We explain the ESRS framework, exploring its relevance, requirements, and implications for companies and financial institutions subject to the CSRD.

Since January 2024, the European Sustainability Reporting Standards (ESRS) have emerged as a cornerstone of sustainability reporting in Europe, reshaping the landscape of corporate transparency and accountability. With the implementation of the Corporate Sustainability Reporting Directive (CSRD), the adoption of ESRS standards has become mandatory for companies within its scope, marking a significant milestone in the journey towards standardized and enhanced non-financial reporting across the continent.

Which reporting recommendations do the ESRS align with?

At its core, the ESRS framework aims to provide a transparent, accurate, and comparable view of a company’s environmental, social, and governance (ESG) impacts, risks, and opportunities. Developed by the European Financial Advisory Group (EFRAG) in a public consultation together with the Committee of European Auditing Oversight Bodies, and endorsed by the European Commission and the European Environment Agency, the ESRS standards align with existing international reporting recommendations and legal EU frameworks, ensuring interoperability with initiatives such as the EU Green New Deal and Sustainable Finance Framework. By leveraging established global standard setting initiatives such as the Task Force on Climate-Related Financial Disclosures (TCFD), the Global Reporting Initiative (GRI) and the International Sustainability Standards Board (ISSB), the ESRS foster interoperability and alignment with global best practices in sustainability reporting.

What is the ESRS double materiality concept?

Central to the ESRS framework is the concept of double materiality, which underscores the high degree of interconnectedness of sustainability issues with both financial performance and societal well-being. The double materiality requirement obliges companies to report on the impacts of their activities on people and the environment (inside-out perspective) and how social and environmental issues create financial risks and opportunities for the company (outside-in perspective). This holistic approach to materiality assessment helps companies identify which sustainability topics are most relevant to their organization and stakeholders, guiding them in prioritizing disclosure efforts and resource allocation.

