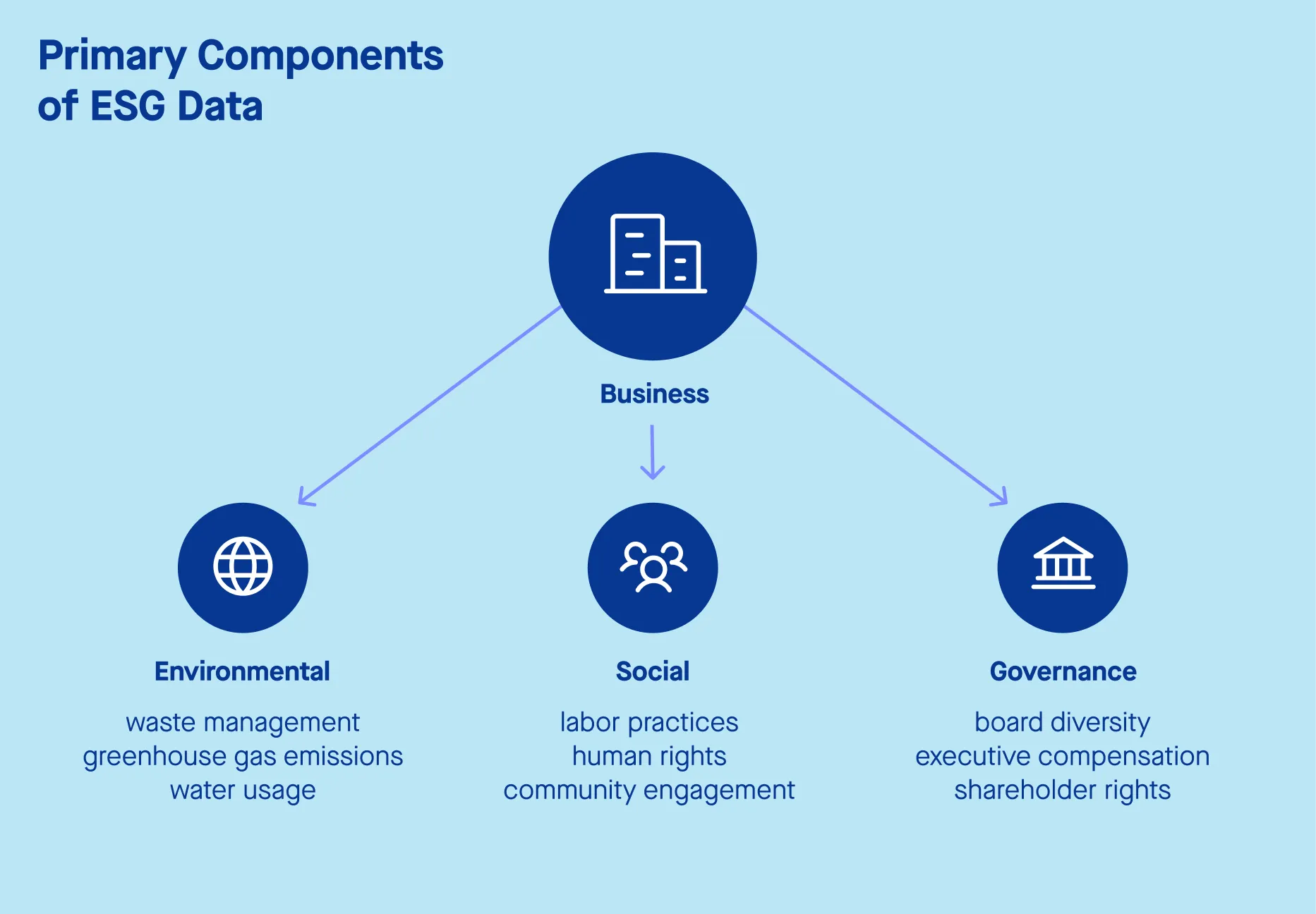

ESG. While it’s not quite a household name in the US yet, it’s certainly on its way to becoming one. ESG is an acronym for Environmental, Social, and Governance, and it describes a modern business framework that helps organizations assess their operational impacts internally (governance) and externally (environmental and social).

The term, which was once considered a lofty ideology, has now evolved into a core business strategy that fosters long-term success in a number of ways – which we discuss at length below.

