Marie-Anne Vincent, our VP of Climate Finance, explains what the new European Union (EU) regulation means for your company and how to get ready to accurately report your carbon and ESG data.

On January 5, 2023, the new mandatory sustainability reporting regulation came into force across the EU, with almost 50,000 companies impacted. They now must prepare to comply, seize the opportunity to transform, and start to organize themselves, as the CSRD reporting will require a great deal of data collection and formatting work on the part of companies.

-

Four takeaways to get your climate and ESG strategy ready

-

What’s the objective of this new regulation?

-

Which companies are concerned by the new directive?

-

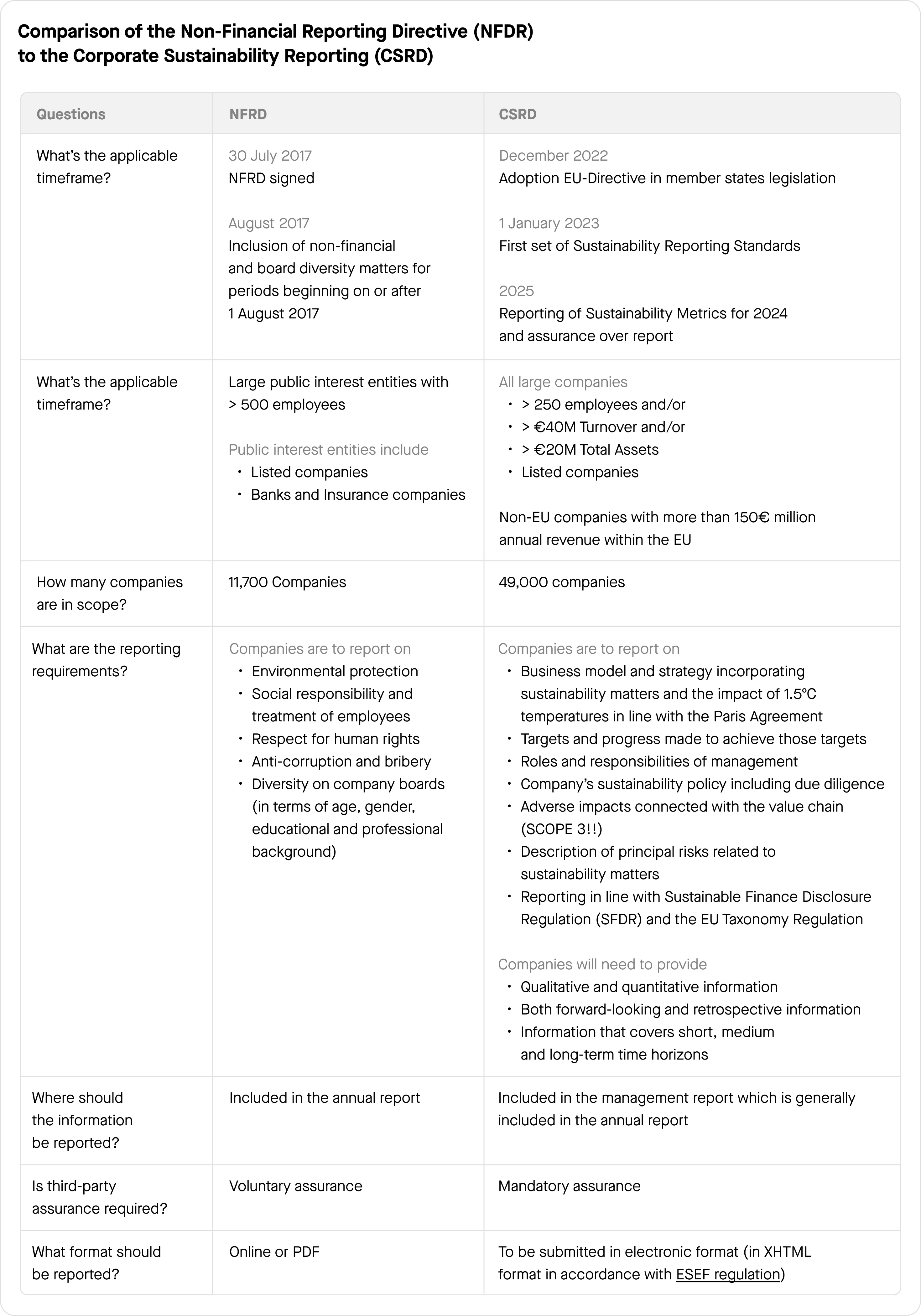

Comparison of the Non-Financial Reporting Directive (NFDR) to the Corporate Sustainability Reporting (CSRD)

Four takeaways to get your climate and ESG strategy ready

1. Sustainability information will sit alongside financial information

Data transparency, accountability, and accuracy will now be required. The core objective of the CSRD is to define a standardized and common language for sustainability information, bringing sustainability reporting to the same level as financial reporting.

2. EU regulations will be the first to apply a double materiality lens in reporting

Companies will need to report on their sustainability-related impacts and how they affect their performance (known as “double materiality”).

3. The amount of data that needs to be collected will greatly increase, as will the number of people involved in the integrated reporting process.

Companies will need a collaborative platform to facilitate data collection and integration internally and externally, especially on scope 3 indirect emissions from their supply chain.

4. Sustainability information will be audited

Companies will also be required to seek third-party assurance for the information they disclose, either from an independent sustainability reporting partner organization or auditor.

What’s the objective of this new regulation?

The CSDR will allow companies to publish harmonized sustainability reports facilitating the work of responsible investors to collectively transition towards a more responsible economy. The directive is in line with the Sustainable Finance Disclosure Regulation (SFDR) and the EU Taxonomy Regulation.

This move takes significant steps toward the goals of the European Green Deal, and making the EU climate neutral by 2050.

Which companies are concerned by the new directive?

Companies that exceed two of the following three thresholds are concerned with the regulation:

-

€20M+ total assets and/or,

-

€40M+ turnover and/or, * 250+ employees,

-

Listed companies

International and non-EU companies with more than €150M in annual revenue within the EU will also need to comply with the new rules.

Other companies outside the scope will likely face increased pressure to provide sustainability information in view of the obligation to consider the entire value chain.

What's the adoption and implementation process for this directive?

On December 16, 2022, the final text of the CSRD was published in the Official Journal of the European Union, replacing the current NFRD.

EU member states have 18 months to transpose it into their national law (by July 6, 2024 at the latest). This will be the final step to specify the scope of the CSRD requirements and its implementation schedule.

The CSRD regulation will be implemented progressively in four phases:

-

Companies already subject to the NFRD must begin reporting in 2025 on their 2024 financial year

-

Large companies not currently subject to the NFRD must begin reporting in 2026 on their 2025 financial year

-

Listed SMEs must begin reporting in 2027 on their 2026 financial year

-

International and non-EU companies must begin reporting in 2029 on their 2028 financial year

Comparison of the Non-Financial Reporting Directive (NFDR) to the Corporate Sustainability Reporting (CSRD)

Learn how Sweep can help you comply with regulations and meet your climate targets.