value. Failure to anticipate and adapt to these changes can erode market share, profitability, and investor confidence.

Liability risks – Liability risks stem from potential legal, regulatory, or reputational actions taken against businesses for their role in contributing to or failing to mitigate climate change. As regulatory frameworks and public awareness evolve, companies may face litigation risks through lawsuits alleging failure to disclose climate-related risks, environmental damage, or non-compliance with climate regulations. Reputational damage also presents a significant threat, as public backlash and loss of customer trust can result from perceived inaction or environmental negligence. These risks can lead to financial penalties, increased insurance costs, restricted access to capital, and long-term brand damage.

Financial implications of climate risk

Transition risks encompass policy changes, technology adaptation, and market dynamics as organizations respond to environmental regulations. Comprehending both physical and transition risks is vital for assessing financial impacts across sectors. Climate risks can lead to increased expenditures, operational disruptions, and regulatory compliance costs for businesses. The systemic risk posed by climate risks includes potential threats to financial stability and crisis.

Companies may face escalating costs from adaptation and compliance while transitioning to sustainable practices. Insurers face financial risks related to climate change, affecting their resilience and stability in the market. Transparent climate risk disclosures enable stakeholders to recognize and manage potential risks.

Adopting assessment and mitigation strategies enhances investors’ portfolio resilience against climate risks in the financial markets. There is a growing trend towards requiring businesses to assess and disclose climate-related risks due to emerging regulations. Financial institutions are becoming vital in managing climate risks by helping offset potential risks. Understanding climate risks is vital for investors to manage risks and comply with regulations.

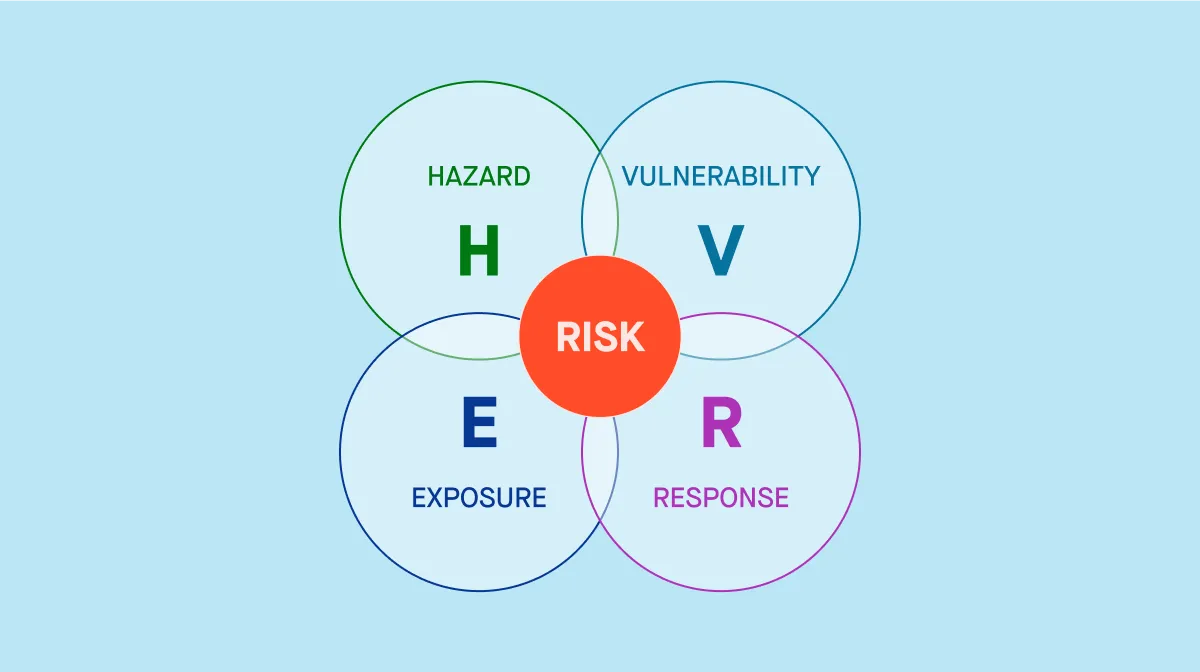

1. Conducting a climate risk assessment

Start by identifying where your business is most exposed — both today and in the future. Map your operational sites, supply chain locations, and key markets against climate hazard data, such as flood zones, wildfire-prone areas, or regions at risk of rising temperatures and water scarcity.

Use established frameworks or regional models like CLIMAAX as a starting point, but tailor your assessment to your business context and geographic footprint. Engage internal teams from operations, finance, supply chain, and sustainability to get a well-rounded view of risk exposure. Set clear financial thresholds for what qualifies as a ‘significant’ risk, and document your methodology to ensure consistency across reporting cycles.

