On May 24, 2024, the European Council and European Parliament officially adopted the EU Corporate Sustainability Due Diligence Directive (CSDDD). This directive imposes due diligence obligations on large companies to address the adverse impacts of their activities on human rights and environmental protection, along with specifying the associated liabilities. These rules apply not only to the companies’ own operations but also extend to the activities of their subsidiaries and business partners throughout their value chains, including indirect business partners.

However, the Omnibus proposal of February 2025 has introduced several significant adjustments to the implementation and scope of the CSDDD. These include an extended timeline, giving companies more time to comply by postponing the transposition deadline to July 26, 2027, and delaying the application of due diligence obligations for the largest companies to July 26, 2028. We walk you through what you need to know.

What is the aim of the CSDDD?

The aim of the EU’s Corporate Sustainability Due Diligence Directive (CSDDD) is to enhance the protection of human rights and to combat climate change. It requires in-scope companies to identify, prevent, mitigate, and address adverse human rights and environmental impacts caused by their operations, subsidiaries, and business partners. This directive helps minimize negative impacts on people and the planet while enabling companies to manage risks across their entire supply chain and chain of activities.

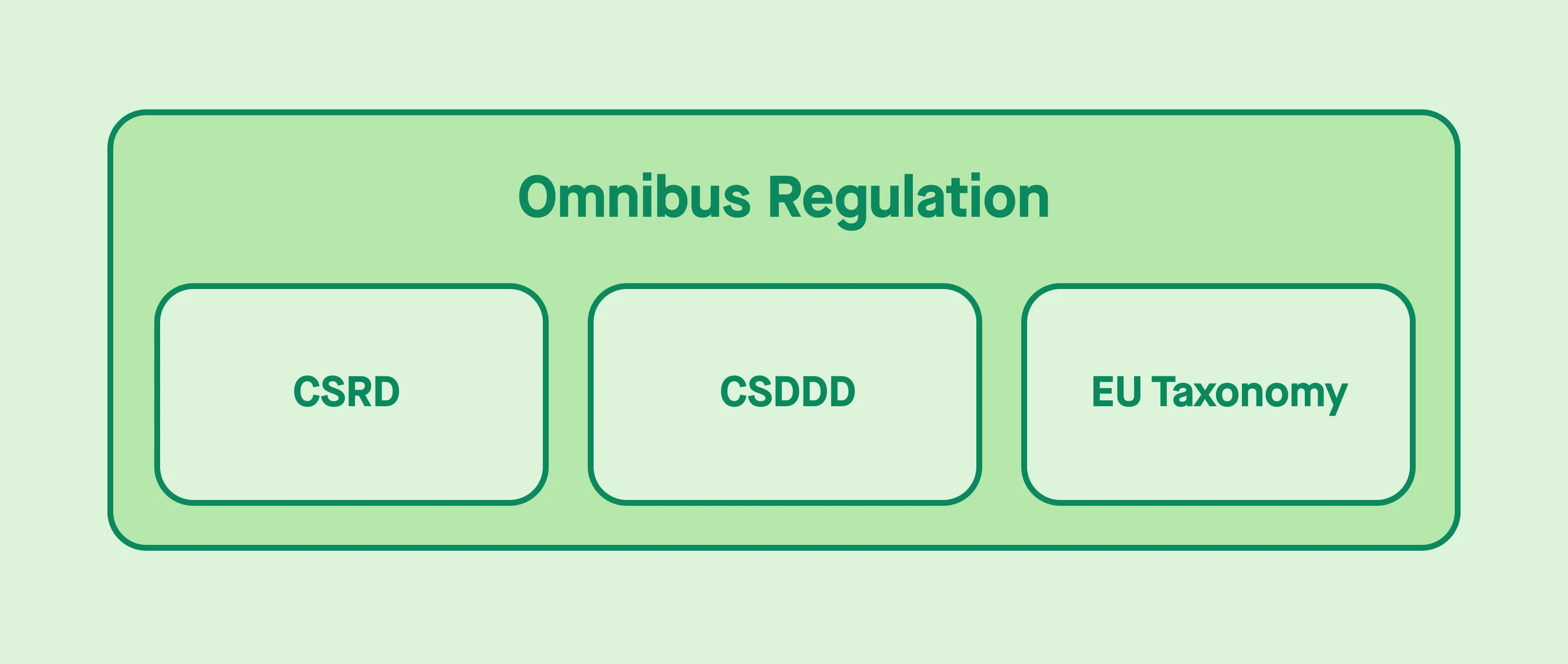

Corporate sustainability due diligence is a critical component of a sustainable economy. The CSDDD is part of the European Green Deal, which aims to reduce the EU’s greenhouse gas emissions by at least 55% by 2030 and achieve climate neutrality by 2050. It works alongside other regulations such as the Corporate Sustainability Reporting Directive (CSRD) and the EU Taxonomy Regulation, furthering sustainable business practices under a unified European framework. It also supports businesses in developing a transition plan for climate change mitigation.

By standardizing due diligence requirements across the EU, the CSDDD harmonizes legal requirements, reducing uncertainty and fostering responsible business conduct uniformly across Europe.

What changes were introduced under the Omnibus proposal?

The Omnibus proposal introduced several key changes to the CSDDD to allow companies more time to adapt and to simplify compliance processes:

Extended deadlines: The transposition deadline has been postponed by one year to July 26, 2027, with the first phase of application for the largest companies now beginning on July 26, 2028.

Guidelines for compliance: The European Commission will publish guidelines by July 2026, giving companies more clarity on best practices and reducing reliance on legal counseling.

