The portfolio decarbonization challenge

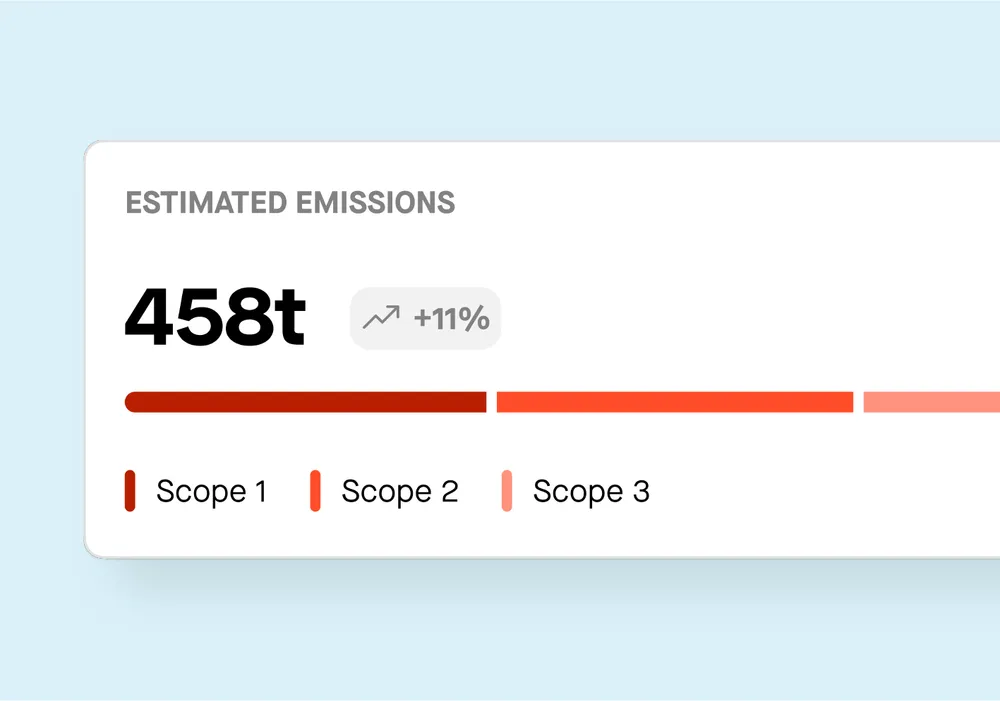

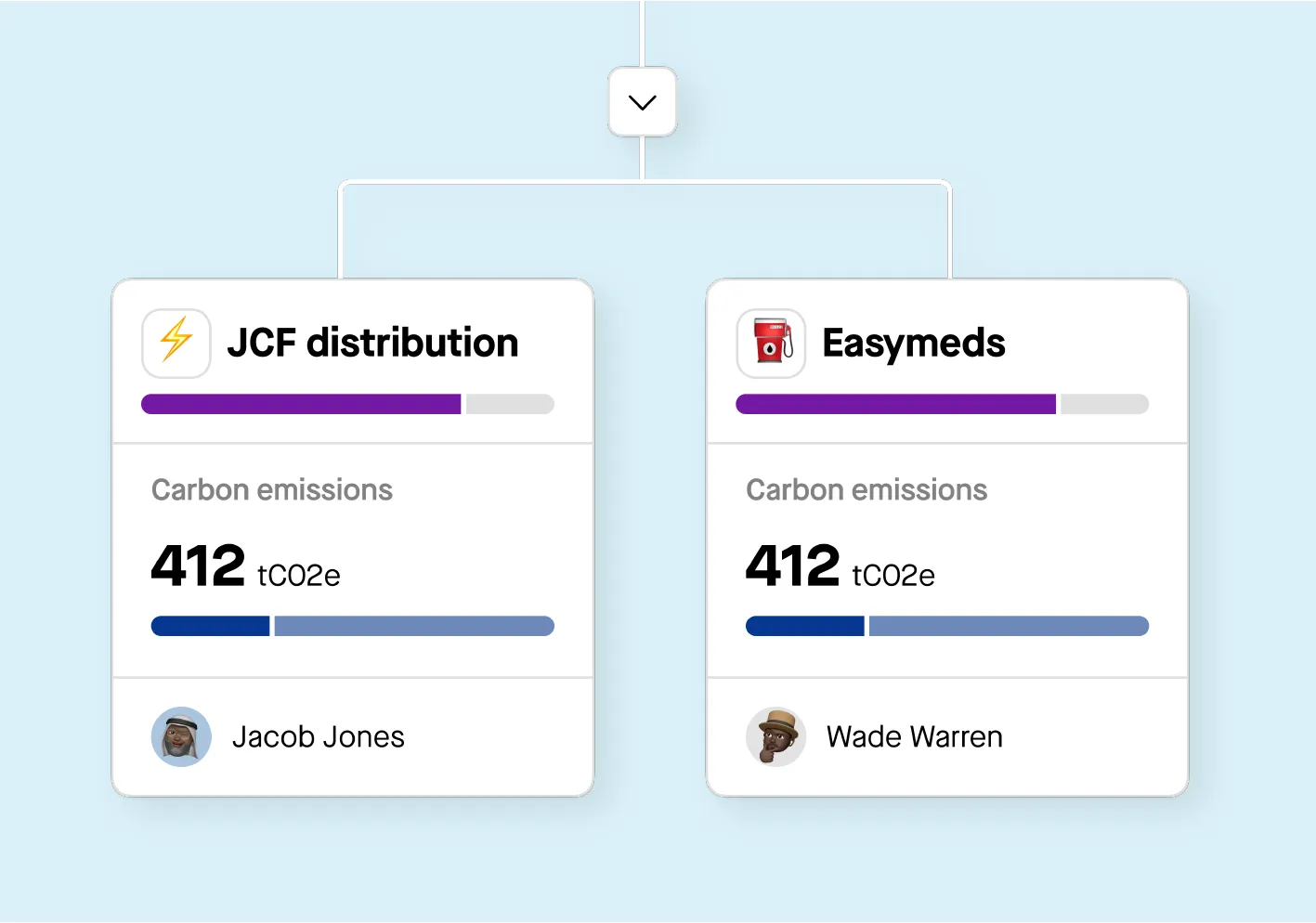

1. Measuring financed emissions:

Financed emissions are the indirect emissions that come from your company’s assets and investments, falling under Scope 3 emissions. You’re facing growing pressure to measure and report these emissions due to increasing investor demands for transparency on ESG factors.

2. Regulatory pressure:

The amount of climate legislation is mounting, with many countries now requiring financial institutions to disclose their climate-related risks and report on their progress towards meeting climate targets.