The key components of ESG

Each of the three pillars of ESG – Environmental, Social, and Governance – offers businesses unique opportunities and challenges. To capitalize on ESG opportunities, it’s imperative first to understand each pillar comprehensively.

Environmental

The environmental pillar, as you may have guessed, focuses on how a company’s operations impact the natural world. In 2024, we witnessed hurricanes that devastated the East Coast, wildfires wreaking havoc in California, and rapidly developing heatwaves that shut down regional power grids.

With climate change affecting everything from supply chains to material and energy costs, understanding how your operations contribute to those issues is essential. At the very least, it should encourage companies involved with processes that pose environmental risks to make an effort to address climate change, limit their impact, and reduce ESG risks.

So, what ESG goals are businesses considering in light of the quickly changing environment?

- Reducing Carbon Emissions: For many US companies, particularly those that fall under EU regulations (CSRD), reducing their carbon footprint is a requirement. For others, investor and stakeholder expectations are driving emission reduction goals – be it for direct or indirect greenhouse gas emissions.

- Energy Efficiency: Companies are changing how they see energy use, and it’s about time. Not only are they investing in renewable energy, but they are also making changes internally with ESG strategies to reduce their reliance on the grid. It’s a win-win for the environment and the company’s bottom line.

- Waste and Resource Management: Circular economies are becoming the norm, which means making a conscious effort to reduce the amount of waste generated through operations and use resources more efficiently.

While many businesses and industries are adopting these strategies, certain companies are making a more substantial effort to tackle environmental issues than others. Costco, for example, has introduced numerous ESG data strategies over the past few years, stating, “Our goal is to create a sustainable supply chain that benefits our members, our suppliers, and the environment.” Their efforts and ESG data are published in their annual sustainability reports, which can be found here.

Social

The social pillar focuses on how a business’s operations impact people, be it the company’s employees, customers, or those in operationally adjacent communities. Companies in the United States have focused strongly on this pillar in recent years, driven largely by human rights issues, social movements, and changing workplace cultures.

While socially responsible investing certainly hasn’t been the norm, it is becoming more and more common as stakeholders and investors demand the Environmental, Social, and Governance push. Let’s take a look at a few examples of social responsibility efforts being made by some of the top US companies.

- Diversity, Equity, and Inclusion (DEI): While DEI laws are changing with the 2025 US administration, many businesses are choosing to continue supporting DEI initiatives and integrate them as core company values. U.S. businesses are doing more than just diversifying their hiring practices – they’re creating a safe, fair, and transparent workplace for those within the companies that are continuing support.

- Employee well-being: Work-life balance hasn’t always been a value of US business, but more and more companies are reevaluating the outlook. Mental health programs, on-site support, and other employee-centered initiatives are being used to attract and retain top talent – something that drives success in modern business.

- Community impact: Businesses are becoming more engaged with their communities, whether it’s through charitable donations, volunteer programs, or social justice initiatives. All of these types of initiatives make a positive impact on other people while also building brand reputation and customer loyalty.

In 2024, Hewlett Packard Enterprise Company was named #1 by JUST Capital in ESG efforts in the United States. The company takes a strong stance on social initiatives, supporting things like education, human rights, digital equity, and volunteering within their local communities.

Governance

The governance pillar refers primarily to a company’s management and includes its leadership structure, compliance with laws and regulations, and business ethics. Leaders and asset managers within a company hold a governance responsibility to make the right operational decisions and ensure those within the company are held accountable for their choices. However, as of late, corporate governance is coming under more and more scrutiny from investors and stakeholders for the lack of internal controls. While governance criteria aren’t always the same between businesses, there are some standard approaches that many take.

How are some of the top US companies managing governance risks in successful ways?

- Transparency and ethical behavior: For many, acting ethically and without deception comes naturally. However, different businesses, industries, and applications have varying degrees of what is considered ethical. In short, ethical business behavior is following all tangible rules and regulations, while transparency involves clear and honest corporate reporting on things like ESG ratings.

- Board diversity: US stakeholders and ESG funds are looking for more diversity. Not just for the sake of diversity but for the different experiences and knowledge it brings. By keeping some level of diversity within an organization, businesses are able to tackle a wide range of issues with more confidence, giving them a leg up against those that are more unilateral.

- Regulatory compliance: This is a consistently changing consideration – but a necessary one. Remaining compliant in your business or industry keeps you out of trouble, and remaining aware of the SEC’s proposed climate policies, for example, helps build resilience to potential issues down the road.

In 2023, Microsoft was recognized as a top 100 company in the US for standout ESG performance by 3BL. Microsoft has consistently taken governance seriously and continues to make efforts to improve the governance pillar of its ESG strategies.

Why is ESG critical for US businesses?

Those who haven’t hopped on the Environmental, Social, and Governance (ESG) train yet might be wondering, “Why should I make the move to ESG-focused operations?” The simple answer is that the world is changing, and businesses must adapt alongside it.

Unlike Corporate Social Responsibility (CSR), ESG investing is more about analyzing how sustainably a company is operating. ESG metrics and ESG reporting both focus on some key metrics within a business.

Let’s take a closer look at some of the key ESG factors to consider below.

Regulations and legislation

Pressure, pressure, pressure. US companies are under an increasing amount of pressure from regulators, lawmakers, and even the public to disclose their ESG performance year by year.

For example, the SEC has proposed rules for ESG disclosures for companies of certain sizes or revenues. While most of these rules have yet to stick, there were around 3,200 US companies in 2023 that fell under the EU’s reporting laws and regulations, so either they disclose their ESG and financial performance or they can’t operate in Europe.

In addition to federal regulations, states like California have introduced stringent climate laws that require businesses to align with statewide sustainability goals; reducing a company’s carbon emissions, for example.

Investor pressure

In the United States, institutional investors like BlackRock and Vanguard are considering ESG criteria when they make sustainable investment decisions. Since ESG has transformed from something that was simply “nice to have” into something that is a “must have,” it’s made a huge impact on the corporate investment process.

Investors now look to make contributions in businesses that align with environmental and social values while also remaining increasingly profitable, something that has practically become “responsible investing 101.”

Consumer expectations

While not all US consumers are actively demanding more sustainable operations from their favorite brands and businesses, more than 70% are willing to pay for products and services that are more sustainable than others – up to 9.7% more, to be exact.

While businesses have the choice of whether or not they want to invest fully in such initiatives, most businesses recognize that they risk losing loyal customers and investment from financial institutions if they don’t.

Corporate risk and resilience

A company’s risk and resilience is another critical consideration that must be made regarding ESG. Simply put, businesses put themselves at risk when they don’t adapt to the rapidly changing world, especially when it comes to environmental and sustainability issues. From hurricanes to drought, supply chains are disrupted today more than ever. If a company chooses to ignore the warning signs, it could soon face rising product costs, unpredictable energy availability, and more.

Preparing with a proactive ESG approach allows businesses to build resilience to future change and have a plan in place for when things start to go south.

Benefits of implementing ESG in US business

A long list of benefits exists for those that implement proactive ESG strategies into their operations. Why? Because when you can prepare for the worst, you know what your limitations are and how to correct a variety of circumstances that might occur.

Operational efficiency

Among the biggest ways Environmental, Social, and Governance (ESG) helps businesses streamline their operations, reduce waste, and cut energy costs is by simply operating in a more efficient manner. While there are numerous ways to accomplish this, there are some pretty straightforward strategies that don’t require a lot of direction.

Implementing renewable energy or energy-efficient lighting in the office, reducing redundancies in supply chains by buying products locally, and minimizing transportation through the use of interactive technologies are all easy strategies to operate more efficiently. They will save you money, time, and resources, and the improvements can be showcased in your corporate sustainability reports.

Brand reputation and consumer loyalty

Transparency and ethical behavior, which we talked about in the above sections, are huge selling points in terms of a company’s brand and reputation. When US businesses align with their customers’ ideals through ESG-focused initiatives and operations, they create a long-lasting funnel of repeat customers who spread a positive message through word-of-mouth.

Not only can a strong ESG data strategy differentiate your brand from your competitors, but it can also drive recurring revenue for prolonged periods – something that many businesses struggle to do.

Attracting and retaining talent

Talent is key when developing a business that thrives, but keeping the younger generation on your team often takes more than a solid paycheck. For many, it has become increasingly important that the company they work for is operating both sustainably and responsibly. If you don’t show a clear and active effort to support environmental issues and drive social initiatives through ESG strategies, they may begin looking for employment with a company that does.