Changes to indirect business partner assessments: Companies are no longer required to systematically conduct in-depth assessments of adverse human rights or environmental impacts at the level of indirect business relationships with business partners in their supply chain. Instead, full due diligence obligations apply only when there is plausible information suggesting adverse impacts may occur.

Streamlining sustainability due diligence obligations: The frequency of periodic assessments has been extended from one year to every five years, reducing compliance burdens.

Limiting trickle-down effects on SMEs: Large companies can only request information from SME business partners based on the CSRD Voluntary Sustainability Reporting Standards (VSME standard), unless additional data is required for specific mapping purposes.

Removal of harmonized civil liability rules: The directive now defers to national civil liability regimes, meaning each member state will determine how liability applies within its jurisdiction.

Alignment with CSRD on transition plans: The requirements for companies to adopt a transition plan for climate mitigation have been aligned with the CSRD framework.

Exclusion of financial services: The review clause that previously suggested the potential future inclusion of financial services within the CSDDD’s scope has been removed.

What are the human rights and environmental impacts covered?

The Corporate Sustainability Due Diligence Directive (CSDDD) addresses a specific set of potential adverse human rights and environmental impacts aligned with key international standards. For human rights, it covers a range of labor rights, such as the prohibition of child labor, forced labor, and discrimination, as well as the rights to freedom of thought, conscience, religion, association, assembly, and collective bargaining. While freedom of expression is not explicitly listed, it would likely be included in the due diligence process for media organizations.

On the environmental front, the CSDDD includes violations related to the handling, collection, storage, and disposal of waste, and the use of biological resources affecting biodiversity. The CSDDD is the first piece of EU legislation mandating companies to adopt a transition plan for climate mitigation.

In-scope companies must commit to ensuring their business models are compatible with the transition to a sustainable economy and to limiting global warming to 1.5°C, in line with the Paris Agreement. They should also incorporate emissions reduction objectives if climate risks are significant to their operations.

Which businesses are covered?

Both EU and non EU companies operating in EU, are covered by the CSDDD, provided that they satisfy the below criteria for two consecutive financial years.

EU Companies which:

- Have more than 1,000 employees on average and a net worldwide turnover exceeding EUR 450 million over consecutive financial years.

