In this guide you’ll learn:

- What the SFDR is.

- The companies covered by the SFDR.

- The journey to SFDR compliance.

- How dedicated software can help you on the compliance journey.

Navigating the complexities of the Sustainable Finance Disclosure Regulation (SFDR) may seem like a daunting task, but it doesn’t need to be. This comprehensive guide from Sweep is here to help you at every step of the journey to achieving full SFDR compliance. From understanding the regulatory requirements through data collection, all the way to reporting – we’ll equip you with the knowledge and tools needed to become a compliance champion.

La SFDR est un cadre réglementaire introduit par l’Union européenne (UE) pour améliorer la transparence et promouvoir la finance durable.

Elle vise à répondre à la demande croissante d’informations environnementales, sociales et de gouvernance (ESG) de la part des investisseurs et à aligner les activités financières sur des objectifs de l’Accord de Paris.

La SFDR définit des obligations de reporting extra-financier pour les acteurs des marchés financiers afin de faciliter l’intégration des facteurs ESG dans les décisions d’investissement. Elle aborde également la double matérialité dont les effets négatifs des investissements sur l’économie, la planète et la société.

En se conformant à la SFDR, les organisations peuvent ainsi démontrer un engagement concret en faveur du développement durable, répondre aux attentes des investisseurs et contribuer à la transition vers une économie bas carbone.

The SFDR applies to various entities within the European Union (EU), including:

Private equity firms are covered by the SFDR and need to assess and disclose the environmental, social, and governance (ESG) risks and impacts of their investments, along with their strategies for managing those risks.

Non-listed companies, especially those offering investment products or services, are also subject to SFDR requirements regarding ESG disclosure and reporting.

Adhering to the SFDR not only helps PE and non-listed companies meet regulatory obligations but also enhances transparency, fosters investor confidence, and supports the transition towards a more sustainable financial system.

The journey towards full SFDR compliance involves a few key steps:

Data collection is the first crucial aspect of SFDR compliance, requiring financial market participants to gather and manage relevant information on sustainability risks, adverse impacts, and environmental, social, and governance (ESG) indicators.

Sustainability Risk Indicators

Information on potential risks arising from environmental factors (e.g., climate change), social factors (e.g., labor rights), and governance factors (e.g., board structure) that may have an impact on investment performance.

Principal Adverse Impact (PAI) Data

Data related to the adverse impacts of investment decisions on sustainability factors, including metrics and indicators to quantify and assess these impacts.

Portfolio-level Data

Information on the ESG characteristics and sustainability goals of investment portfolios, including the proportion of assets aligned with specific environmental or social objectives.

Data on Investment Products

Details on the environmental or social characteristics of investment products and their alignment with sustainability objectives, as well as any associated methodologies or third-party certifications.

Collecting data from across an investment portfolio for SFDR compliance can pose several challenges, including:

Data availability: Accessing reliable and standardized data on sustainability factors, adverse impacts, and ESG indicators can be a challenge, especially when the data is not readily available or consistently reported by investee companies or third-party sources.

Data quality and consistency: Ensuring the quality and consistency of the collected data can be tricky due to variations in reporting methodologies, data sources, and the lack of standardized frameworks. Inconsistencies or incomplete data can hinder accurate analysis and reporting.

Data integration: Integrating data from multiple sources and formats into a centralized system or platform can be complex and time-consuming. It may require establishing data pipelines, overcoming compatibility issues, and addressing data cleansing and normalization challenges.

Data verification and assurance: Validating the accuracy and reliability of the collected data can be challenging, as it may involve verifying data sources, engaging with investee companies, or conducting independent audits to ensure the information is trustworthy.

Sustainability is critical in private equity (PE) investments, yet accessing and leveraging Principles Adverse Impacts (PAI) data remains challenging due to:

Limited data availability

PE companies aren’t obliged to disclose sustainability data, resulting in limited and often incomplete information. Accessibility is further restricted by potential barriers, hindering a comprehensive evaluation of a company’s sust ainability profile.

Non-standardization of data

The lack of uniform metrics across the PE sector makes comparing sustainability data difficult. Companies use varying methods to calculate their adverse impacts, causing inconsistency in benchmarking and tracking sustainability performance across investments and asset classes.