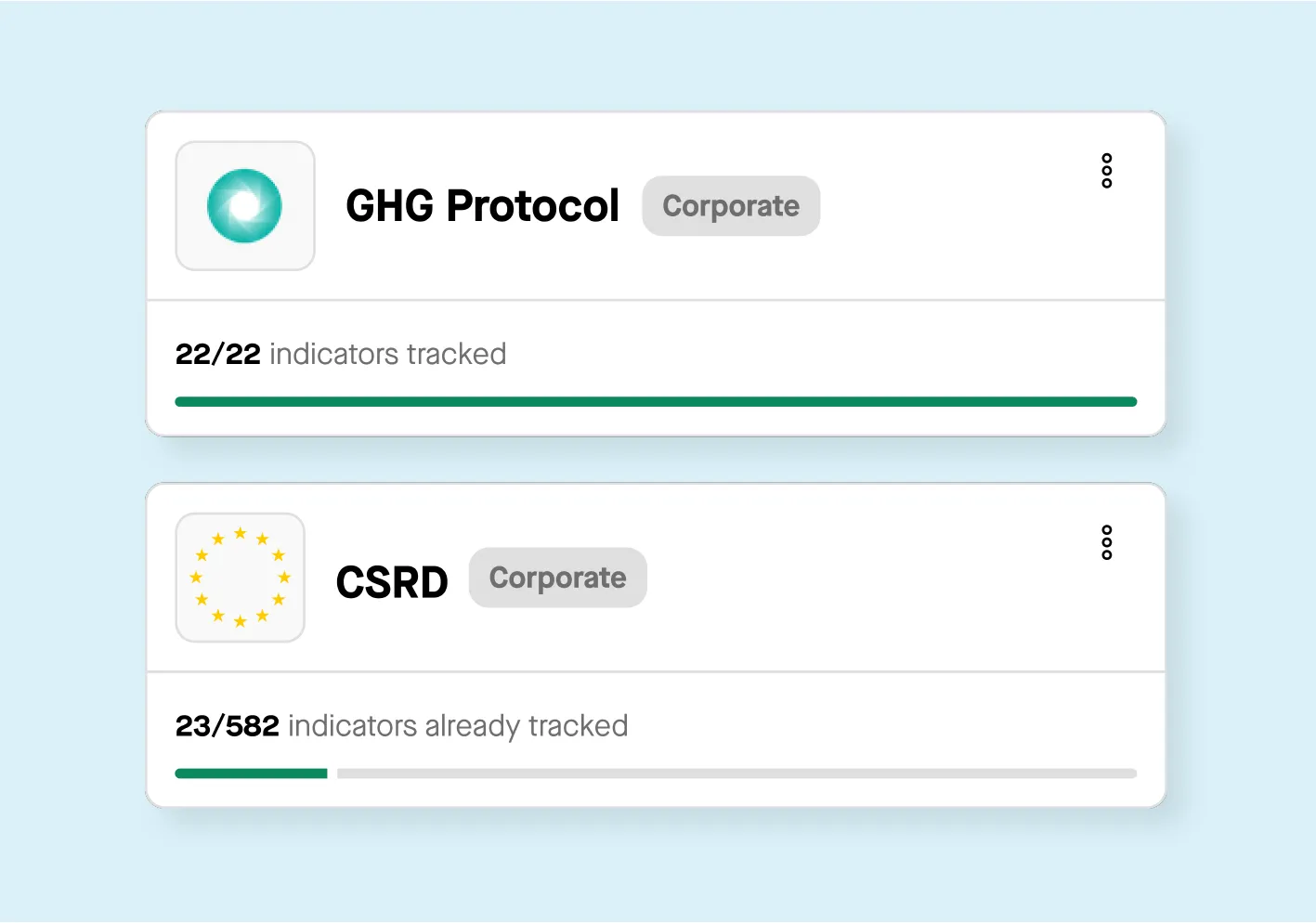

The disclosure challenge

There are a number of voluntary and mandatory climate disclosures affecting finance companies. Here are the most important ones:

Sustainable Finance Disclosure Regulation (SFDR)

Scope: Financial market participants and financial advisers operating within the EU, including asset managers, institutional investors, and insurance companies.

Requirements:

- Disclose information on sustainability risks and adverse sustainability impacts.

- Provide transparency on the integration of sustainability risks in investment decision-making processes.

- Disclose how remuneration policies are consistent with the integration of sustainability risks.

- Specific disclosures for products that promote environmental or social characteristics or have sustainable investment objectives.

Standards: SFDR framework, aligned with other EU regulations such as the Taxonomy Regulation and the Non-Financial Reporting Directive (NFRD).

Timeline:

- March, 2021: Level 1 disclosures were implemented.

- December, 2021: Deadline for firms to comply with the Principal Adverse Impacts (PAI) statement requirements.

- July, 2022: Level 2 Regulatory Technical Standards (RTS) come into effect.

- January, 2023: First annual reporting for Article 8 and Article 9 products.

- January, 2024: Further refinement and integration of disclosure standards as mandated by the European Supervisory Authorities (ESAs).

Find out more.

Corporate Sustainability Reporting Directive (CSRD):

- Scope: Large companies and all listed companies, including SMEs.

- Requirements: Report on double materiality (impact on performance and the environment), detailed disclosures on climate change, social rights, governance, and more.

- Standards: European Sustainability Reporting Standards (ESRS).

- Timeline:

- 2024: First reports for large public-interest entities.

- 2025: First reports for other large companies.

- 2026: First reports for listed SMEs, small credit institutions, and captive insurance.

Find out more.

International Sustainability Standards Board (ISSB):

- Scope: Recommended for all companies, increasingly mandated by governments and regulators.

- Requirements: Disclose governance, strategy, risk management, and metrics & targets related to sustainability risks and opportunities.

- Standards: ISSB framework.

- Timeline: Varies by jurisdiction; many companies already voluntarily adopting.

Find out more.