2. Map future climate scenarios

Once you know where you’re exposed, assess how those risks might evolve. Scenario analysis isn’t just a compliance requirement — it’s a practical way to test your business strategy against multiple plausible futures. Work with risk, strategy, and sustainability teams to build at least three distinct scenarios, covering both physical risks (like heatwaves, droughts, sea level rise) and transition risks (like carbon pricing, policy shifts, and changing customer preferences).

Model the operational and financial implications of these scenarios for different business units, supply chains, and assets. Identify thresholds where risks become material, and test how effective your current mitigation and adaptation plans would be under each future condition.

3. Quantify climate risk

Next, translate those risks and scenarios into clear, measurable financial, operational, and strategic consequences. Use climate modeling and financial stress-testing tools to quantify the costs of acute physical risks (such as facility downtime or supply chain delays) and transition risks (such as exposure to carbon pricing or reputational impacts).

Integrate climate risk data into your enterprise risk models to pinpoint which assets, markets, and revenue streams are most vulnerable. The more quantified your insights, the easier it is to prioritize action, manage risk, and communicate effectively with stakeholders and boards.

4. Mitigation and adaptation

Now, determine what you can do to reduce emissions and respond to unavoidable climate impacts. Set credible, science-based emissions reduction targets and identify opportunities to switch to renewable energy, electrify your vehicle fleet, improve operational efficiency, and engage suppliers on decarbonization.

At the same time, develop adaptation strategies to protect your business from the physical consequences of climate change. This could involve relocating vulnerable assets, retrofitting infrastructure, diversifying suppliers, or investing in water and energy resilience. Focus on areas with the highest exposure and financial consequence first.

5. Build resilience

Building resilience means embedding climate risk into your core decision-making processes. Review land use, infrastructure design, procurement practices, and business continuity plans to ensure they account for climate-related hazards. Use catastrophe modeling and risk mapping tools to layer climate, hazard, and asset data for smarter capital allocation and risk reduction.

Monitor policy changes, such as carbon pricing and emissions regulations, that could materially affect your cost base or market access. Train leadership teams and operational staff on climate risk awareness, scenario planning, and emergency response protocols to ensure resilience becomes part of your business culture.

6. Climate risk disclosure

As you strengthen your climate risk management, communicate it transparently to stakeholders. Use a framework like the Task Force on Climate-related Financial Disclosures (TCFD) to structure your reporting. This should cover your exposure to climate risks, how you’re managing them, the scenarios you’ve considered, and progress against your emissions reduction targets.

Disclose your greenhouse gas emissions (Scope 1, 2, and increasingly Scope 3) and set clear, time-bound mitigation goals. Stay ahead of tightening regulations by preparing for mandatory climate disclosures already being introduced in key markets. Treat disclosure not as a box-ticking exercise but as a strategic opportunity to demonstrate climate resilience, leadership, and long-term value creation.

Throughout this process, ESG tools play a critical enabling role. They centralize climate data, automate emissions reporting, and track your progress on targets in line with climate science. Integrated ESG platforms connect with your financial and operational systems to visualize risk exposure across your asset base, business units, and supply chain.

Many leading platforms offer scenario analysis, climate risk quantification, and automated reporting aligned to ISSB, GRI, CSRD, and other reporting frameworks. Prioritize tools that provide integrated views of physical and transition risks, financial modeling capabilities, and customizable dashboards. These tools don’t just help you report — they drive faster, better-informed decisions in an increasingly volatile climate environment.

Frequently Asked Questions

What are the main categories of climate risks?

The main categories of climate risks are physical risks, transition risks, and liability risks, which are crucial for a comprehensive climate risk assessment . Each category addresses distinct challenges posed by global warming, impacting various sectors and stakeholders.

How can businesses benefit from climate risk management?

Businesses can enhance resilience, reduce operational costs, and seize emerging opportunities by implementing effective climate risk management strategies. This proactive approach to addressing climate risks not only safeguards assets but also positions organizations for long-term success in a changing environment.

What is the role of climate risk disclosure?

Climate risk disclosure plays a crucial role in enhancing transparency regarding an organization’s exposure to climate risks and its management strategies, ultimately facilitating informed decision-making among stakeholders. This proactive approach is essential for fostering accountability and promoting sustainability within the business landscape.

Why is scenario analysis important in addressing climate change risk?

Scenario analysis is crucial in quantifying climate risk as it allows organizations to assess a range of possible future conditions, thereby improving the accuracy of their risk assessments and strategic planning. This approach fosters better preparedness for potential climate-related challenges.

To build resilience against climate risks, it is essential to implement adaptation policies, modify infrastructure, and encourage behavioral changes while integrating climate data into investments for risk reduction. Taking these steps will significantly enhance your ability to withstand changing climate impacts.