In this guide you will learn:

- What the CSRD is

- The companies covered by the CSRD

- The journey to CSRD compliance

- How dedicated software can help you on the compliance journey

We’d love to know a little more about you. Enter your details to unlock the page

In an era where sustainability is increasingly integrated into business practices, organizations face growing pressure to demonstrate their commitment to environmental, social, and governance (ESG) factors. The Corporate Sustainability Reporting Directive (CSRD) represents a significant development in sustainability reporting requirements within the European Union (EU), mandating companies to provide more comprehensive and standardized ESG disclosures. To assist businesses in successfully navigating the complexities of CSRD compliance, we have created this comprehensive handbook. Whether you’re a multinational corporation or a small and medium-sized enterprise (SME), this guide will provide you with the essential knowledge, practical guidance, and valuable resources needed to achieve CSRD compliance and unlock the potential of sustainable reporting.

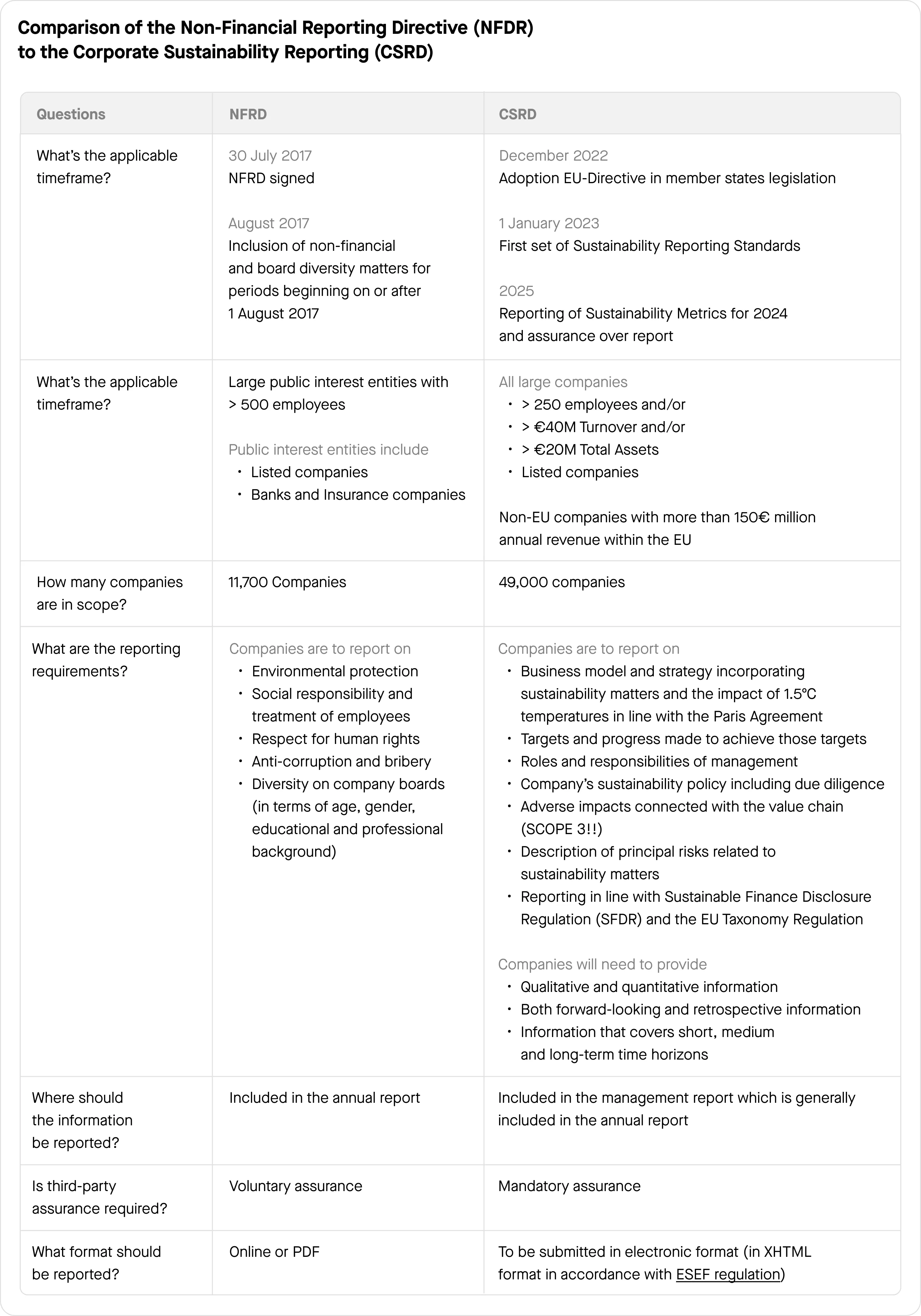

The Corporate Sustainability Reporting Directive (CSRD) represents a significant evolution from its predecessor, the Non-Financial Reporting Directive (NFRD). While the NFRD laid the foundation for sustainability reporting within the European Union (EU), the CSRD takes reporting requirements to a new level. The key difference lies in the scope and depth of reporting obligations. The CSRD expands the number of companies subject to reporting, including small and medium-sized enterprises (SMEs), and introduces more comprehensive disclosure requirements. It aims to enhance the transparency, comparability, and reliability of environmental, social, and governance (ESG) information disclosed by companies.