A strong ESG strategy helps foster a workplace environment that is inclusive, appreciative, and actively seeking to do better in all aspects of its operations.

Risk mitigation

Managing risk is tough, and it becomes even harder when businesses ignore all the warning signs coming their way. Environmental, Social, and Governance metrics can help build resilience against fines, lawsuits, and reputational damage, and conquering those related aspects of operations can even help drive profits (or at least not lose them).

By preparing for the worst, planning for failures, and exposing operational downfalls before they reach other stakeholders, companies gain the ability to correct their shortcomings, facilitate responsible investment, and remain in the green.

What is meant by ESG investing?

ESG investing refers to the practice of allocating capital to companies that prioritize environmental responsibility, ethical business practices, and strong corporate governance. Investors consider ESG issues such as climate impact, labor practices, and board diversity to assess long-term financial stability and risk exposure.

By integrating ESG factors into investment decisions, businesses and individuals can support sustainable growth while reducing financial risk associated with poor governance or environmental negligence. The demand for sustainable products and responsible business practices has driven significant growth in ESG-focused mutual funds and portfolios.

Moreover, companies that promote transparency in their ESG strategies are more likely to attract long-term investors, reinforcing the importance of sustainability in modern finance.

As a note: While ESG investing and impact investing are similar, impact investing focuses more on specific social and environmental outcomes, while ESG investing focuses more on how ESG factors can be integrated for better decision-making. Either way, both offer some form of sustainable investing.

What are ESG rating agencies?

ESG rating agencies evaluate and score companies based on their ESG issues, helping investors identify businesses that align with their values and sustainability goals. These agencies analyze factors such as environmental responsibility, ethical supply chain management, and corporate governance to determine an organization’s overall ESG performance.

Their ratings provide crucial insights into financial risk, as companies with poor Environmental, Social, and Governance scores may face legal challenges, reputational damage, or regulatory fines. By assessing how well companies promote transparency and commit to sustainable products, ESG rating agencies play a critical role in guiding responsible investment decisions. Their work has contributed to the significant growth of ESG investing on a global scale, ensuring that businesses remain accountable for their social and environmental impact.

How can businesses prepare for ESG reporting?

Preparing for ESG reporting requires a structured approach to ensure compliance, accuracy, and alignment with industry standards. Companies must stay informed about the latest ESG trends and implement effective strategies to enhance their sustainability efforts. Here’s how businesses can prepare:

- Gather comprehensive ESG information – Collect and analyze data related to environmental impact, governance policies, and social responsibility initiatives to provide a transparent and accurate report.

- Set clear sustainability targets – Establish measurable goals, such as achieving net zero emissions, improving workforce diversity, and enhancing ethical supply chain practices.

- Stay updated on regulatory requirements – Ensure compliance with evolving ESG regulations, ESG standards, and disclosure frameworks to meet stakeholder expectations and avoid potential penalties.

- Integrate environmental stewardship – Adopt eco-friendly practices, such as energy efficiency programs and waste reduction strategies, to demonstrate a commitment to environmental stewardship.

- Engage stakeholders – Communicate ESG efforts effectively with investors, employees, and customers to build trust and reinforce corporate sustainability commitments.

By proactively addressing these areas, businesses can enhance their Environmental, Social, and Governance performance, improve investor confidence, and align with global sustainability standards.

How Sweep can help US business meet their ESG objectives

At Sweep, we help businesses, big and small, take control of their sustainability journey with actionable ESG strategies. From assessing and monitoring carbon emissions to ensuring compliance with industry-specific regulations, our innovative approach and platform make managing ESG data a breeze.

- Simplify the process of tracking and reporting your ESG metrics to ensure full transparency and compliance with evolving regulations.

- Leverage Sweep’s tools to track carbon emissions across your operations and implement effective strategies to reduce environmental impact.

- Strengthen your governance framework with Sweep’s data-driven insights, ensuring accountability, compliance, and ethical decision-making.

- Use Sweep’s platform to clearly communicate your ESG goals and progress to investors, customers, and external stakeholders in your annual reports, fostering trust and engagement.

- Identify areas for improvement in your supply chain and resource management, driving cost savings and sustainability across your business operations.

- Justify sustainable investing with accurate and timely environmental social and governance data specific to your business.