With rising pressure from governments, investors, and consumers to address climate change, businesses are increasingly expected to manage and disclose their company’s carbon footprint. Carbon accounting, or greenhouse gas accounting, has become a pre-requisite for companies looking to reduce their environmental impact, enhance their sustainability credentials, and comply with regulatory requirements. Tracking and reporting emissions is now essential for any business serious about contributing to global efforts to combat climate change.

In this blog post, we’ll explore what carbon accounting entails, explain the different carbon accounting methods available, and guide you in selecting the best approach for your business. Understanding these methods will help your organization make informed decisions on reducing emissions across your value chain and enable accurate carbon accounting and reporting to stakeholders.

What is carbon accounting?

At its core, corporate carbon accounting is the process of measuring, quantifying, and reporting the greenhouse gas emissions associated with a company’s operations. These emissions are often calculated in carbon dioxide equivalents (CO2e) to account for all GHGs, including methane and nitrous oxide, which have a greater warming potential than CO2. Carbon accounting allows companies to better understand their environmental impact and take concrete actions to reduce emissions, improve efficiency, and meet regulatory requirements or voluntary sustainability goals.

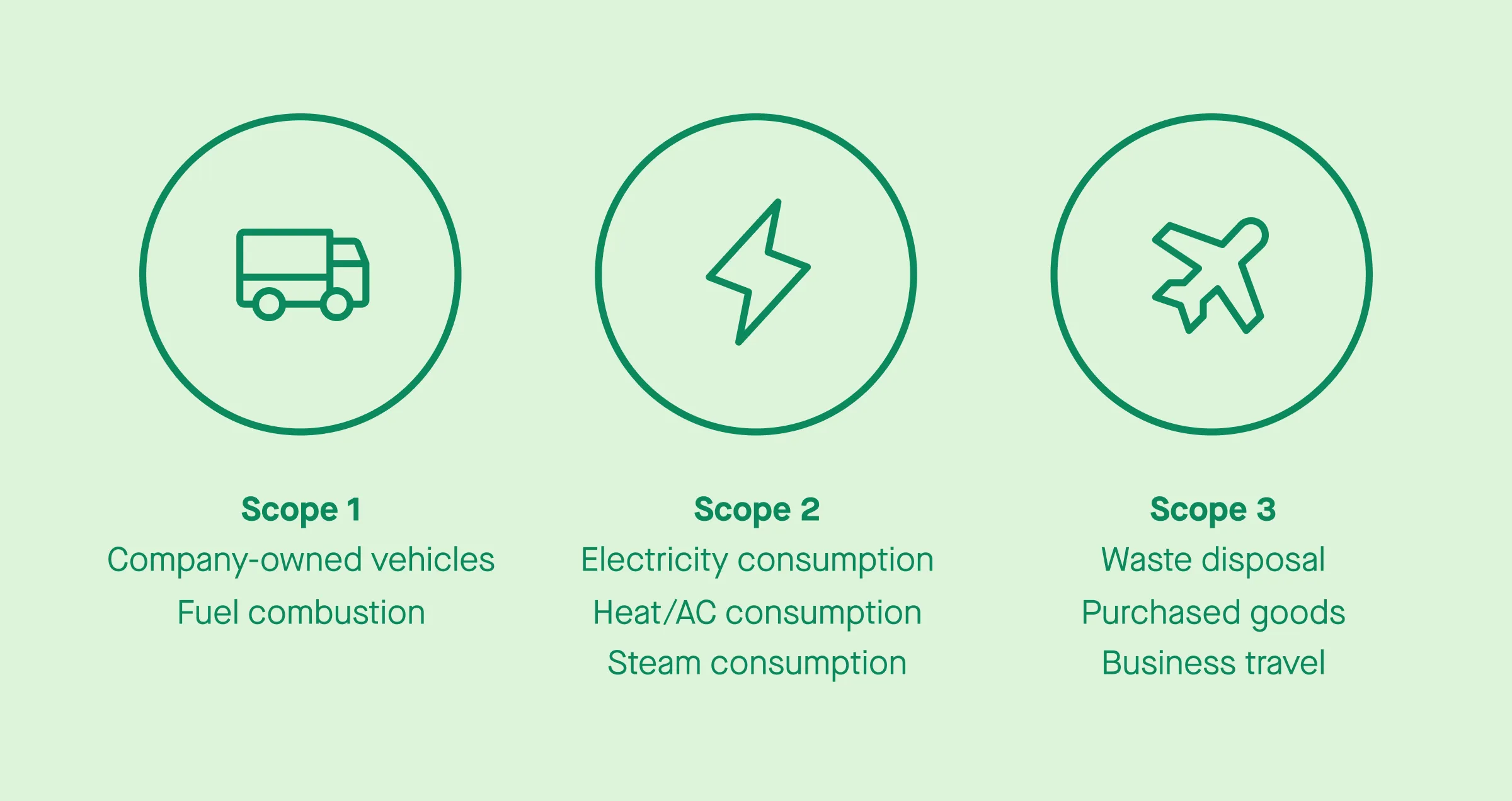

The carbon accounting process typically involves collecting emissions data from a variety of sources, such as energy usage, transportation, production processes, and purchased goods and services. This emissions data is then used to calculate the total GHG emissions across different scopes, defined by the Greenhouse Gas Protocol as Scopes 1, 2 and 3.