The CSRD encompasses a wide range of companies, including more than 50 thousand entities, which collectively represent approximately 75% of business activity in the European Economic Area (EEA).

The CSRD applies to EU-based public companies, excluding micro-enterprises. Additionally, all EU-based private organizations considered “large” fall under the CSRD requirements. A company is classified as “large” if it meets two or more of the following criteria:

For non-EU parent companies, their EU subsidiaries must comply with the CSRD reporting obligations if they meet the criteria mentioned above. However, some companies may choose to voluntarily consolidate their reporting at a global level, providing a comprehensive overview of their sustainability performance.

In the future, the CSRD will introduce consolidated reporting requirements for non-EU parent companies with an annual revenue of €150 million or more in the EU. To fall under this provision, the non-EU parent company must have at least one branch or subsidiary meeting the criteria for large EU-based organizations: generating €40 million or more in annual EU revenues or being listed in the EU. In such cases, the parent company will also be responsible for including their non-EU activities in the sustainability reporting process.

CSRD Assurance refers to the process of independently verifying and validating the accuracy and reliability of a company’s sustainability disclosures. The assurance process plays a crucial role in building trust among stakeholders, investors, and the public by offering an objective assessment of an organization’s sustainability performance. Companies subject to the CSRD will need to undergo an assurance engagement for their sustainability reports. The assurance timeline typically involves conducting the engagement after the end of the reporting period but before the publication of the final sustainability report. This allows for a thorough examination of data, methodologies, and assumptions used in the reporting process.

There are two main levels of CSRD Assurance: limited assurance and reasonable assurance. Limited assurance provides a moderate level of confidence that the sustainability information is free from material misstatements, whereas reasonable assurance provides a higher level of confidence, as the assurance provider conducts more extensive testing and evidence gathering. Generally, larger organizations or those with significant sustainability impacts may opt for reasonable assurance to demonstrate a stronger commitment to accurate reporting.

The Corporate Sustainability Reporting Directive (CSRD) introduces comprehensive reporting requirements for companies, building upon the existing framework of the NFRD (Non-Financial Reporting Directive) while introducing more specific guidance. Under the CSRD, companies are asked to report on various sustainability-related information, covering environmental impact, social matters, human rights, anti-corruption efforts, and board diversity.

In terms of reporting, the CSRD outlines the following key areas that companies must disclose:

Strategy: Companies are required to disclose their sustainability strategies, outlining their approach to addressing key sustainability challenges and opportunities.

Targets: Companies should report on their sustainability targets, setting measurable goals to drive their sustainability agenda and track progress over time.

Role of the board and management: The CSRD emphasizes the importance of board-level involvement in sustainability matters. Companies need to disclose the role of the board and management in overseeing and driving sustainability initiatives.

Main adverse impacts: Companies are expected to disclose the principal adverse impacts (PAIs) related to their operations and value chain. This includes identifying and addressing risks and negative effects on the environment, society, and stakeholders.Sustainable Finance Disclosure Regulation (SFDR)

Principal Adverse Impacts (PAIs) refer to the significant negative effects that a company’s activities, products, or services have on sustainability factors, such as the environment, society, and stakeholders. These impacts can include, but are not limited to, environmental degradation, social inequalities, human rights violations, health and safety risks, and corruption. Note that PAIs are also a key requirement of the Sustainable Finance Disclosure Regulation (SFDR).

Intangibles: The CSRD requires companies to disclose information on intangible assets related to sustainability, such as intellectual property, reputation, and brand value.

Identification of reported information: Companies should provide clear information on how they have identified and selected the reported sustainability information, ensuring transparency in the reporting process.

The CSRD goes beyond the NFRD by introducing additional requirements for reporting, such as:

Qualitative and quantitative information: Companies need to provide both qualitative and quantitative data to support their sustainability disclosures, offering a comprehensive view of their sustainability performance.

Forward-looking and retrospective information: The CSRD requires companies to report on both forward-looking information, such as future sustainability plans and targets, and retrospective information, including historical performance and achievements.

Reporting over different time periods: Companies should cover short, medium, and long periods of time when appropriate, providing a holistic perspective on their sustainability progress.