- Are the ultimate parent companies of a group meeting the above criteria.

- Have entered into franchising or licensing agreements in the EU where royalties exceed EUR 22.5 million, provided that the company or group had a net worldwide turnover exceeding EUR 80 million.

Non EU Companies which:

- Have generated a net turnover in the EU exceeding EUR 450 million over consecutive financial years.

- Are the ultimate parent company of a group meeting the above criteria.

- Have entered into franchising or licensing agreements in the EU where royalties exceed EUR 22.5 million, provided that the company or group had a net turnover exceeding EUR 80 million in the EU.

Note: SMEs are not directly in scope but may be affected as contractors or subcontractors to any of the above companies. Third-country companies must also ensure compliance with the directive when conducting operations within the EU. Note that regulated financial undertakings are only subject to due diligence for the upstream part of the chains of activities.

What is the timeline for adoption?

2024-2026: Member states will incorporate the CSDDD into their national law.

2026-2027: The CSDDD becomes enforceable at the national level.

Starting 2028: Compliance is required for companies with more than 5,000 employees and a net annual turnover exceeding EUR 1.5 billion.

Starting 2029: Compliance is required for companies with more than 3,000 employees and a net turnover exceeding EUR 900 million.

Starting 2030: Compliance is required for companies with more than 1,000 employees and a net turnover exceeding EUR 450 million.

How does the CSDDD relate to the CSRD?

The Corporate Sustainability Due Diligence Directive (CSDDD) and the Corporate Sustainability Reporting Directive (CSRD) are complementary frameworks that help companies enhance transparency and accountability in their sustainability efforts.

While the CSRD requires companies to disclose sustainability-related information, the CSDDD mandates that businesses implement effective risk management systems to identify, prevent, and mitigate adverse human rights and environmental impacts throughout their chain of activities.

By aligning with the CSRD, the CSDDD ensures that sustainability is not just a reporting exercise but an integral part of corporate governance and operational or financial decisions. Companies subject to both directives must establish due diligence requirements and report on their progress through sustainability disclosures, demonstrating how their business models align with responsible business conduct.

The CSRD’s reporting obligations provide essential data that can support supervisory authorities in monitoring compliance with the CSDDD, ensuring that companies are taking appropriate measures to address sustainability risks.

For more information about the CSRD and how to prepare, take a look at our dedicated resource.

How does the CSDDD relate to the EU Taxonomy?

The CSDDD and the EU Taxonomy Regulation work together to drive sustainable corporate practices by linking due diligence obligations with financial decisions affecting environmental and social sustainability.

The EU Taxonomy provides a classification system that defines which economic activities are considered environmentally sustainable, guiding investors, businesses, and policymakers in making informed decisions. In contrast, the CSDDD establishes concrete requirements for companies to implement due diligence processes that ensure their business activities and value chains do not contribute to adverse human rights or environmental impacts.

Both frameworks share the goal of fostering a sustainable economy by encouraging companies to integrate sustainability into their core business strategies. The CSDDD helps companies align their operations with the EU Taxonomy by embedding environmental due diligence into their risk management systems, ensuring compliance with sustainability criteria when making strategic financial and operational decisions. Additionally, supervisory authorities overseeing CSDDD compliance can leverage the EU Taxonomy’s sustainability criteria to assess whether companies are meeting their due diligence requirements.

By reinforcing each other, these frameworks create a common business concept of sustainability, ensuring that financial markets and corporate strategies contribute to long-term environmental and social objectives.

How can Sweep help with the CSDDD?

- Develop and monitor a transition plan for climate mitigation efficiently to avoid penalties and mitigate identified risks.

- Automate carbon emissions data management for swift compliance.

- Engage all partners seamlessly for accelerated decarbonization.

- Identify emissions hotspots and allocate resources effectively.

- Utilize expert questionnaires for streamlined compliance and improved partnerships.

Find out more today.