Use of proxies and PAI calculation methods

As PE firms resort to proxy data to fill in the gaps, the need arises for expertise to choose reliable indicators. Additionally, new methods for calculating PAI are in the early stages and lack validation and standardization. They need further refinement and industry-wide agreement to ensure they fairly represent a company’s sustainability impacts.

Recognizing and addressing these issues is vital for the PE sector’s advancement in sustainable investment practices.

Software providers simplify data collection for SFDR by offering streamlined processes that automate tasks, organize data, and provide analysis.

They provide data templates designed specifically for SFDR reporting, making it easier for financial market participants (FMPs) to capture the required information accurately and consistently.

The software also includes data validation checks, minimizing errors and ensuring the completeness and accuracy of the collected data. This saves valuable time for FMPs by reducing manual efforts and provides better insights for informed decision-making.

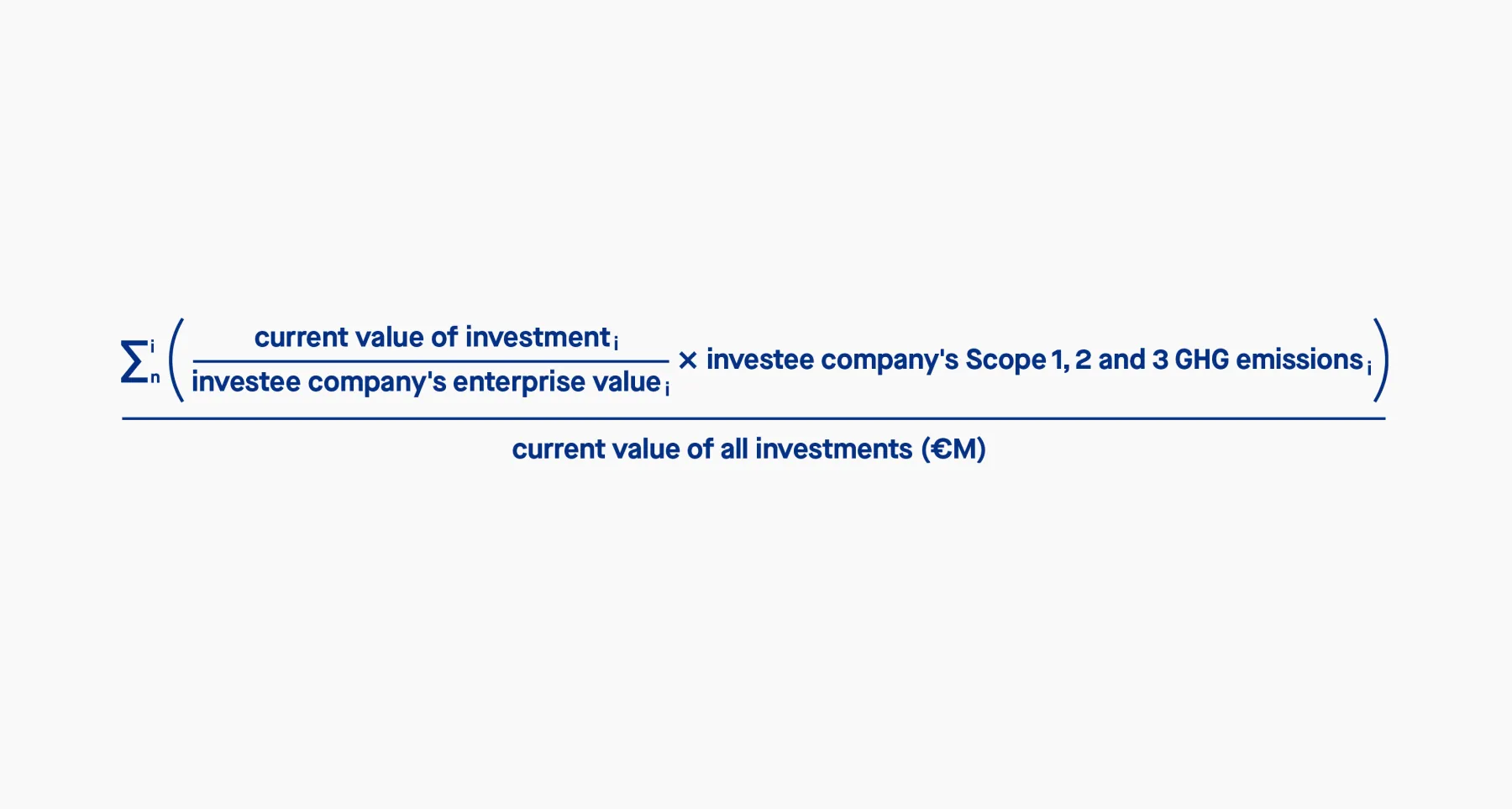

After collecting validated sustainability data from your investee companies, you need to aggregate it at the portfolio level using the methodology outlined in the SFDR, which we’ll explain below.