According to the European Commission’s impact assessment, the anticipated expense for EU companies to adhere to the CSRD is projected to range from €3.6 billion to €8.8 billion over a decade, encompassing expenses linked to gathering and validating sustainability data, upgrading internal systems, and engaging stakeholders on sustainability matters.

Beyond the direct financial outlays tied to CSRD compliance, there could be indirect costs tied to the reputational risks stemming from non-compliance with the novel reporting requisites. Enterprises falling behind their industry counterparts in sustainability reporting might encounter censure from investors, customers, and other stakeholders, potentially impairing their brand reputation.

As part of the CSRD, the European Financial Reporting Advisory Group (EFRAG) has been mandated to develop the ESRS. These standards will serve as the foundation for sustainability reporting under the CSRD framework, providing a common set of guidelines and requirements for companies to follow when disclosing their financial and ESG information and performance. By aligning with the EU sustainability reporting standards, companies can ensure that their sustainability reports are consistent, reliable, and comparable, facilitating transparency and enabling stakeholders to make informed decisions. The ESRS play a crucial role in harmonizing sustainability reporting practices across the EU, supporting the overarching objectives of the CSRD to promote sustainable and responsible business practices.

The double materiality concept recognizes that sustainability reporting should consider both the impact of the environment and society on an organization’s value (financial materiality) and the impact of the organization itself on these factors (impact materiality).

It signifies a shift from solely considering financial performance to recognizing the significance of broader societal, human rights and environmental impacts, plus governance factors. This holistic approach ensures that organizations assess and disclose sustainability matters that are financially material to their own business model and also material to the wider environment and society at large.

1. Familiarize yourself with the CSRD: Gain a comprehensive understanding of the CSRD’s provisions, reporting obligations, and disclosure requirements. Study the directive, official guidelines, and any supporting documents to grasp the scope and expectations set forth by the CSRD.

2. Assess current reporting practices: Evaluate your company’s existing sustainability reporting practices and identify any gaps in alignment with CSRD requirements. Determine areas where additional data collection, reporting methodologies, or disclosure enhancements may be necessary.

3. Identify material sustainability issues: Conduct a materiality assessment to identify the sustainability issues that are most significant to your company and stakeholders. This evaluation will ensure that you’re including the relevant information in your CSRD report.

A materiality assessment is a process used by companies to identify and prioritize the sustainability issues that are most significant to their business and stakeholders. It involves evaluating the potential impacts of environmental, social, and governance (ESG) factors on the company’s operations, reputation, and long-term value creation. Through a materiality assessment, companies can determine which issues are most relevant and influential to their business strategy, decision-making, and reporting. By focusing on material issues, companies can effectively allocate resources, set targets, and communicate their sustainability performance to stakeholders, enhancing transparency and addressing the concerns that matter most.

4. Enhance data collection and management: Establish robust systems and processes to collect, manage, and validate sustainability data. Implement appropriate data collection methodologies, integrate data from relevant sources within your organization, and ensure data accuracy, consistency, and reliability.

5. Align with reporting standards: Review and align your reporting practices with recognized sustainability reporting frameworks and standards. Consider using established frameworks such as the Global Reporting Initiative (GRI) or the Sustainability Accounting Standards Board (SASB) to guide your reporting approach and ensure compliance with CSRD reporting requirements.

6. Engage stakeholders: Engage with internal and external stakeholders to gather their perspectives, expectations, and feedback on sustainability reporting. This collaborative approach will help identify relevant topics, improve the credibility of your reporting, and strengthen stakeholder relationships.

7. Develop internal capacity: Invest in building internal capacity and expertise in sustainability reporting. Provide training and resources to relevant staff members involved in data collection, reporting, and disclosure to ensure they are equipped with the knowledge and skills needed for CSRD compliance.

8. Consider assurance and audit requirements: Familiarize yourself with the assurance and audit requirements outlined by the CSRD. Assess whether your company has the necessary resources and expertise to meet the assurance obligations and consider engaging independent assurance providers to enhance the credibility of your reports.

9. Monitor regulatory updates: Stay informed about regulatory developments and updates related to the CSRD. Monitor guidance and publications from regulatory authorities and industry bodies to ensure ongoing compliance and incorporate any changes into your reporting practices.

10. Start early and plan for implementation: Begin early preparations for CSRD compliance to allow sufficient time for data collection, internal alignment, and reporting enhancements. Develop a clear implementation plan with defined timelines, responsibilities, and milestones to ensure a smooth transition to the new reporting requirements.

The CSRD represents a significant milestone in sustainability reporting, aiming to improve the quality and comparability of information disclosed by companies operating within the EU. Embracing the CSRD not only aligns companies with evolving sustainability goals but also strengthens their reputation, stakeholder relationships, and long-term resilience in an increasingly sustainability-focused world.

Sweep is a carbon and ESG management platform that empowers businesses to meet their sustainability goals.

Using our platform, you can: