The European Commission’s Omnibus package, introduced on February 26, 2025, proposes significant step changes to key sustainability regulations. This EU directive aims to simplify corporate sustainability reporting while reducing administrative burdens for businesses. The proposed rules impact the Corporate Sustainability Reporting Directive (CSRD), the Corporate Sustainability Due Diligence Directive (CSDDD), and the EU Taxonomy Regulation.

While the Omnibus package is still under discussion, it reflects the EU’s ongoing efforts to align sustainability reporting with large companies’ operational realities. The changes will affect listed companies, small and medium enterprises (SMEs), and large enterprises, altering the scope of corporate sustainability reporting and influencing investments, consumer trust, and corporate strategy.

Key changes to the CSRD under the Omnibus proposal

The Omnibus proposal introduces revisions to the CSRD that redefine which companies must comply with European sustainability reporting standards. The proposed amendments will determine which companies are required to publish sustainability reports, shifting the regulatory landscape for companies across the EU.

What’s the current situation?

Currently, the Corporate Sustainability Reporting Directive (CSRD) builds on and expands the scope of its predecessor, the Non-Financial Reporting Directive (NFRD), which applied only to large listed companies, banks, and insurance firms with more than 500 employees. The CSRD significantly broadens reporting obligations to include more large companies and listed SMEs. However, the Omnibus proposal seeks to narrow this scope, meaning that many smaller entities will be exempt. At the same time, it maintains sustainability reporting requirements for companies with the most significant risks and impact on the environment and society.

The new scope: who will be covered?

Under the revised CSRD criteria, only companies that meet specific thresholds will be subject to mandatory corporate sustainability reporting. Companies must have:

- More than 1,000 employees

- A net turnover exceeding €50 million or a balance sheet total above €25 million

- Be a listed company on European Union-regulated markets

This adjustment reduces the number of affected companies by approximately 80%, removing thousands of small and medium enterprises from mandatory reporting requirements. The shift aims to streamline sustainability reporting while ensuring that large companies remain accountable for their environmental and social impact.

Voluntary reporting for small and medium enterprises

The Omnibus package proposes a voluntary measure allowing Very Small and Medium Enterprises (VSMEs) to report on sustainability. SMEs with fewer than 1,000 employees will not be required to disclose, track and measure their ESG performance in line with the CSRD, but will have the option to publish sustainability reports. This voluntary approach allows businesses to demonstrate their commitment to sustainability without the burden of full regulatory compliance.

More on the proposed CSRD amendments

Below we outline further implications for companies subject to the CSRD:

European Sustainability Reporting Standards (ESRS) revisions

The European Commission proposes to revise the ESRS to:

- Reduce the number of data points required in sustainability reports “substantially.”

- Clarify unclear provisions to improve consistency with other legislation.

- Streamline sustainability information reporting by eliminating sector-specific requirements.

These revisions are intended to make sustainability reporting more proportionate and less complex while ensuring that investors and other stakeholders continue to receive relevant environmental information.