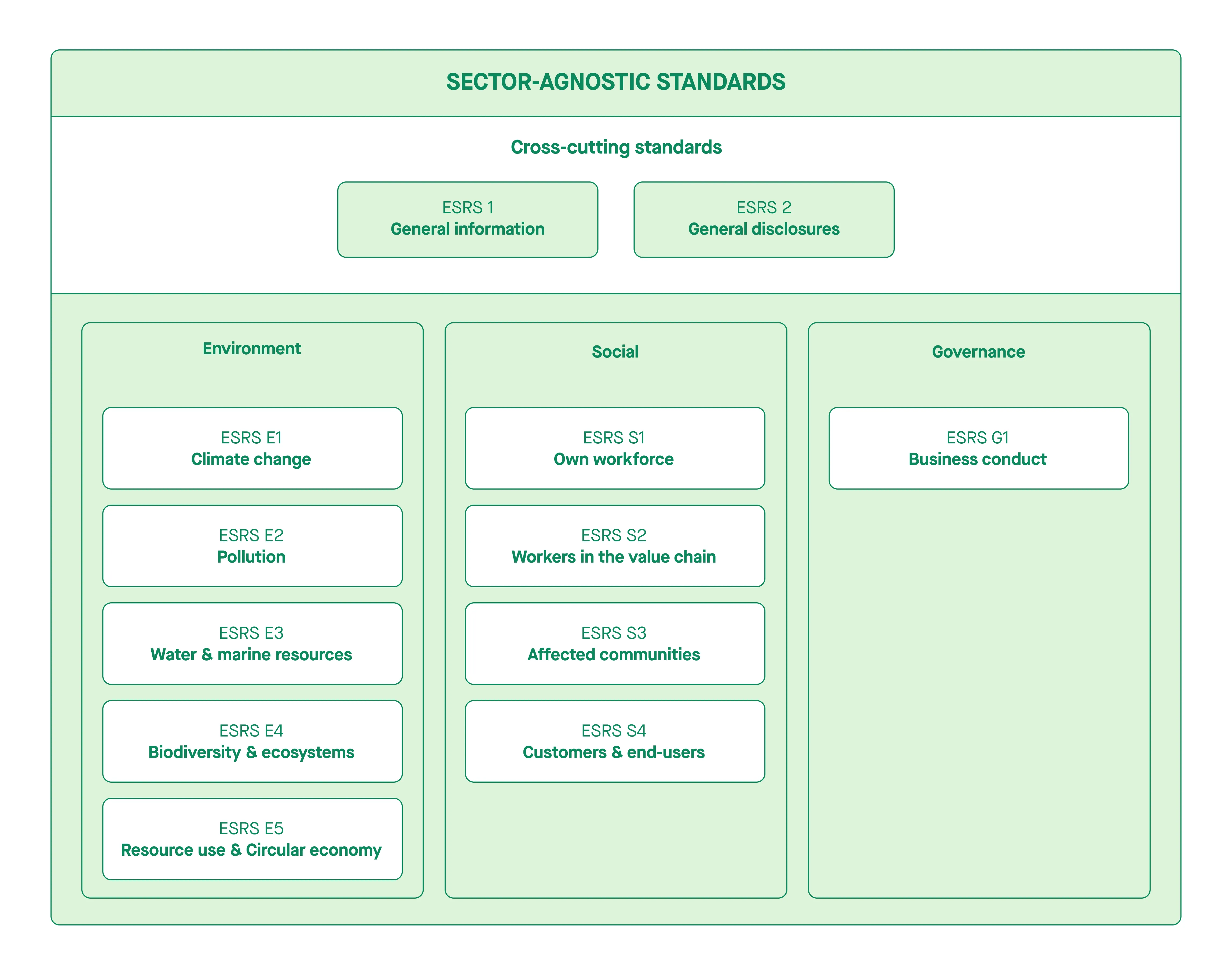

What are the ESRS standards relevant to the CSRD?

ESRS 1 and 2 – Mandatory cross-cutting standards

At the core of the ESRS framework are the two cross-cutting standards, which establish foundational requirements for CSRD compliance. These standards, including ESRS 1 and ESRS 2, outline essential principles and disclosure requirements that are universally applicable, regardless of the specific sustainability subject matter.

ESRS 1, titled “General Requirements,” sets general principles for sustainability reporting, detailing areas and minimum requirements necessary for understanding a company’s impacts, risks, and opportunities regarding environmental, social, and governance (ESG) aspects. It mandates specific disclosure requirements on your own workforce, including governance structures, business strategies, risk management, objectives, and organizational information. Additionally, ESRS 1 clarifies the reporting principle of double materiality and delineates what information is mandatory, optional, or subject to materiality assessment. Companies must report requirements from ESRS 2 and other relevant EU regulations, irrespective of materiality.

ESRS 2, known as “General Disclosures,” specifies essential information for preparing a sustainability statement, applicable to all companies regardless of their activities or sustainability relevance. It mandates information on governance, strategy, materiality assessment, key performance indicators, and value chain coverage. Annexes to ESRS 2 list mandatory data points from EU legislation like the Sustainable Finance Disclosure Regulation (SFDR) and EU Climate Law, ensuring comprehensive reporting on sustainability-related aspects.

Topical standards

In addition to the mandatory cross-cutting standards, the ESRS framework includes ten topical standards that delve into specific ESG topics. These topical standards provide specialized frameworks for comprehensive disclosure in areas such as climate change, human rights, and biodiversity. While not mandatory, these standards are instrumental in enabling companies to evaluate and report their sustainability performance in specific ESG areas, enhancing the granularity and relevance of their disclosures.

Sector-specific standards

Recognizing the diverse nature of industries, the ESRS framework will evolve to include sector-specific standards tailored to address the unique sustainability aspects and reporting needs inherent to different sectors. Anticipated to be finalized and adopted by the European Commission by June 2026, these sector-specific standards aim to ensure that reporting is as relevant and insightful as possible, reflecting the specific sustainability challenges and opportunities faced by different industries.

Preparing for reporting using the ESRS

Transitioning to ESRS reporting under the Corporate Sustainability Reporting Directive (CSRD) presents both challenges and opportunities for companies subject to the regulation. To report sustainability information effectively under the ESRS, companies should consider the following steps:

1. Set the boundaries of your ESRS reporting

If your company already produces financial reports, your sustainability reports must align with the same scope and time frame. Other reporting requirements include: coverage of the company’s impact, risks, and opportunities across the entire value chain, both upstream and downstream. You’ll need to specify which parts of the value chain are included in the report. Make sure to clearly define the time horizons used in your reporting, categorizing them as short, medium, and long-term.

2. Conduct a double materiality assessment

Identify material ESRS topics by assessing their impact from both financial and societal perspectives. Engage in a comprehensive analysis of your organization’s activities and their potential impacts on people, the environment affected communities, and financial performance to prioritize disclosure efforts effectively.

The ESRS outlines various topics, subtopics, and sub-subtopics that can help you start your double materiality assessment. These topics are deemed material for reporting if they are significant from either an impact or risk perspective. Companies can also include “entity-specific” topics to address their unique circumstances or industry specifics.

In early 2025, EFRAG will release the first sector-specific draft standards, which will help companies in particular industries identify material topics. The initial sector standards will cover oil, gas, mining, coal, and later, the financial sector.