Scope 1: Direct emissions

Scope 1 includes direct greenhouse gas emissions that occur from sources owned or controlled by a company. These emissions come from activities like fuel combustion in company-owned vehicles, boilers, and furnaces, as well as emissions from on-site industrial processes. Scope 1 emissions are within a company’s direct control, meaning that reducing these emissions can be achieved through actions like improving energy efficiency, switching to cleaner fuels, or adopting electric vehicles.

Scope 2: Indirect emissions from purchased energy

Scope 2 encompasses indirect emissions from the generation of purchased electricity, heat, or steam that a company consumes. While the company does not directly produce these emissions, they are caused by its energy consumption. Reducing Scope 2 emissions typically involves switching to renewable energy sources, increasing energy efficiency, or purchasing green energy certificates to offset the emissions from purchased electricity.

Scope 3: Indirect emissions across the value chain

Scope 3 includes all other indirect emissions that occur throughout a company’s value chain, both upstream and downstream. This can involve emissions from suppliers, the transportation of goods, employee commuting, and even the use and disposal of products.

Scope 3 often represents the largest share of a company’s carbon footprint, but it is also the hardest to measure and control, as it depends on external partners. Reducing Scope 3 emissions typically requires collaboration with suppliers, customers, and other stakeholders to address emissions across the full product lifecycle.

By accurately measuring carbon emissions across these scopes, companies can gain a clear understanding of their carbon footprint and make informed decisions about how to reduce their impact on climate change. However, choosing the right carbon accounting methodology is critical to ensuring that emissions data is accurate, consistent, and actionable.

Different carbon accounting methods

There are several carbon accounting methods that businesses can use to measure carbon emissions. These methods vary based on the type and quality of data available and the level of detail required. The most common methods include the spend-based method, activity-based method, and hybrid method. Each has its own unique approach to calculating emissions, as outlined below.

Spend-based method

The spend-based method is one of the simplest approaches to carbon accounting. This method estimates emissions based on financial spending data. It involves multiplying the amount spent on a particular good or service by an emission factor associated with that category of expenditure.

For example, a company might estimate its emissions from business travel by analyzing the total amount spent on flights, hotels, and transportation. The spend-based method applies predefined emission factors to these expenditure amounts to estimate the associated greenhouse gas emissions. These factors are typically derived from general industry averages or published databases, reflecting average emissions for similar types of spending.

This method is particularly useful for businesses at the beginning stages of their carbon accounting journey or for those lacking detailed activity data. It offers a straightforward way to get an initial estimate of emissions based on financial records that are already maintained.

Advantages:

- Simplicity: The spend-based method is straightforward and easy to implement because it relies on financial data that businesses already track.

- Ease of Implementation: Businesses can quickly apply emission factors to financial data to estimate emissions without needing extensive additional data collection.

Disadvantages:

- Rough Estimates: This method can provide only approximate estimates of emissions, as it assumes all spending within a category results in the same level of emissions. Variations between suppliers or products are not accounted for.

- Lack of Precision: For instance, a $1,000 expenditure on flights with different airlines might result in varying emissions due to differences in flight routes and carrier efficiencies, which the spend-based method cannot capture.

Activity-based method

The activity-based method offers a more detailed approach to measuring carbon emissions by using specific activity data rather than financial expenditures. This method involves tracking actual activities, such as the amount of electricity used, miles traveled by vehicle, or volume of raw materials consumed. Each of these activities is then multiplied by corresponding emission factors to calculate total emissions.

For example, a company might track the number of kilowatt-hours of electricity consumed in its manufacturing processes. The emissions are calculated using an emission factor specific to the electricity grid in the region where the factory operates. Similarly, transportation emissions can be calculated by tracking miles traveled by delivery vehicles and applying emission factors for fuel consumption.

This method provides a more precise estimate of emissions because it is based on actual usage data. However, it requires more detailed record-keeping and a greater commitment of resources to gather and manage the necessary data.

Advantages:

- Higher Accuracy: The activity-based method yields more accurate emissions estimates because it uses specific data on actual activities rather than financial proxies.

- Reflects Actual Usage: It provides a more detailed and precise picture of emissions by accounting for the actual usage of resources and activities.

Disadvantages:

- Data Collection Effort: Requires detailed record-keeping and the allocation of resources to collect and manage activity data, which can be labor-intensive.

- Complexity: Tracking and applying the appropriate emission factors for various activities can be complex and demanding.

Hybrid method

The hybrid method combines elements of both the spend-based and activity-based approaches. This method is particularly useful for businesses with complex operations or those transitioning towards more detailed carbon accounting practices. The hybrid method allows companies to use spend-based calculations where detailed activity data is not yet available and switch to activity-based calculations for areas where specific data can be collected.

For example, a company might use the spend-based method to estimate emissions from office supplies or services. For more precise measurements, such as emissions from electricity use or manufacturing processes, the company could apply the activity-based method. This blend of approaches enables businesses to balance accuracy with practicality.

Advantages:

- Balanced Approach: Combines the simplicity of spend-based calculations with the accuracy of activity-based methods, providing a flexible solution for different types of emissions data.

- Flexibility: Allows businesses to start with simpler methods and gradually transition to more detailed calculations as more data becomes available.

Disadvantages:

- Complexity in Integration: Combining two methods can introduce challenges in integrating and interpreting data from both approaches.

- Transition Challenges: Moving from spend-based to activity-based data may present difficulties in aligning and reconciling different types of emissions estimates.

In summary, each carbon accounting method has its own strengths and limitations. Choosing the right method—or a combination of methods—depends on the specific needs of your business, the available data, and the level of detail required for accurate emissions reporting.