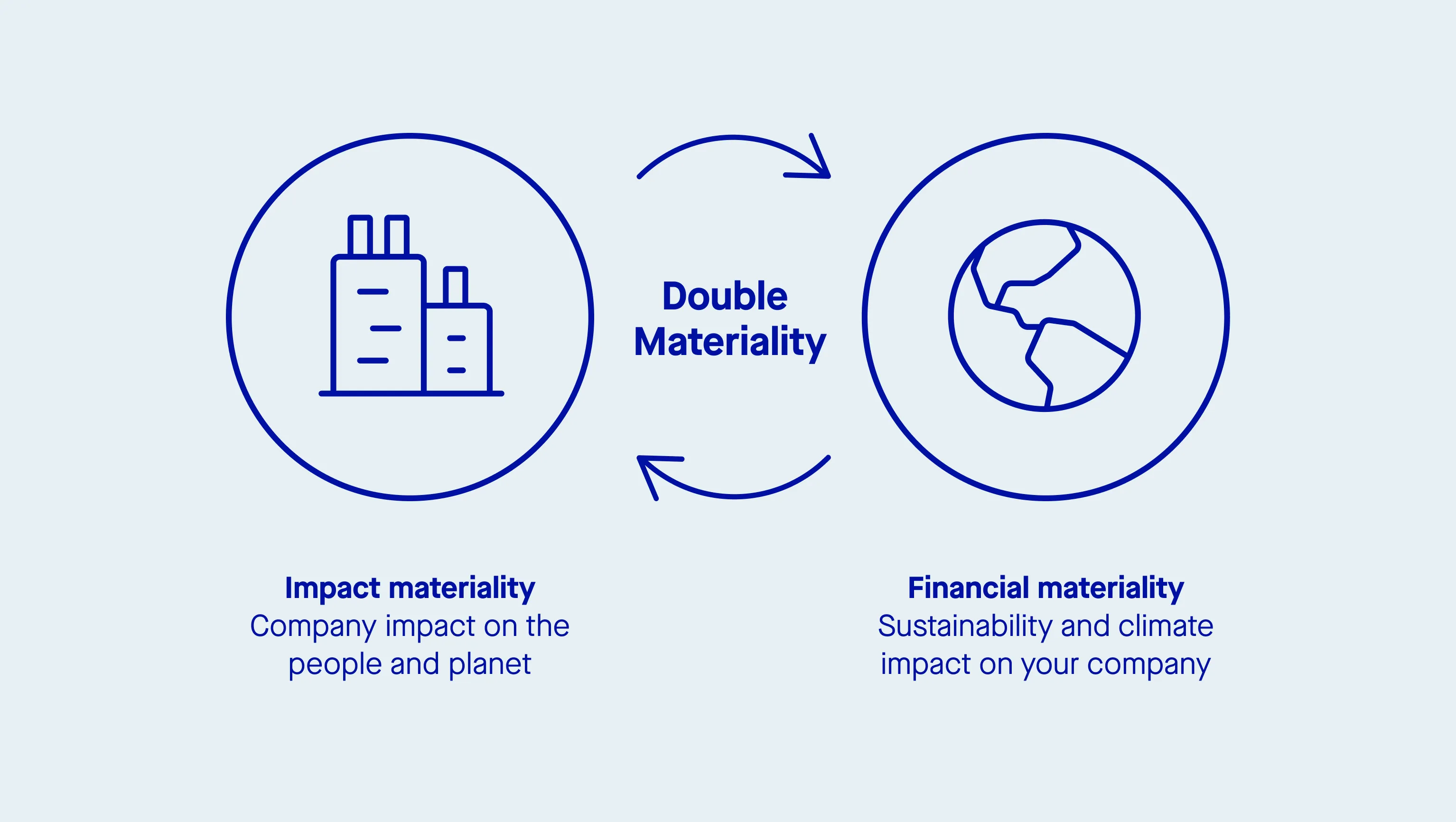

Double materiality principle remains unchanged

Despite other proposed revisions, the double materiality principle—which requires companies to disclose both how sustainability issues impact their business and how their operations affect the environment and society—remains in place. This ensures that EU member states continue to uphold high standards for sustainability disclosure. The double materiality principle ensures that companies provide valuable sustainability information to investors and consumers.

Proposed implementation timeline

If, as expected, the Omnibus Package proposal is adopted, it would adjust the implementation schedule for sustainability reporting obligations. This adjusted timeline will allow many companies more time to provide meaningful sustainability information.

Proposed timeline adjustments

2026-2027 – Reporting obligations postponed by two years for “Wave 2 and 3” companies.

2028 – New transposition deadline for the first phase of CSDDD application.

These delays would give businesses additional time to comply with evolving EU directives and integrate sustainability performance reporting into their corporate strategy.

Beyond the CSRD, what are the other proposed changes?

The Corporate Sustainability Due Diligence Directive (CSDDD) would see notable adjustments under the Omnibus proposal:

- Limited supply chain monitoring – Companies would only be required to oversee their direct suppliers, reducing the complexity of due diligence while maintaining transparency.

- Less frequent compliance checks – Companies with more than 500 employees would need to assess supply chain risks once every five years instead of annually, with additional reviews conducted only when necessary.

The EU Taxonomy framework would also undergo key revisions:

- Simplified reporting – The European Commission aims to cut the number of required data points by 70%, easing the administrative burden on companies. Companies would also be exempt from reporting on financially immaterial activities that make up less than 10% of turnover, capital expenditure, or total assets.

- Changes for financial institutions – Banks could adjust their Green Asset Ratio (GAR) by excluding exposures to companies that are no longer covered under the revised CSRD scope.

These proposed changes reflect the EU’s rules to streamline sustainability reporting and reduce administrative pressure, while still ensuring investors and consumers receive meaningful corporate sustainability information. However, as the Omnibus package remains a proposal, companies should stay informed on its implementation and final legislative decisions.

What companies should do next

With the Omnibus package still under discussion, companies should take proactive steps to assess how the proposed changes will affect their sustainability reporting obligations.

1. Determine if you are still in scope for CSRD

Companies should evaluate whether they meet the revised CSRD thresholds (1,000+ employees, €50M+ net turnover, or €25M+ balance sheet total). Companies that fall below these thresholds may no longer need to comply with corporate sustainability reporting requirements.

2. Review supply chain monitoring policies

Companies should assess whether their current due diligence practices align with the revised CSDDD requirements, focusing on direct suppliers. This will ensure compliance with evolving EU sustainability legislation.

3. Stay informed on the legislative process

Since the Omnibus package is still a proposal, companies should monitor its progress and prepare for potential amendments. Listed companies, large enterprises, and SMEs should engage with industry associations and regulatory updates to stay ahead of implementation timelines.

4. Strengthen sustainability initiatives

Regardless of regulatory requirements, sustainability remains an important step toward long-term business resilience. Companies should continue to integrate sustainability into their operations, improve ESG data management, and align with best practices in European sustainability reporting standards.

A move towards simplification and greater comparability

The Omnibus edition of the CSRD represents a significant step in EU climate change legislation, reducing the number of companies required to publish corporate sustainability reports while simplifying reporting for those still in scope. While these proposed changes ease compliance burdens, they also present strategic decisions for companies regarding investments and voluntary disclosures.

As the proposal moves through the EU legislative process, companies should stay engaged, assess their sustainability reporting obligations, and prepare for the evolving regulatory landscape.

Whether through mandatory or voluntary reporting, delivering transparency on sustainability performance with meaningful disclosures will remain crucial for securing investment, meeting consumer expectations, and building a resilient corporate strategy.