3. Assess your data collection and identify gaps

First, assess your current data collection processes to evaluate their status and identify any gaps in data availability and quality. This involves a thorough review of your existing sustainability reporting disclosures to see how well they align with ESRS requirements and to pinpoint areas that need improvement.

Once you’ve determined which issues are material to your business, perform a gap analysis to ensure you’re collecting all the required indicators for those issues. This involves meticulously reviewing the ESRS requirements, data point by data point, to check whether your company is collecting or reporting the necessary data. For companies already producing ESG reports, this can be done by reviewing the latest report. For those new to ESG reporting, it will involve reaching out to specialists throughout the company to gather information on what data is being collected or reported. Often, some data will already be available because it is required by law or used by management to improve efficiencies or track employee trends. This methodical approach ensures you identify any missing data and areas needing enhancement, helping you meet ESRS requirements effectively.

4. Plan for efficient data collection

Develop a strategic approach to data collection and reporting, considering factors such as data availability, collection methods, and reporting timelines. Start by reviewing the detailed explanation provided by the ESRS on how each indicator should be reported. These explanations are an important reference point for ensuring comparability between sustainability reports, specifying units, required granularity, and the need for data disaggregation by country of operation. Additionally, all quantitative metrics must include a comparator year.

Assess your current data collection processes to see if they meet these requirements. You may need to adjust existing systems or set up new processes to capture such datapoints. For indicators not yet monitored, develop new data collection processes and build internal competencies. Large organizations might need specialized IT systems to unify data collection across the organization, ensuring transparency and reducing errors.

Define clear roles and responsibilities within your organization for efficient data collection. Allocate resources appropriately and ensure each team understands its role in gathering and reporting data. By following this plan, you will ensure your organization collects the necessary data on each material topic, meeting ESRS requirements and enhancing the quality of your sustainability reports.

5. Understand indicators

After collecting the necessary data, companies can begin preparing their sustainability reports. For qualitative indicators, such as company policies, action plans, and targets, firms must either detail what is currently in place or acknowledge the absence of such documents. These descriptions should adhere to the “Minimum Disclosure Requirements” (MDRs) outlined in ESRS 2 General Disclosures. Companies must also provide a detailed assessment of financial risks and opportunities, which can be qualitative initially but must be quantitative from 2028 onwards.

Quantitative indicators vary in format from single percentages to detailed tables. The ESRS taxonomy will eventually provide templates for these tables, but until then, companies can use Excel based on ESRS guidelines. All quantitative data must be compared with previous years’ data, and monetary data should align with financial reports.

6. Prepare for third party auditing

Anticipate the need for third-party auditing and assurance to validate the accuracy and reliability of reported information in your sustainability disclosures. Proactively address potential issues and challenges by collaborating with verified assurance partners and leveraging their expertise to enhance the credibility and transparency of your reporting efforts.

How should you present your ESRS report?

When preparing your ESRS report, it’s important to ensure that the format is both human- and machine-readable. EFRAG is developing a digital taxonomy for ESRS reports, known as XBRL taxonomy, which will be essential for electronic reporting. Although the final taxonomy won’t be available until the second half of 2024, you can get a head start by organizing your report in a structured format that can be easily tagged later.

Your ESRS report should include four main sections: General Information, Environmental Information, Social Information, and Governance Information. You can find detailed examples of this structure in Appendix D and Appendix F of ESRS 1. The first section should cover all general disclosures, except for those related to material impacts, risks, and opportunities of each topic (SBM-3). These specific disclosures should be placed within their respective chapters. Additionally, information related to EU Taxonomy reporting should have its own clearly marked section within the Environmental chapter. By following this format, you’ll ensure your report is comprehensive, clear, and ready for future digital tagging.

To summarize

The European Sustainability Reporting Standards represent a significant milestone in the journey towards standardized and enhanced non-financial reporting requirements in Europe. By providing a clear and comprehensive framework for sustainability reporting, the ESRS facilitate transparency, comparability, and accountability while driving the transition to a sustainable economy. As companies navigate the complexities of sustainability reporting under the CSRD, understanding and embracing the ESRS framework is essential for ensuring compliance, enhancing stakeholder trust, and driving meaningful progress towards a more sustainable and resilient future.

How Sweep can help

With our platform, reporting using the ESRS doesn’t have to be a headache. We can help you obtain the information needed in a matter of weeks.

-

Streamline your data collection process

-

Cut your audit processing time in half

-

Avoid risks of non-CSRD compliance penalties

-

Help from our carbon experts to identify focal points and assist with compliance

-

Provide your investors and other stakeholders with all the information they need.

Contact us today to find out more.