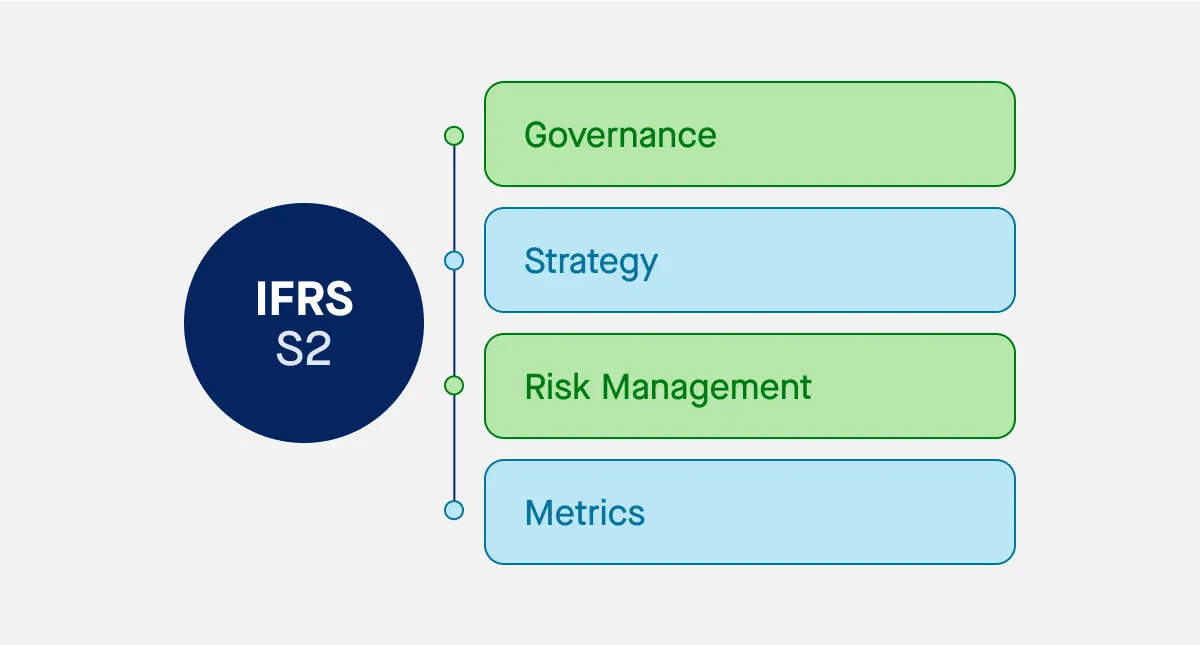

IFRS S2 is a key standard introduced by the International Sustainability Standards Board (ISSB), which sets out specific requirements for the disclosure of climate-related risks and opportunities in the financial reports of companies. As businesses face increasing pressure from regulators, investors, and the public to act on climate change, IFRS S2 provides a framework for them to disclose relevant and transparent climate-related information. This post will explore the key objectives, scope, governance, strategy, risk management, metrics, targets, and other essential aspects of IFRS S2, as well as how businesses should implement it in their annual reporting periods.

When does IFRS S2 become effective?

S2 climate related disclosures are effective for annual reporting periods beginning on or after January 1, 2024, with earlier application permitted as long as IFRS S1 (General Requirements for Disclosure of Sustainability-related Financial Information) is also applied. This allows businesses to adopt the standard sooner, but they must ensure full compliance with the requirements of IFRS S1 as well. For businesses, this means that climate-related disclosures will become an integral part of their overall reporting process starting from the 2024 reporting period. If a company decides to apply IFRS S2 earlier, it must disclose that fact, and apply IFRS S1 at the same time.

What is the objective and scope of IFRS S2?

The primary objective of IFRS S2 is to require businesses to disclose information about their climate-related risks and opportunities that is useful to the primary users of general-purpose financial reports. These reports help investors, lenders, and other stakeholders make informed decisions about providing resources to the company. The key focus of IFRS S2 is on climate-related risks and opportunities that could reasonably be expected to affect a company’s cash flows, access to finance, or cost of capital over the short, medium, or long term.

According to IFRS S2, businesses are required to disclose the following:

Climate-related physical risks

These risks are associated with the direct impacts of climate change on a business’s operations, assets, and supply chains, such as extreme weather events, rising sea levels, or changing temperatures.

Climate-related transition risks

These risks stem from the transition to a low-carbon economy, including regulatory changes, shifts in market preferences, and evolving technological innovations that could impact business models.

Climate-related opportunities

These are positive impacts businesses can seize as part of the transition to a sustainable economy, such as opportunities from new low-carbon technologies, renewable energy sources, or sustainable products and services.

The standard sets out to guide businesses in identifying and reporting these climate-related risks that could have a significant impact on their financial position and future performance.

How should governance relate to climate-related risks?

The objective of climate-related financial disclosures on governance is to allow users of financial reports to understand how an entity governs and manages its climate-related risks and opportunities. IFRS S2 requires businesses to disclose detailed information about the governance structure responsible for overseeing these matters. Specifically, businesses must identify the body or individual(s) responsible for climate-related oversight—whether it’s the board of directors, a dedicated committee, or an individual executive responsible for environmental concerns.

In addition, companies must disclose the role of management in overseeing the governance processes. This includes how climate-related risks are incorporated into the business’s decision-making processes and what controls are in place to manage these risks.

What is the strategic approach to managing climate-related risks?

The objective of the strategy section in IFRS S2 disclosures is to help users understand how a business plans to manage and respond to climate-related risks and opportunities. This requires a detailed explanation of the following:

- The climate-related risks and opportunities that are likely to affect the business.

- The effects of these risks on the company’s business model, value chain, and decision-making process.

- The company’s climate-related transition plan and how these plans inform its broader strategy.

- How the company anticipates the impacts of these risks on its financial position, performance, and cash flows in both the short and long term.

- The resilience of the company’s strategy to climate-related changes and uncertainties.

This section is important for demonstrating how climate-related risks are integrated into business strategy, financial planning, and long-term objectives. Companies must also show how their strategy is aligned with broader global goals, such as the Paris Agreement or national climate targets.

How should companies manage climate-related risks?

IFRS S2 requires companies to disclose information about their processes for identifying, assessing, prioritizing, and monitoring climate-related risks and opportunities. The objective of these disclosures is to enable users to understand how the company integrates climate risks into its overall risk management processes.

The disclosures must address the following:

- The processes and policies used to identify, assess, prioritize, and monitor climate-related risks – This includes the methods used to identify potential risks, the data and tools involved (such as climate-related scenario analysis), and the scope of operations covered by the processes.

- Climate-related scenario analysis – Companies are encouraged to use climate-related scenario analysis to understand the potential financial impact of different climate scenarios (e.g., a 2°C or 4°C warming scenario) on their business.

- Prioritization of risks – It’s crucial for businesses to explain how they prioritize climate-related risks relative to other risks and how they monitor these risks on an ongoing basis.

- Risk integration – Companies must also describe how their climate-related risk management processes are integrated into their overall risk management strategy.

IFRS S2 emphasizes that effective risk management processes should not only identify and assess climate-related risks but also inform decisions about risk mitigation, adaptation, and resilience.

What metrics and targets should companies disclose regarding climate-related risks?

The disclosure of metrics and targets is a critical component of IFRS S2. Companies are required to report on their performance concerning climate-related risks and opportunities, as well as the progress made toward any climate-related targets they have set. This is vital for helping users of general purpose financial reports understand how well a company is managing its climate risks and opportunities.

Under IFRS S2, businesses must disclose the following:

- Greenhouse gas (GHG) emissions – Companies are required to disclose their absolute gross GHG emissions during the reporting period, classified as Scope 1, 2, and 3 emissions. This includes the direct emissions from the company’s operations (Scope 1), indirect emissions from purchased energy (Scope 2), and emissions along the value chain (Scope 3).

- Climate-related transition risks and opportunities – Companies must disclose the amount and percentage of assets or business activities vulnerable to transition risks or aligned with climate-related opportunities.

- Capital deployment – Businesses should report the amount of capital expenditure, investment, or financing allocated to addressing climate-related risks and opportunities.

- Internal carbon prices – If the company uses an internal carbon price in its decision-making process, it must disclose how the price is applied and the per-metric-tonne carbon cost used.

- Executive remuneration – Companies must disclose whether climate-related considerations are factored into executive compensation and the percentage of executive remuneration linked to climate-related targets.

Furthermore, companies must disclose any quantitative and qualitative climate-related targets they have set. These targets may include objectives related to reducing GHG emissions, adapting to climate change, or transitioning to a more sustainable business model. For each target, the company must disclose:

- The metric used to measure progress.

- The objective behind the target (e.g., mitigation or adaptation).

- The timeframe for the target.

- Any interim milestones or progress benchmarks.

Key takeaways: How should businesses adapt to IFRS S2?

In light of the evolving global climate landscape, businesses are increasingly expected to be transparent and proactive in managing climate-related risks. IFRS S2 provides companies with a structured approach to disclosing their climate-related risks and opportunities, helping them communicate their efforts to stakeholders. By adhering to these requirements, businesses can enhance their credibility, attract investment, and build long-term resilience.

Key elements of IFRS S2 include:

Identifying climate-related risks

Both physical and transition-related risks must be assessed and disclosed, with an emphasis on climate-related physical risks, such as extreme weather events.

Governance and strategy

Clear reporting on the governance processes, decision-making, and strategic plans to manage climate-related risks and opportunities.

Risk management and metrics

Comprehensive reporting on risk management processes and climate-related performance metrics, including GHG emissions and progress toward climate-related targets.

By adopting these guidelines, businesses will not only meet regulatory requirements but also demonstrate their commitment to sustainable business practices. As climate-related risks become an ever-present factor in the business environment, companies that act swiftly and transparently will be better positioned for success in a low-carbon economy.

How can sustainability software support ISSB data collection?

As ISSB standards require detailed and structured sustainability-related financial disclosures, companies need efficient tools to manage data collection and reporting. Sustainability software can support ISSB compliance by:

- Automating data gathering from various business operations

- Ensuring alignment with IFRS Sustainability Disclosure Standards

- Providing real-time tracking of sustainability performance

- Facilitating accurate reporting of ISSB-mandated sustainability metrics

- Enhancing risk assessment and scenario analysis for climate-related disclosures

By leveraging sustainability software, companies can streamline their reporting processes and ensure compliance with ISSB requirements while improving the quality and reliability of sustainability-related financial information.