The SFDR regulation includes a set of indicators that FMPs need to report on. These indicators are meant to assess the environmental, social, and governance (ESG) impacts of their investment portfolios.

There are a total of 64 indicators, out of which 18 are mandatory. FMPs must report on these 18 mandatory indicators. The mandatory indicators are divided into two main groups: 9 indicators related to the environment and 6 indicators related to social aspects, employee rights, human rights, and anti-corruption measures.

Additionally, FMPs need to choose and report on at least 1 out of 22 optional environmental indicators and 1 out of 24 optional social indicators. This means they have some flexibility in selecting additional indicators from these categories.

Source: European Commission SFDR Annex 1

Once you have collected validated sustainability data from your investee companies, software platforms can offer you streamlined solutions to help you aggregate the data at the portfolio level, following the SFDR methodology.

These software tools are designed to simplify the complex process of handling the numerous SFDR indicators. In effect, they save you time, help you minimize errors, and provide you with accurate insights for informed decision-making based on ESG impacts.

The next step is to report and communicate your data in a comprehensible format to all your key stakeholders. The SFDR mandates financial organizations to disclose PAI information in pre-contractual documents, periodic reports, and on their websites. Ensure compliance with these requirements by preparing clear and transparent reports and disclosures.

When engaging with potential investors, provide them with relevant information about your approach to sustainability, including how you consider PAI indicators. This can be in the form of brochures, prospectuses, or other pre-contractual documents. Clearly communicate your sustainability objectives, methodology, and the key PAI indicators you consider.

Include PAI information in your periodic reports, such as annual or semi-annual reports, that provide updates on your portfolio’s sustainability performance. Describe how the aggregated PAI data has been used to assess the sustainability impact of your investments and any actions taken based on the findings. Provide insights into the progress made towards sustainability goals and the challenges faced.

Make the aggregated PAI data easily accessible on your organization’s website. Create a dedicated section that outlines your sustainability approach, methodologies, and results. Present the aggregated PAI data in a user-friendly and transparent manner, using visualizations, charts, or tables to enhance understanding.

Provide additional context to aid interpretation and understanding of the PAI data. Explain any limitations, assumptions, or uncertainties associated with the data or methodologies used. Include information about the scope of data collection, such as the percentage of companies covered in your portfolio or any exclusions. This context helps investors and stakeholders make informed judgments about your sustainability performance.

Software plays a crucial role in facilitating SFDR reporting by providing functionalities to generate comprehensive reports based on the aggregated data. It also allows for customization and flexibility, enabling you to tailor reports to your specific needs.

The data that you’ve gathered for SFDR compliance, can also bring you a range of benefits when it comes to decision-making.

Evaluate the aggregated PAI data to assess the overall sustainability performance of your portfolio. Identify areas where improvements can be made, such as reducing exposure to investments with significant adverse impacts or reallocating resources towards more sustainable investments. The SFDR data can help align your investment strategy with sustainability objectives and regulatory expectations.

Share PAI data with your portfolio companies, along with your expectations for improved sustainability performance. Discuss potential actions and initiatives to address adverse impacts and enhance sustainability practices. This engagement can drive positive change and encourage companies to align their practices with sustainable principles.

Regularly monitor and track your PAI data to evaluate the effectiveness of your sustainability initiatives and investment decisions. Use it to identify which portfolio companies may need additional support with aspects of their ESG strategy. Analyze trends, compare performance across different periods, and assess the impact of changes in your investment portfolio – and then take action accordingly.

Sweep gives you all the tools you need to succeed when it comes to SFDR compliance:

Sweep also brings detailed carbon calculation into the ESG software landscape. Contact us today to find out more about how we can support you.

Sweep is a carbon and ESG management platform that empowers businesses to meet their sustainability goals.

Using our platform, you can: